- ADA’s on-chain metrics with technical analysis indicated mixed sentiment among traders.

- 53.2% of top traders held short positions, while 46.8% held long positions.

The sentiment across the cryptocurrency market is quite confusing. Amid this, Cardano [ADA] appeared bullish and is poised for a notable upside rally in the coming days.

Over the past few weeks, ADA has lost nearly 20% of its value and has reached a level where it previously experienced an impressive rally.

However, ADA’s bullish outlook was likely driven by recent price action and the upcoming presidential election in the United States.

ADA technical analysis and key levels

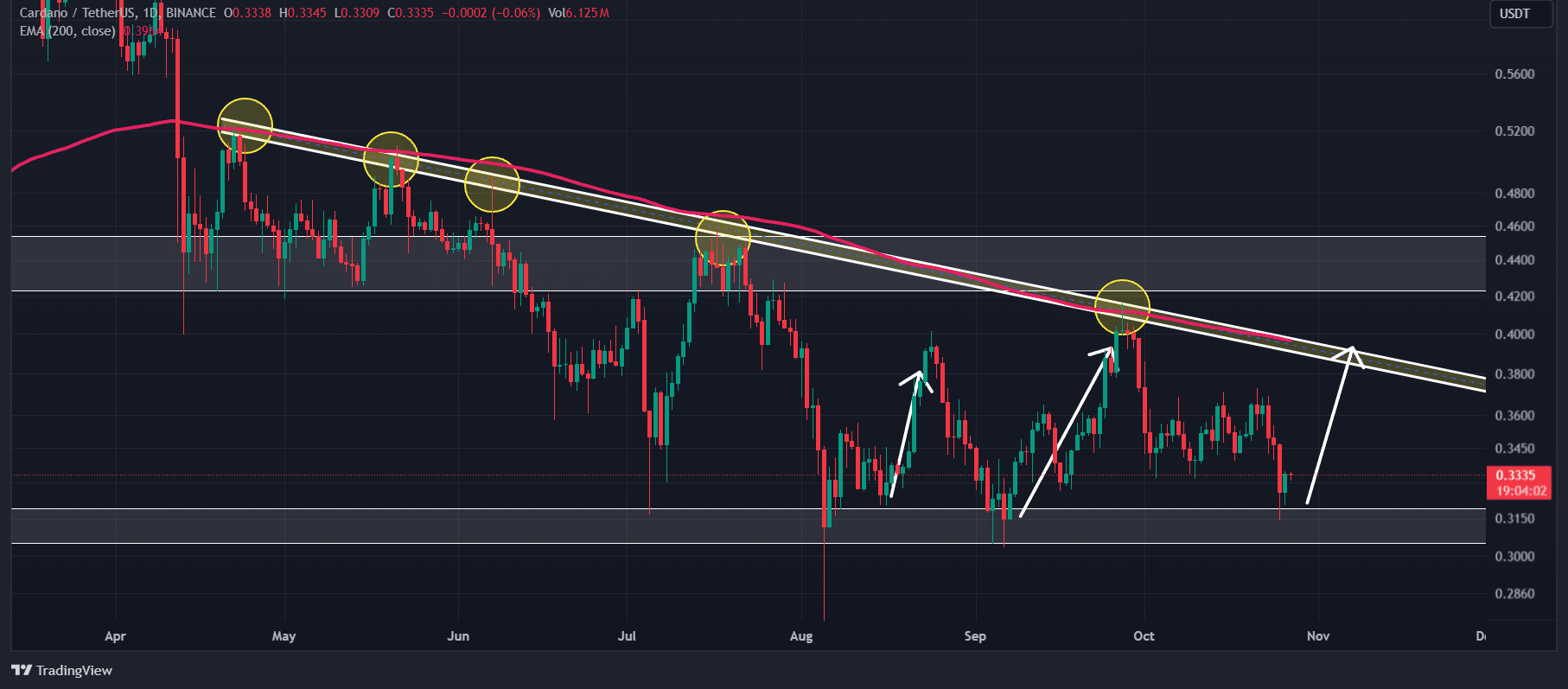

According to AMBCrypto’s technical analysis, ADA was at a crucial support level of $0.315 and was heading in an upward direction. Historically, whenever ADA reached this support level, it tends to encounter buying pressure, leading to an upside rally of at least 20%.

Since July 2024, the asset has reached the support level three times, each time experiencing buying pressure and a price rally of over 20% to the $0.40 level. This time also traders and investors were expecting a similar upside rally, which may occur in the coming days.

However, this positive outlook and the anticipated rally may take some time to occur. ADA’s on-chain metrics reflected bearish sentiment among traders. According to the on-chain analytics firm Coinglass, ADA’s Long/Short ratio stood at 0.88, indicating a strong bearish sentiment.

Additionally, ADA’s open interest has declined by 1.2% in the past 24 hours. This drop in OI suggested a potential liquidation of traders’ positions due to increased volatility in the cryptocurrency market.

At press hour, 53.2% of top traders held short positions, while 46.8% held long positions.

Major liquidation levels

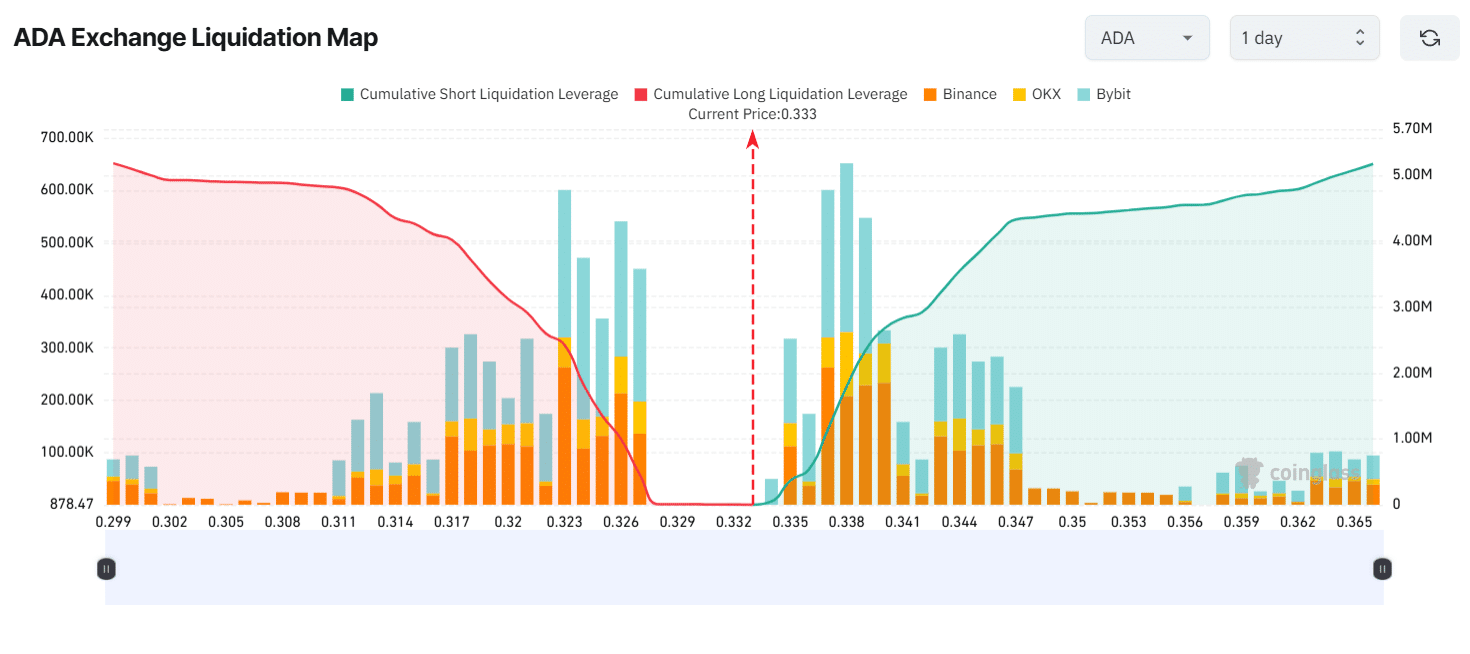

The major liquidation levels were at $0.323 on the lower side and $0.338 on the upper side, with traders over-leveraged at these levels, according to the Coinglass data.

If the sentiment remains unchanged and the price rises to the $0.338 level, nearly $1.79 million worth of short positions will be liquidated.

Read Cardano’s [ADA] Price Prediction 2024–2025

Conversely, approximately $2.43 million worth of long positions will be liquidated if the sentiment shifts and the price drops to the $0.323 level. A combination of these on-chain metrics with technical analysis indicated mixed sentiment among traders.

At press time, ADA was trading near $0.33 and had remained unchanged over the past 24 hours. During the same period, its trading volume dropped by 62%, indicating reduced participation from traders and investors compared to previous days.