- Celestia’s $1.06 billion TIA unlock is imminent, setting a crucial test for key support levels.

- Bearish sentiment prevails with low social engagement and negative funding rates despite upcoming liquidity.

Celestia [TIA] token is on the brink of a major shift as it gears up to unlock $1.06 billion worth of tokens, nearly 80% of its supply. With TIA trading at $5.37, up 0.87% at press time, this influx of liquidity could significantly impact the token’s market direction.

Many investors now wonder if the unlocked tokens will spark new demand or lead to increased selling pressure, thereby shifting TIA’s current trend.

TIA price action analysis: Consolidation or breakout?

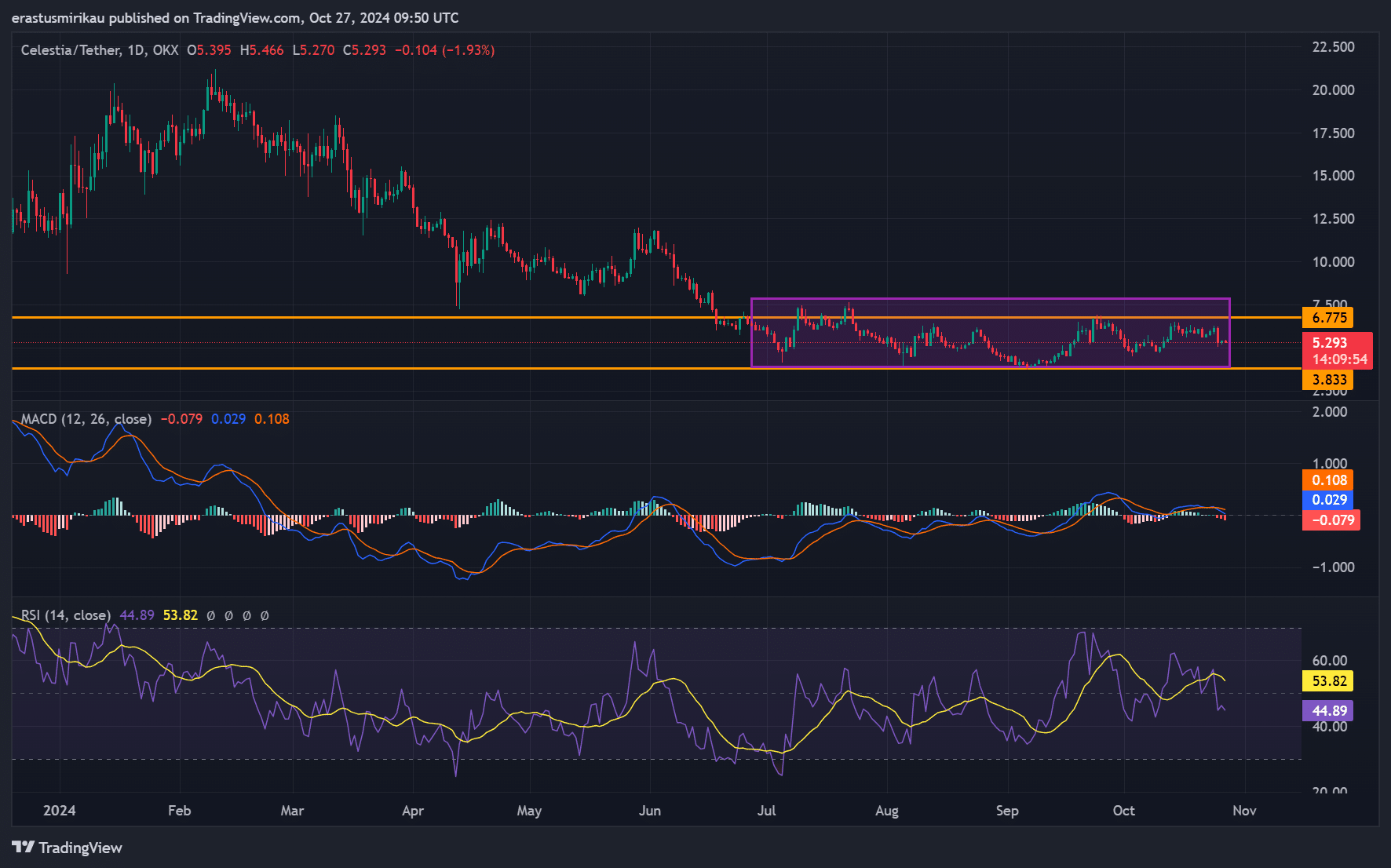

The daily Celestia chart reveals a trading range between $3.83 and $6.77, where the token has been consolidating for months. Currently, TIA hovers around $5.29, with signs of slight bearish momentum.

The MACD indicator suggests weakening bullish momentum, with the signal line near zero. Additionally, the RSI, sitting below 50, indicates limited bullish strength.

However, with the unlock event approaching, Celestia may be at a turning point. Should buyers step in, the price could break the $6.77 resistance, sparking upward momentum.

Conversely, if the market reacts unfavorably, TIA could slide toward its $3.83 support level, which might signal a potential breakdown.

Is TIA attracting enough social interest?

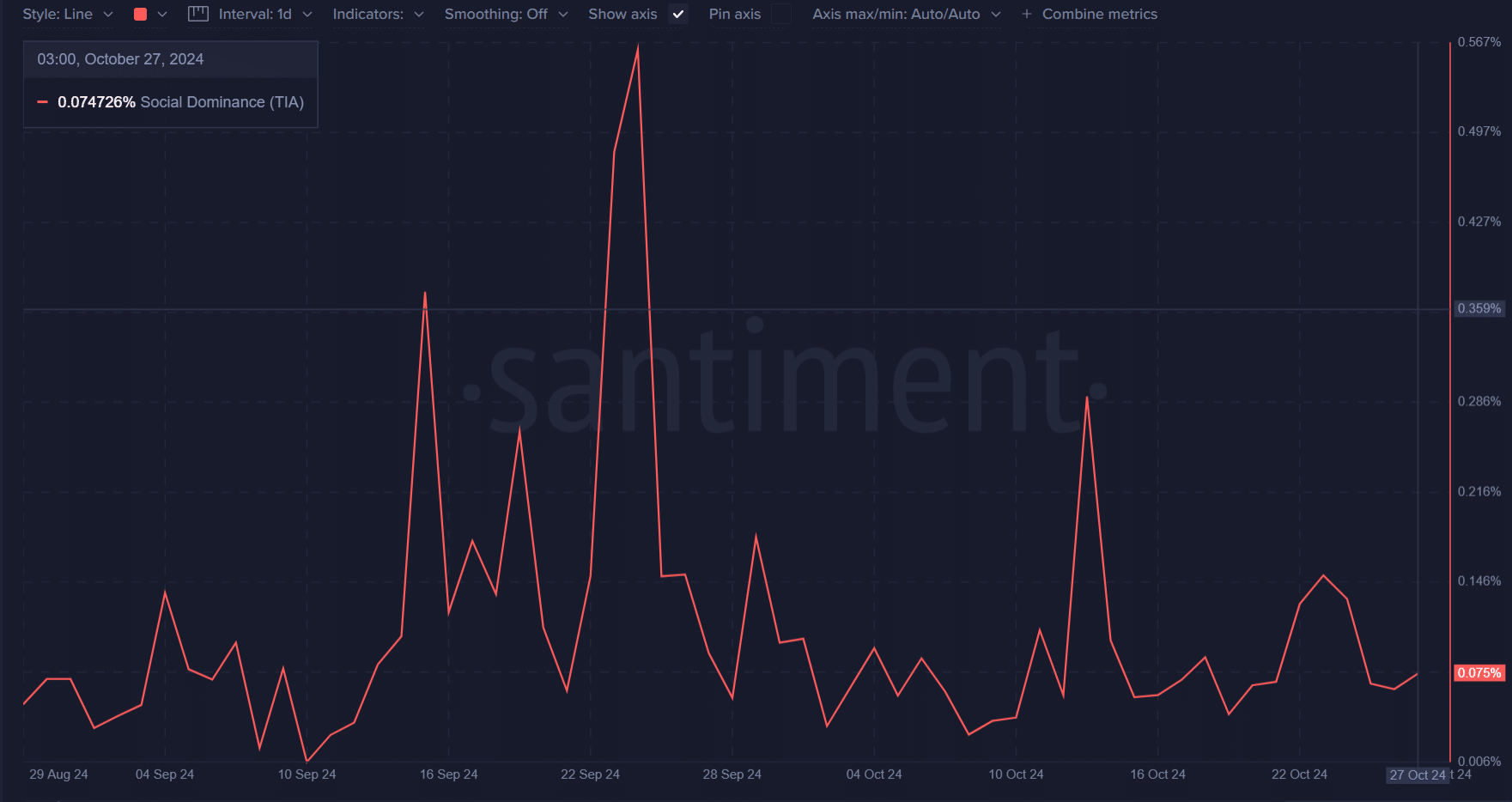

The Social Dominance chart shows sporadic spikes in Celestia discussions, particularly around mid-September and early October. However, recent data reveals subdued social activity, currently hovering around 0.075%. This limited engagement suggests that TIA may not yet be capturing the broader market’s attention.

The lack of social traction could indicate minimal retail excitement leading up to the unlock. A boost in social dominance could drive new interest, potentially aiding a breakout.

However, if TIA continues to lack social momentum, it may struggle to gain traction despite the significant liquidity influx.

Funding rate hints at bearish sentiment

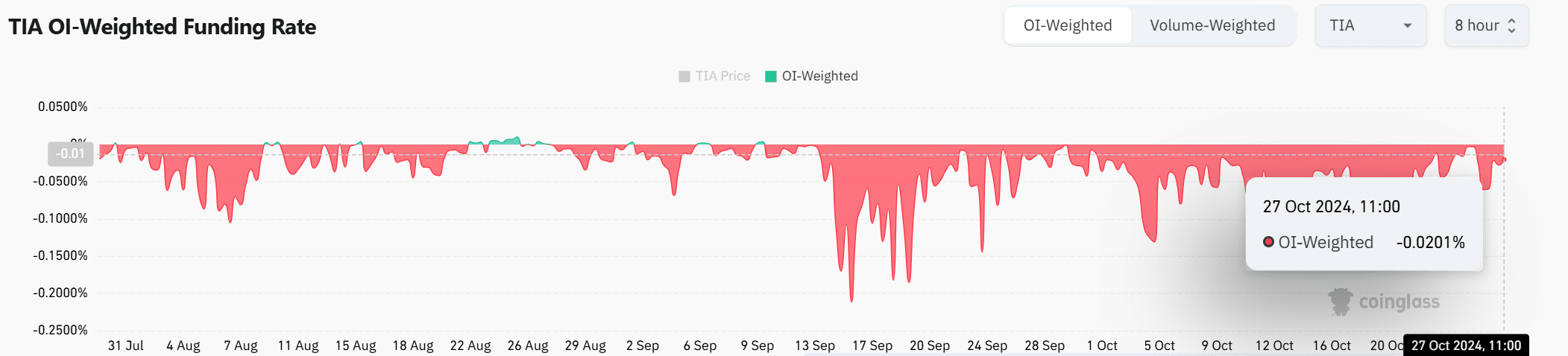

TIA’s OI-weighted funding rate remains in negative territory, most recently at -0.0201%, signaling that short positions dominate the futures market. This trend highlights a cautious sentiment, as many traders appear to be betting on a price decline.

However, if the unlock event triggers renewed buying interest, a shift toward a neutral or positive funding rate could indicate a sentiment reversal, supporting a potential rally.

Therefore, monitoring funding rate trends can provide insight into broader market expectations around Celestia’s price direction.

Is your portfolio green? Check out the TIA Profit Calculator

Conclusively, Celestia’s massive $1.06 billion unlock places TIA at a critical juncture. While the token’s price currently sits at $5.37 within a stable range, several indicators reflect bearish sentiment, including low social dominance and a negative funding rate.

Consequently, Celestia’s next move largely depends on how the market absorbs the influx of unlocked tokens. A surge in interest or a positive funding shift could propel TIA upward; otherwise, the token may struggle to maintain its value, making this event pivotal for Celestia’s future.