- The Avalanche price prediction supported a short-term bullish outlook.

- AVAX’s retracement could offer a great buying opportunity at $50.

Avalanche’s [AVAX] recent pullback could offer a nice long position entry with a 12% potential gain. However, altcoin could offer great long- and short-term opportunities.

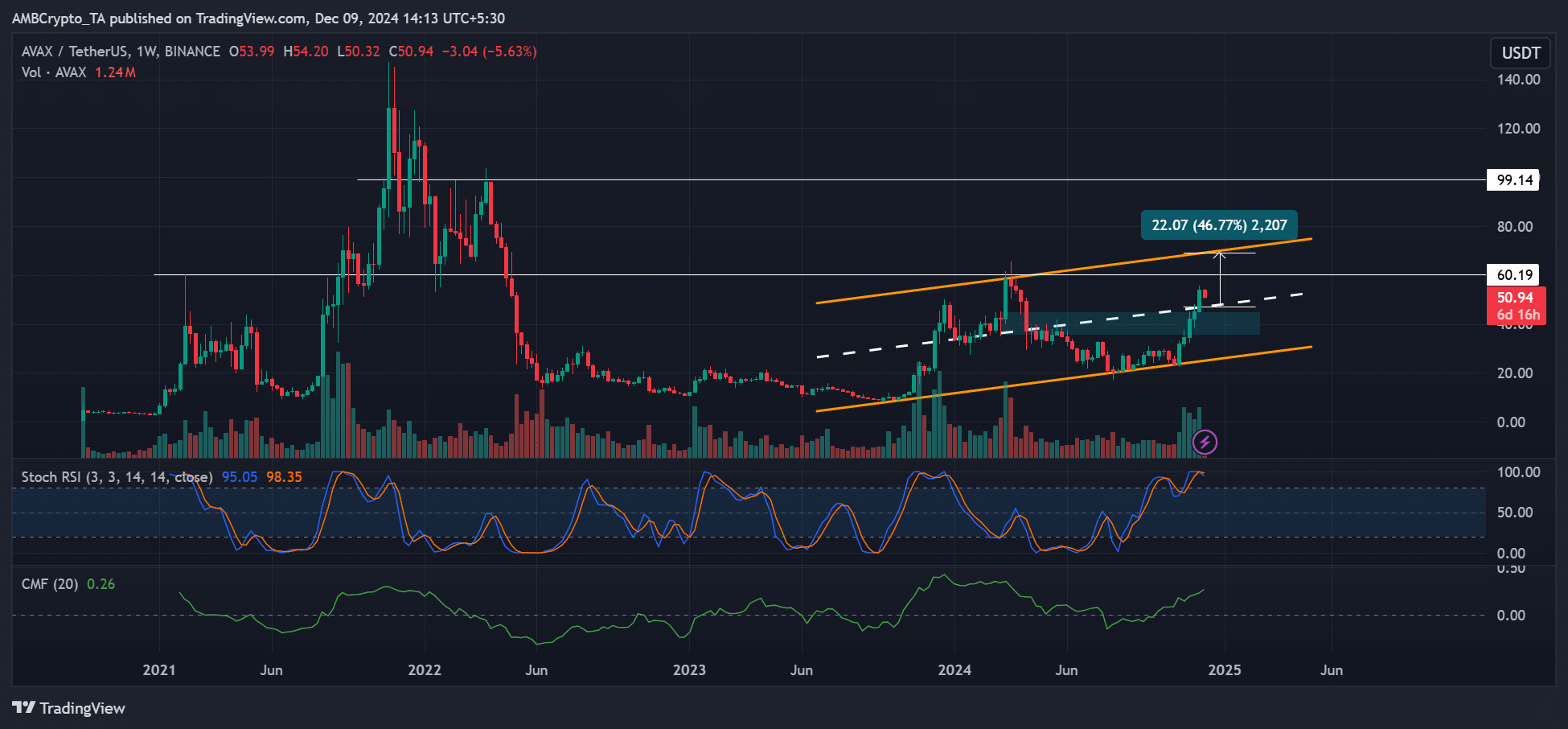

From a broader perspective, AVAX was one of the top 100 tokens by market cap, which has lagged behind most of the major tokens with triple digits on YTD (year-to-date) returns.

This could make it a better opportunity should it soar to its 2024 ($65) or 2021 highs ($147).

Based on historical trends, a decisive move above $60 could make $100 (2021 range high) reachable.

Short-term AVAX prospect

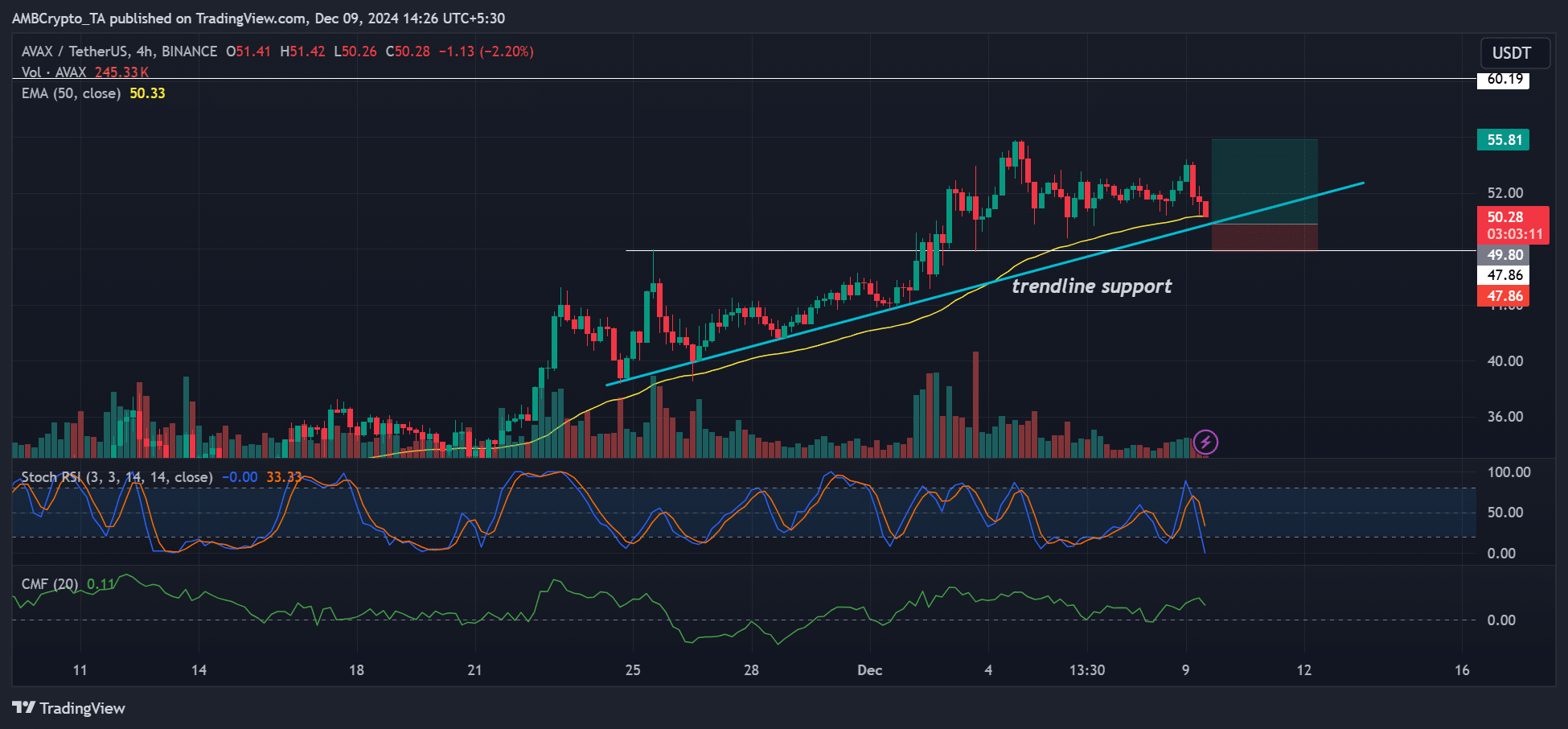

When zoomed in on the 4-hour chart, AVAX retracement was headed to key short-term support levels.

Since late November, the trendline support and the dynamic 50-day EMA (Exponential Moving Average) have held AVAX’s dump.

If the trend repeats, we can expect a bounce at these levels, providing a nice entry for a long position at $49.7.

The area below the high at $49.8 can be the stop loss to preserve capital, meaning a drop below $48 would invalidate the long position.

The short-term price momentum had weakened and could trigger a price reversal based on the oversold reading on Stochastic RSI.

Besides, the above-average inflows, as shown by the CMF, supported the likely price rebound projection.

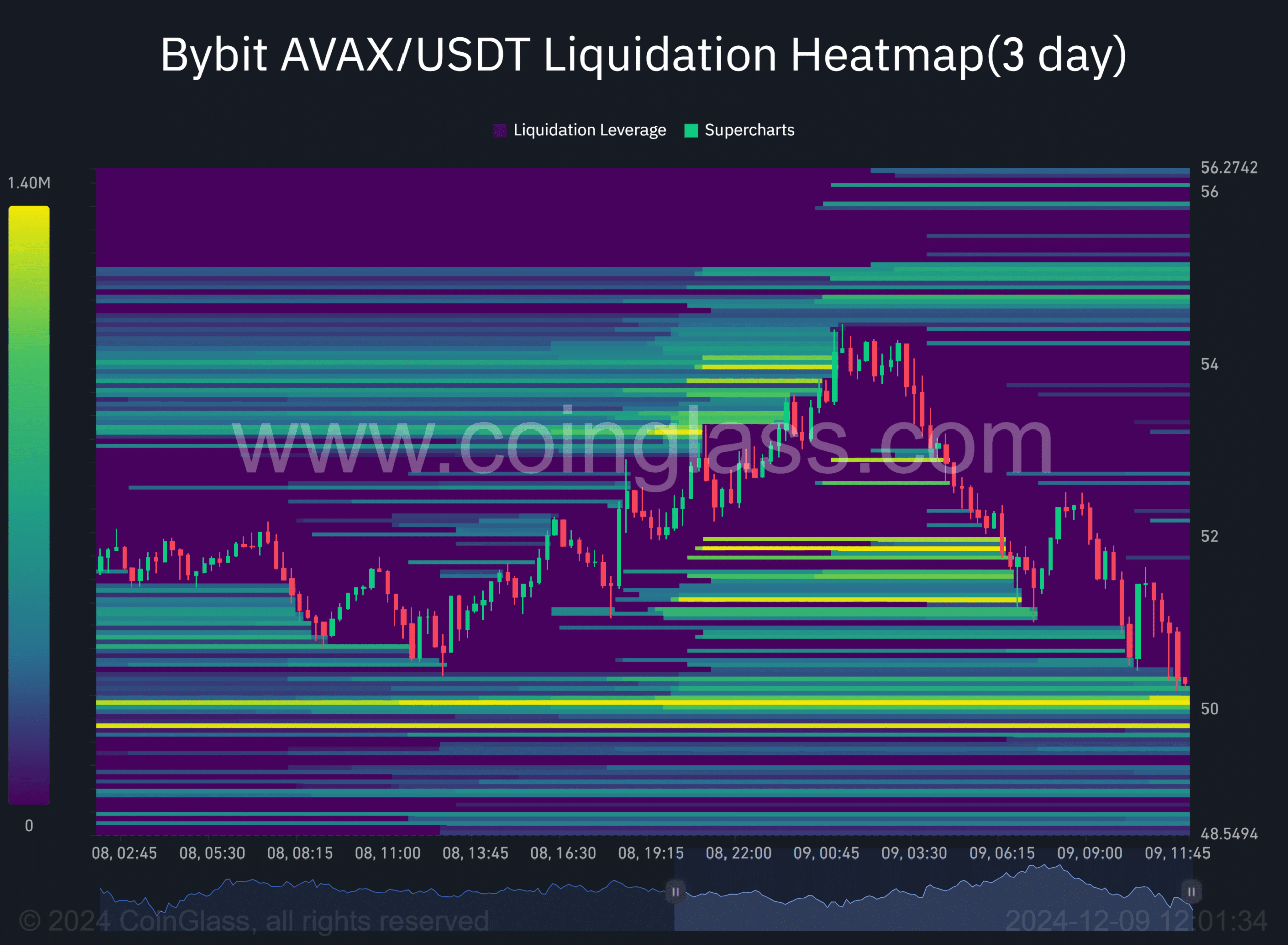

Liquidity sweep at $50

That said, the early-week shake-out was driven by a liquidity hunt. According to Coinglass, AVAX had tapped the liquidity at $52 and went for the one below $50 (bright yellow levels) at press time.

With no significant liquidity beyond the leveraged longs at $49.8, liquidation at these levels could trigger AVAX to reverse to the upside.

Read Avalanche [AVAX] Price Prediction 2024-2025

The upside liquidity was building up near $54-$55. These were piling leveraged short positions, which could be the next upside target for the liquidity sweep.

The likely rebound, driven by the liquidity hunt, from $49.8 to $54-$55, fits the long idea, with a potential gain of 12%. However, an extended drop below $48 would invalidate the short-term bullish outlook.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion