Check back for updates throughout the trading day

U.S. equity futures edged higher Monday, while the dollar slumped and Treasury yields tumbled, as investors braced for a wild week on Wall Street featuring the presidential election, a key Federal Reserve interest-rate decision and a host of corporate earnings.

Stocks ended higher on Friday, but closed out the week in the red, following a mixed slate of megacap tech earnings and a weaker-than-expected October jobs report that was heavily influenced by late-season hurricanes and a crippling strike at planemaker Boeing (BA) .

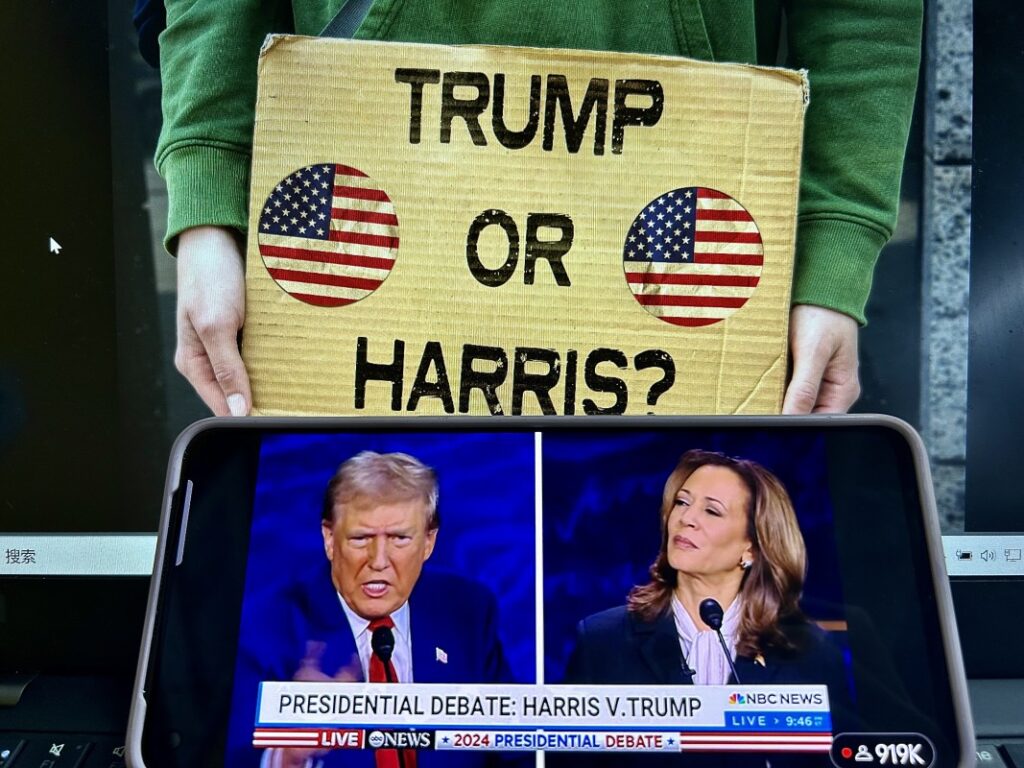

This week’s focus, however, is expected to fall firmly onto Tuesday’s national election — also including 34 Senate seats as well as the regular two-year turnover of the House of Representatives, which will have a crucial impact on any policies that either Vice President Kamala Harris or former President Donald Trump will attempt to bring to Congress.

WELLS: “.. polling suggests Senate control is more predictable this year – and the outcome potentially more impactful.

“.. Across the last 38 two-year election cycles, the $SPX two-year total returns averaged ~27%. When the GOP had Senate control, this figure was ~36%; when… pic.twitter.com/GKpPmbYA4k

— Carl Quintanilla (@carlquintanilla) November 4, 2024

Polls continue to suggest a dead heat between the two candidates, but a series of weekend surveys, including a surprise result from a respected pollster in Iowa, suggests some 11th-hour momentum for Harris.

That’s adding to some reversal of last month’s so-called Trump Trade, putting downward pressure on the dollar, which was marked 0.6% lower against a basket of its global peers, as well as Treasury bond yields, which pushed down 10-year notes 10 basis points to 4.297% in overnight trading.

Trump Media & Technology (DJT) shares, meanwhile, fell another 6% in heavy premarket volume, following on from last week’s 27.5% slump, as traders pared bets on a victory for the former president. Trump Media is the parent of the Truth Social social-media platform.

Broader markets, however, look set for a cautious open ahead of tomorrow’s election and a key Fed policy meeting, slated on Thursday, one day later than usual.

Last week’s inflation and jobs data have had little impact on bets for a quarter-point rate cut this month, which would take the Federal Funds Rate to between 4.5% and 4.75%, with the odds of a follow-on reduction in December pegged at 82% according to CME Group’s FedWatch.

On Wall Street, futures contracts tied to the S&P 500, which remains 20.1% higher for the year, are priced for a 10-point opening-bell gain while those linked to the Dow Jones Industrial Average suggest a 25-point bump.

The tech-focused Nasdaq, which is up 21.5% for the year, is priced for a modest 35-point gain.

Related: Nvidia to reap billions in big tech AI spending

Stocks on the move include Nvidia (NVDA) , which was marked 2.2% higher in the premarket following news late Friday that the AI-chip maker will replace Intel (INTC) in the Dow later this month.

More Wall Street Analysts:

- Analysts update Meta stock price target with Q3 earnings in focus

- Analysts update outlook for Nvidia’s Blackwell chips amid AI boom

- Analyst reboots Reddit stock price target ahead of earnings

In overseas markets, stocks were broadly higher modest gains in Europe, including a 0.3% gain for the Stoxx 600, and a 0.62% advance for the MSCI ex-Japan benchmark in Asia. Japan’s Nikkei 225 remained closed for the country’s annual Culture Day observance.

Related: Veteran fund manager sees world of pain coming for stocks