Bitcoin ETFs are setting unprecedented records as BlackRock‘s offerings lead both U.S. and European markets. Recent data shows $6 billion in new investments across major cryptocurrency investment funds. This growth proves more big institutions are joining the market. BlackRock’s success brings new competition to European Bitcoin funds.

Also Read: What’s the Worth of Donald Trump’s Cryptocurrency Portfolio?

Bitcoin ETFs Surging with Record Inflows & BlackRock Leading the European Market

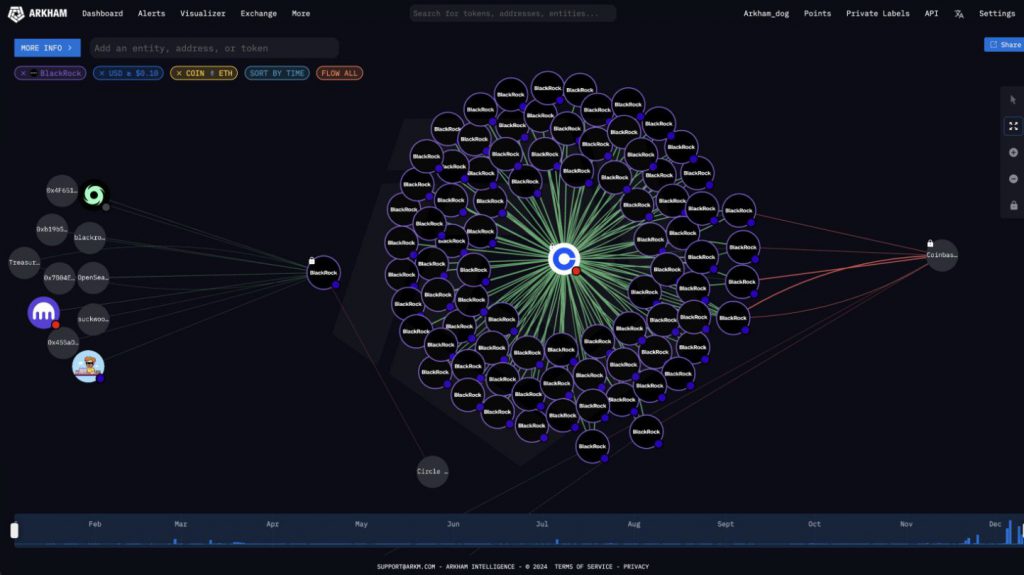

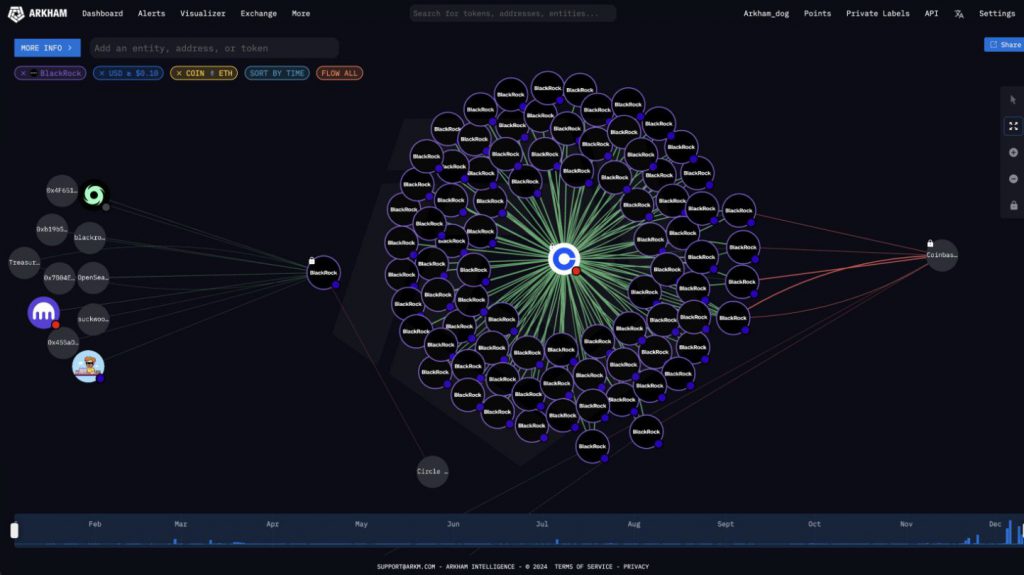

BlackRock’s Market Dominance

BlackRock now controls large shares of both Bitcoin and Ethereum investments through regulated funds. Their Bitcoin ETF (IBIT) has more assets than 50 European ETFs combined. Recent reports confirm that IBIT owns nearly half of all Bitcoin ETF assets. This rapid growth shows increasing trust in cryptocurrency market investments.

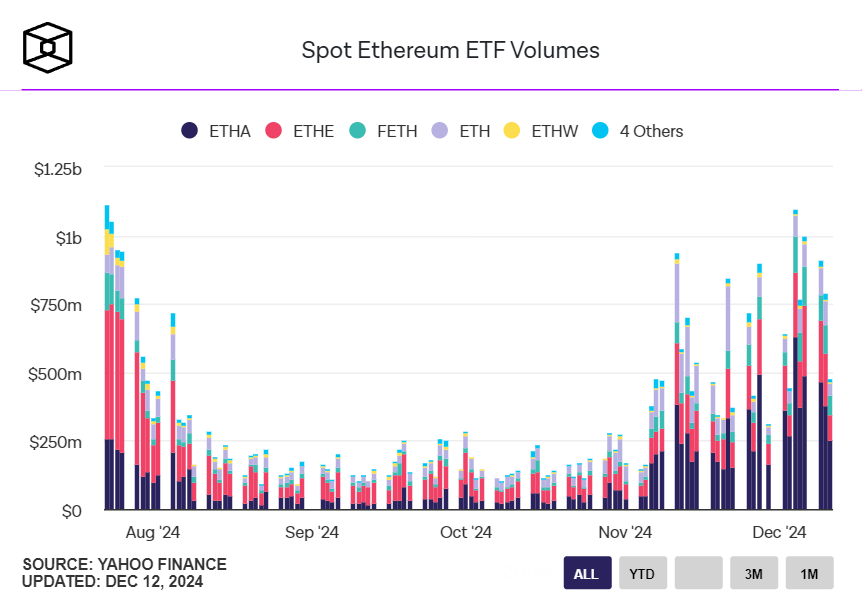

Record-Breaking ETF Performance

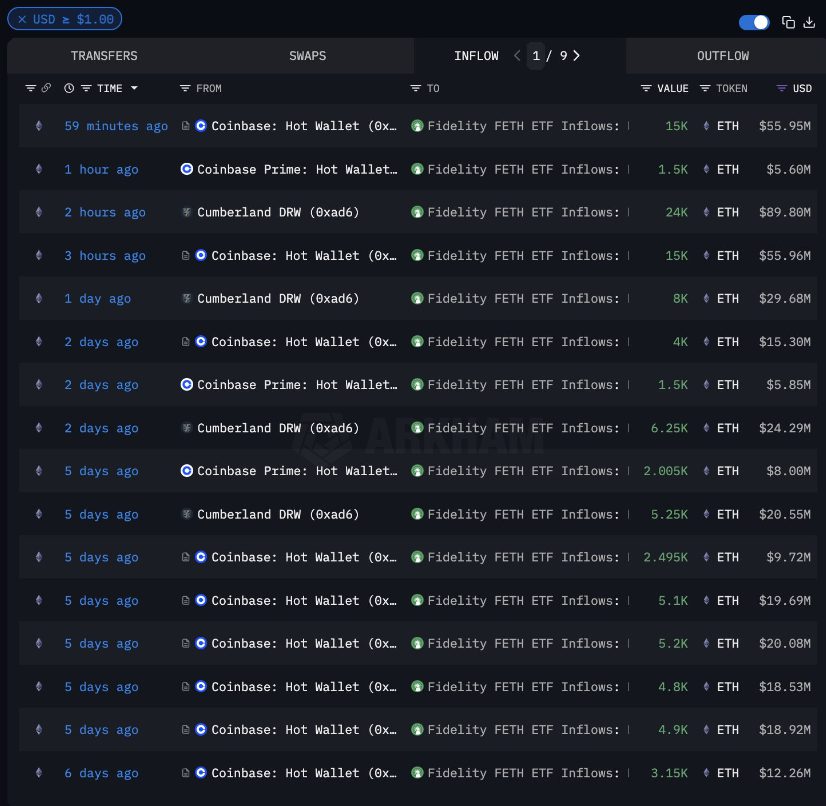

BlackRock and Fidelity just purchased $500 million worth of ETH through regulated channels. Trading volumes keep rising steadily. ETHA recorded $372.4 million in trades, while FETH reached $103.7 million. More financial institutions now trust cryptocurrency investments through these regulated products, with Bitcoin ETF playing a key role.

Also Read: Nvidia Faces Class-Action Over $1 Billion in Crypto Mining Sales

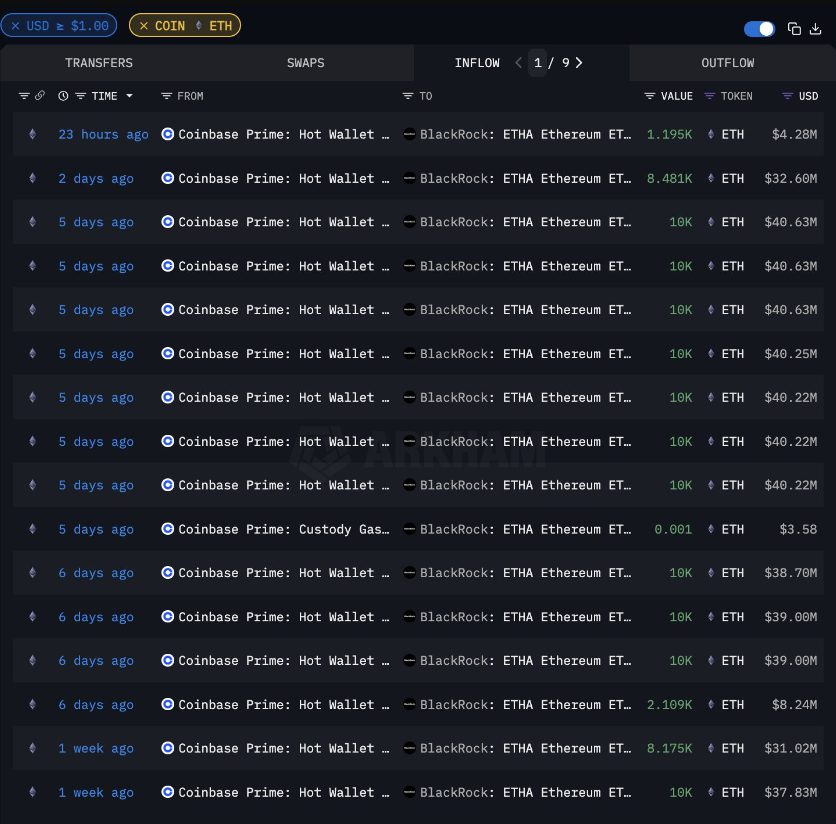

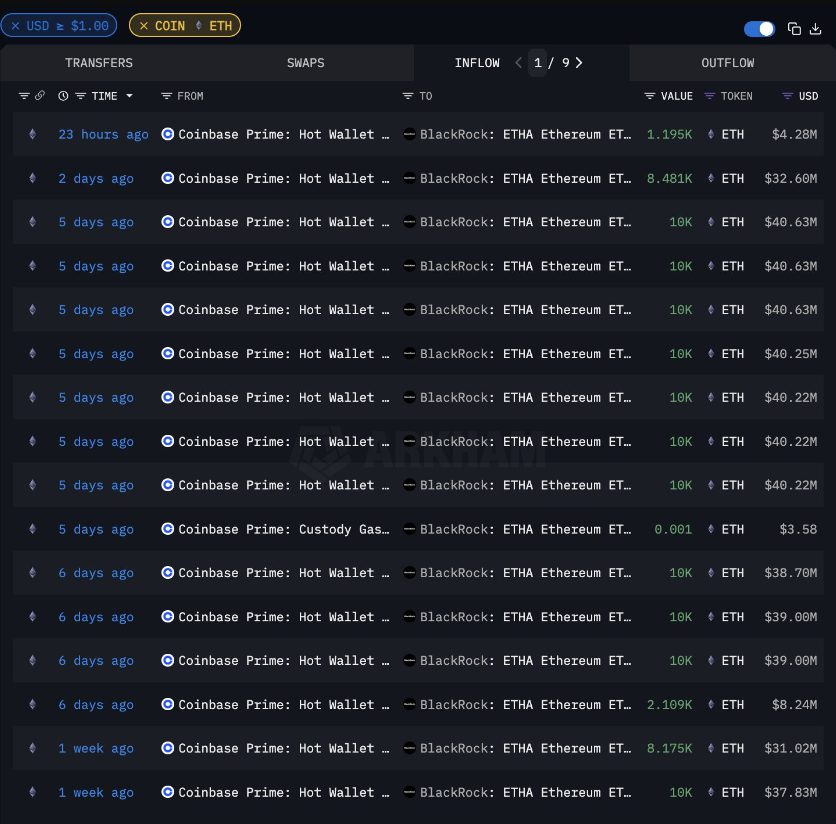

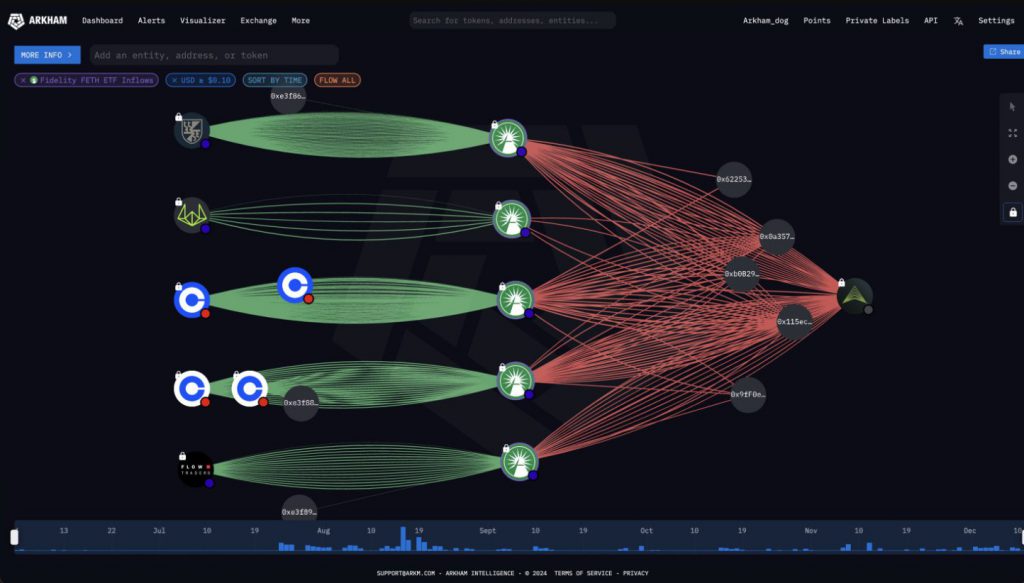

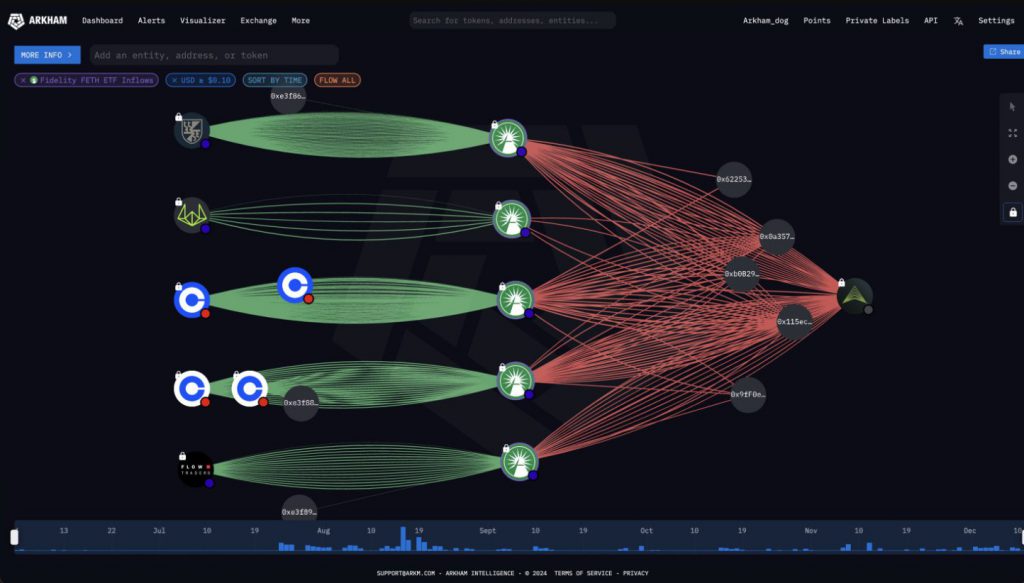

Institutional Buying Patterns

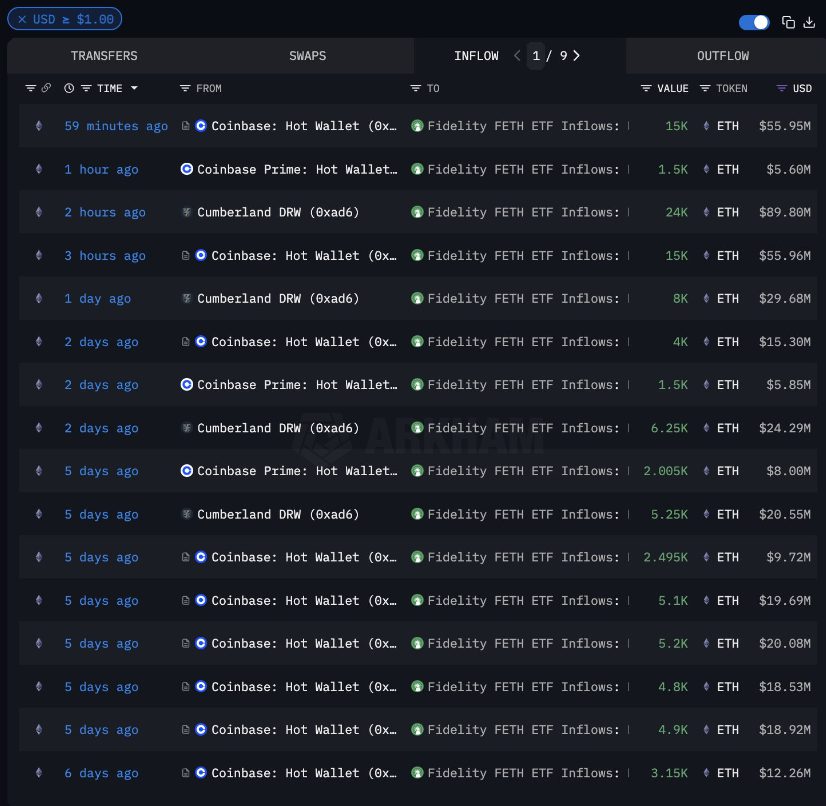

New transaction data reveals steady institutional buying through official channels. Fidelity’s ETH ETF shows consistent purchase patterns. Their trades range from 1.5K to 24K ETH at a time. These regular investments total hundreds of millions of dollars in value. Such patterns reflect a growing interest in regulated products like a Bitcoin ETF.

European Market Impact

U.S. funds now present strong competition to European Bitcoin funds. Daily monitoring shows steady institutional buying patterns. Major ETF products receive constant new investments. Fidelity maintains systematic purchases between $5.6M and $89.8M per transaction.

Also Read: Ripple: ChatGPT Sets XRP’s Price For The Year End

The entrance of major financial institutions into Bitcoin and Ethereum ETF markets signals a crucial shift. Their quick market share gains and steady investment flows demonstrate strong institutional demand for regulated digital asset exposure through traditional financial products.