Stay informed with free updates

Simply sign up to the US inflation myFT Digest — delivered directly to your inbox.

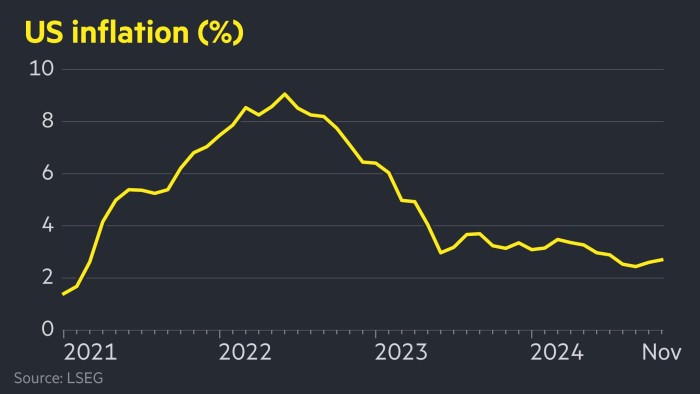

US inflation ticked up to 2.7 per cent last month, matching Wall Street’s forecasts and clearing the way for an expected Federal Reserve rate cut next week.

Wednesday’s data from the Bureau of Labor Statistics was in line with the expectations of economists polled by Bloomberg. But it was higher than the 2.6 per cent rate in October, which itself marked an increase on the previous month.

Market pricing indicated that investors now assign a 98 per cent probability to a quarter-point rate cut in December, up from less than 90 per cent before the release of the latest inflation figures.

Brian Levitt, global market strategist at Invesco, said the figures were “very much within the Fed’s comfort zone and support[ed] a rate cut at the next meeting”.

A quarter-point cut next week would take interest rates to a new target range of 4.25-4.5 per cent.

But the trajectory next year is less certain, as the central bank wrestles with its dual mandate to keep inflation close to 2 per cent and maintain a healthy labour market.

“The Fed probably moves to the sidelines after December,” said Ajay Rajadhyaksha, global chair of research at Barclays, noting that, with next week’s expected cut, the central bank will have lowered borrowing costs by 100 basis points.

He added: “That can change in a hurry if the labour market falls out of bed — but so far there’s not a lot of signs of that.”

US stocks opened higher, with the benchmark S&P 500 gauge adding 0.6 per cent and the tech-heavy Nasdaq Composite jumping 0.9 per cent.

In government bond markets, the policy-sensitive two-year Treasury yield, which moves inversely to price, was 0.05 percentage points lower at 4.1 per cent.

The dollar slightly trimmed an earlier gain to trade 0.1 per cent higher against a basket of six other currencies.

Wednesday’s data showed that on a monthly basis, both headline and core inflation — which strips out food and energy prices — rose 0.3 per cent in November.

On an annual basis, core inflation rose 3.3 per cent.

Fed officials have discussed slowing the pace of cuts as rates reach a more “neutral” setting that is high enough to keep inflation in check but sufficiently low to safeguard the labour market.

They argue that if they cut rates too quickly, inflation may get stuck above their 2 per cent target, but moving too slowly could risk a sharp rise in the unemployment rate.

Last week, chair Jay Powell also suggested that a strong economy meant the central bank could “afford to be a little more cautious” about rate reductions.

The latest jobs report also showed jobs growth rebounding sharply in November after being dragged down by hurricanes and strikes the previous month.

However, the unemployment rate rose to 4.2 per cent, suggesting the labour market’s acceleration was not strong enough to risk reigniting inflation.

Some officials in the outgoing Biden administration have expressed concern that the policies of president-elect Donald Trump will damage the economy after he returns to the White House next month.

US Treasury secretary Janet Yellen said this week that the sweeping tariffs proposed by Trump could “derail” progress on taming inflation.

“[Tariffs] would have an adverse impact on the competitiveness of some sectors of the United States economy, and could significantly raise costs to households,” she said at an event hosted by the Wall Street Journal.