- ETH price has remained resilient despite the latest FUD.

- A key indicator flashed a buy signal as an analyst signaled a potential bottom.

Ethereum [ETH] price has remained resilient despite intensified FUD in recent months.

ETH has been underperforming its peers like Bitcoin [BTC] and Solana [SOL], prompting calls for more investors to dump it for other alternatives.

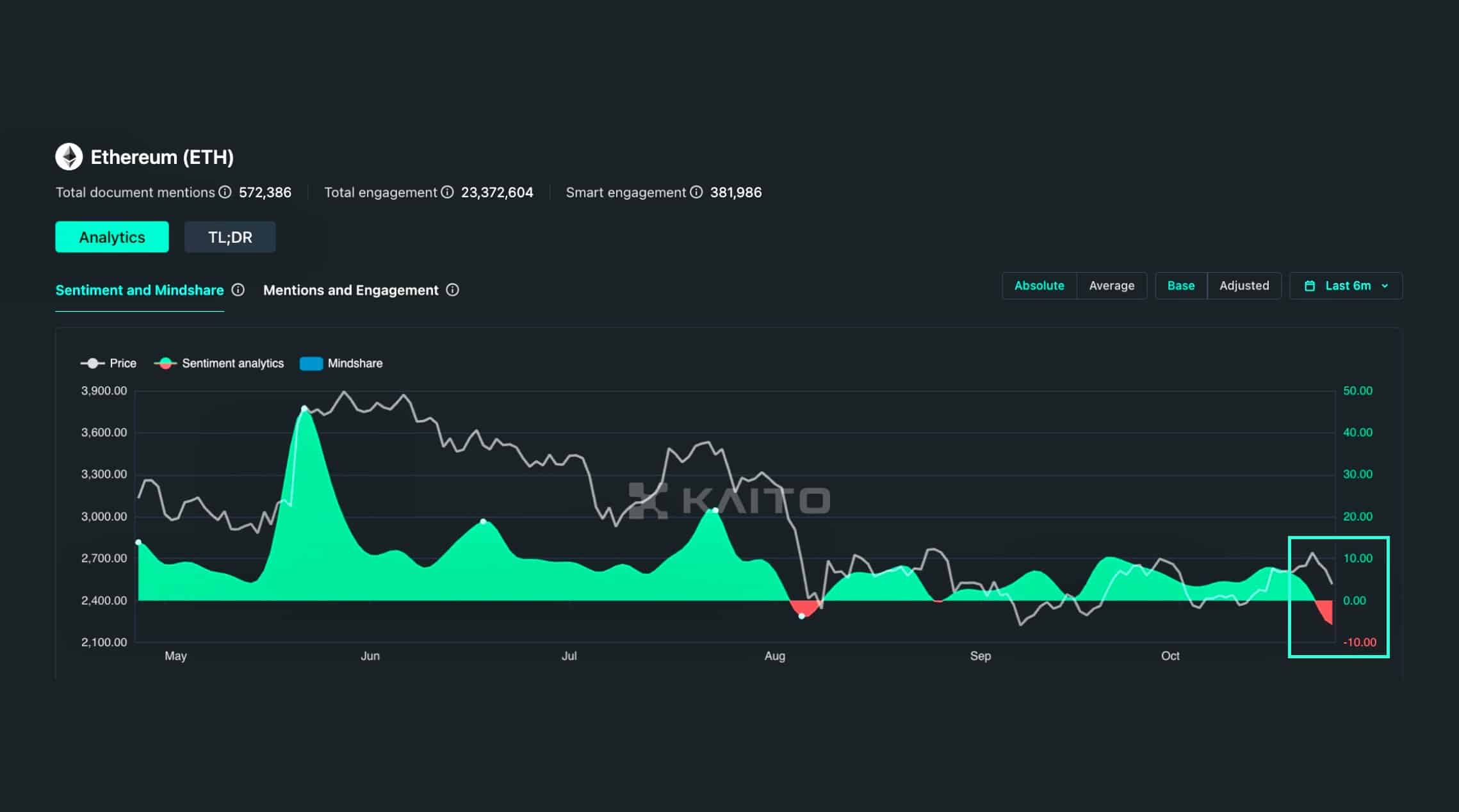

This saw ETH market sentiment turn negative last week, low levels last seen in August.

However, according to Income Sharks’ market analysis, ETH was still resilient and appeared ready to recover from recent losses.

ETH’s resilience

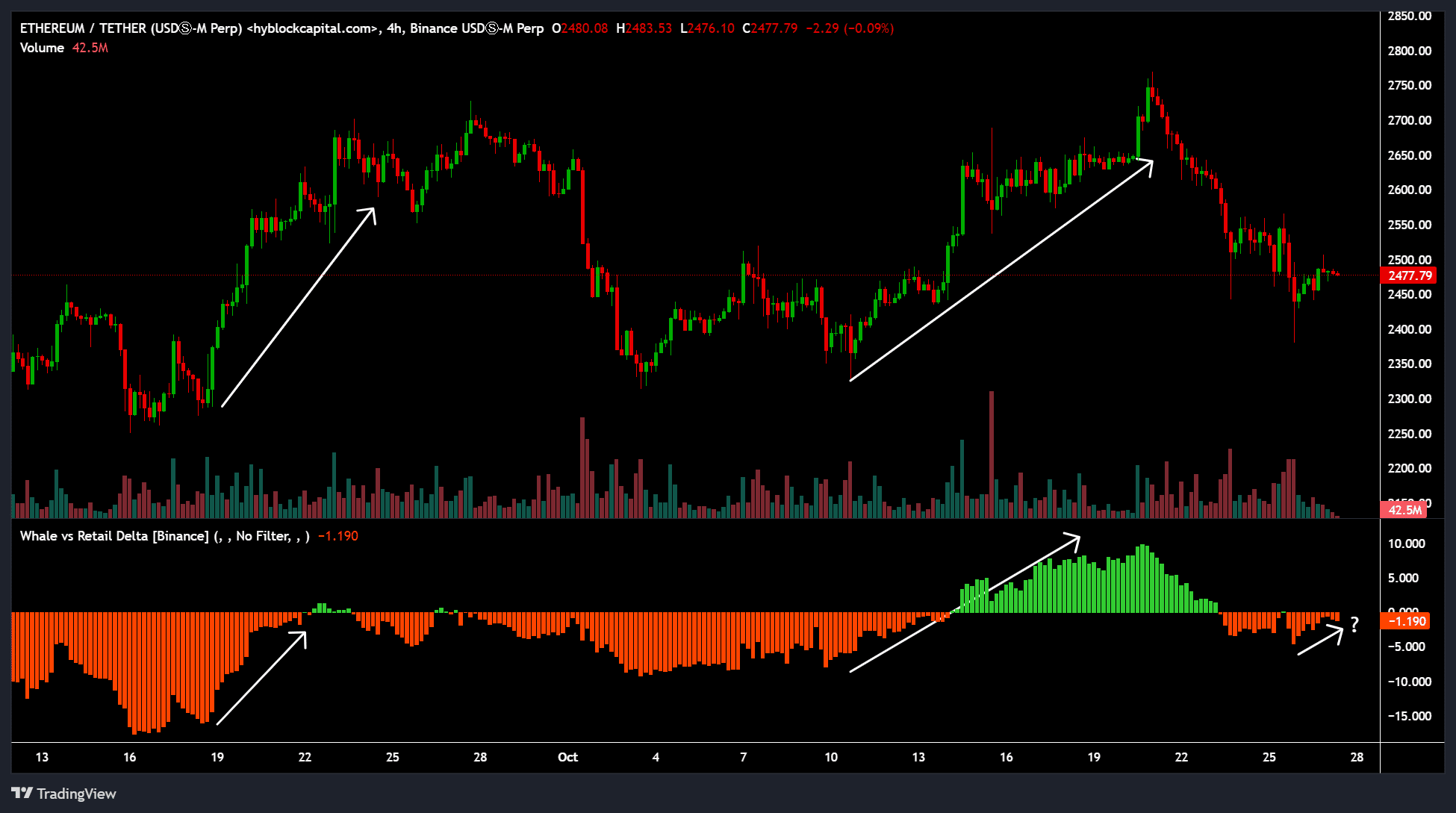

Despite recent pullback and FUD, Income Shark established that ETH’s market structure was solid, with bullish signals from Supertrend. He said,

“$ETH – Love that everyone says it’s over at the lows. Still making higher highs and higher lows. Supertrend still bullish.”

For context, a Supertrend is a simplified sell or buy indicator, and as of this writing, it flashed a ‘buy’ signal (green).

Additionally, a trend with higher highs always signals a potential breakout and continued uptrend. Since ETH has painted a similar pattern, this suggested a likely bottom and potential breakout per Income Sharks.

In fact, Ali Martinez, a renowned analyst, believed that the asset could rally to $6K if it stayed above $2400.

However, whales weren’t that big on ETH as of the time of writing.

Since the 22nd of October, whales have reduced their ETH exposure, as shown by the dropping Whales vs Retail Delta indicator.

The recent pullback was marked by a sharp decline in whale interest. However, there was slight positioning from whales again at press time, but it was not strong enough (not green) to signal strong market interest and a potential market rebound for ETH.

In other news, Ethereum co-founder Vitalik Buterin continues to fight FUD leveled at the network, especially regarding his ETH sell-offs and Ethereum Foundation activities.

That said, ETH was valued at $2.4K at press time. However, whether the ongoing FUD will derail ETH’s strong recovery potential remains to be seen.