- AVAX has declined by 5.13% over the past 24 hours

- With a bearish crossover, Avalanche could decline as it remains stuck in a consolidation range.

After experiencing a sustained uptrend and hitting a recent high of $55, Avalanche [AVAX] has struggled to maintain an upward momentum.

As such, the altcoin has dropped to hit a low of $40. Over the past two weeks, AVAX has traded in a consolidation range between $47 and $55.

In fact, as of this writing, Avalanche was trading at $49.49, a5.13% decline in daily charts. Also, the altcoin has declined on weekly charts, dropping by 2.93%.

Prior to this, Avalanche had been on an upward trajectory, hiking by 55.26% over the past month.

The current market conditions raise questions about Avalanche’s future price movement.

What AVAX’s bearish crossover means

According to AMBCrypto’s analysis, AVAX was seeing strong downward pressure amidst increased selling pressure at press time. The altcoin’s upward momentum was slowly dwindling as bears attempted to take over the market.

This downtrend has now been confirmed by a bearish crossover on Stoch RSI over the past 24 hours. This crossover, at 30.09, indicates short-term bearish momentum.

It reflects a shift in sentiment from bullish to bearish, suggesting that sellers may gain control.

This shift is further witnessed as SMA flips over the price, signaling bearish momentum. As such, the market trend could be entering a corrective phase.

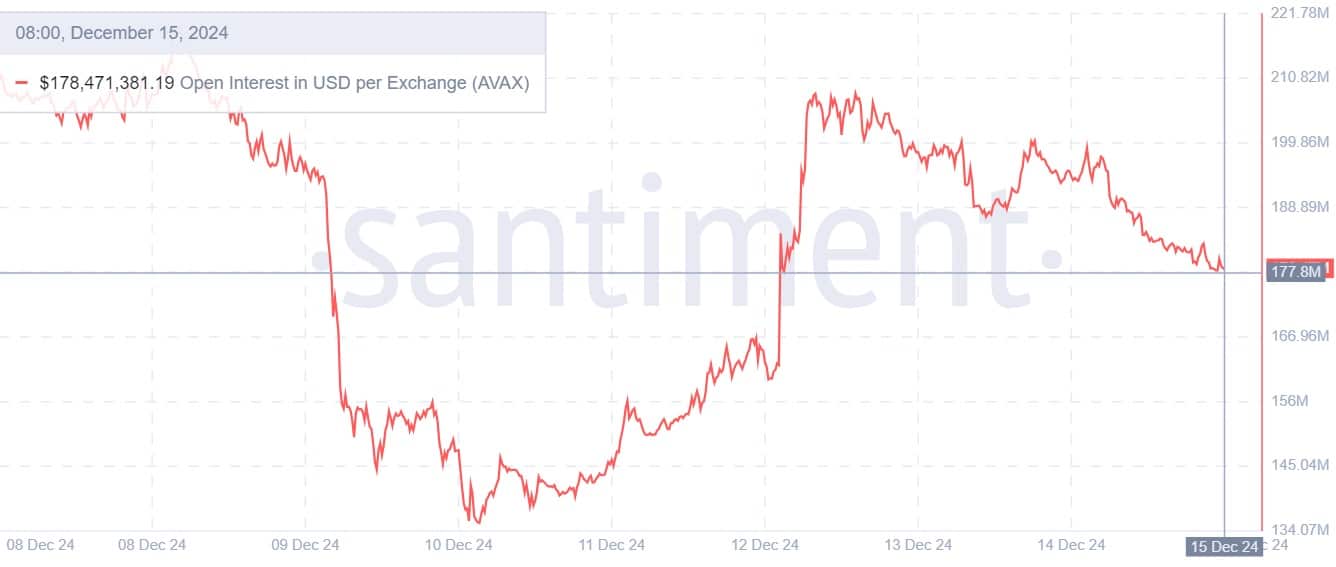

Looking further, Avalanche’s Open Interest per Exchange declined over the past week from $219.5 million to $178.4 million.

A decline in Open Interest reflects investor’s sentiment, as they continue to close their positions while new entrants avoid entering the market.

This bearishness is even more predominant among AVAX whales. As such, large holders inflow has declined from 8.55 million to 2.12 million.

Such a sharp decline implies that capital inflow among whales has declined and they are not buying the altcoin.

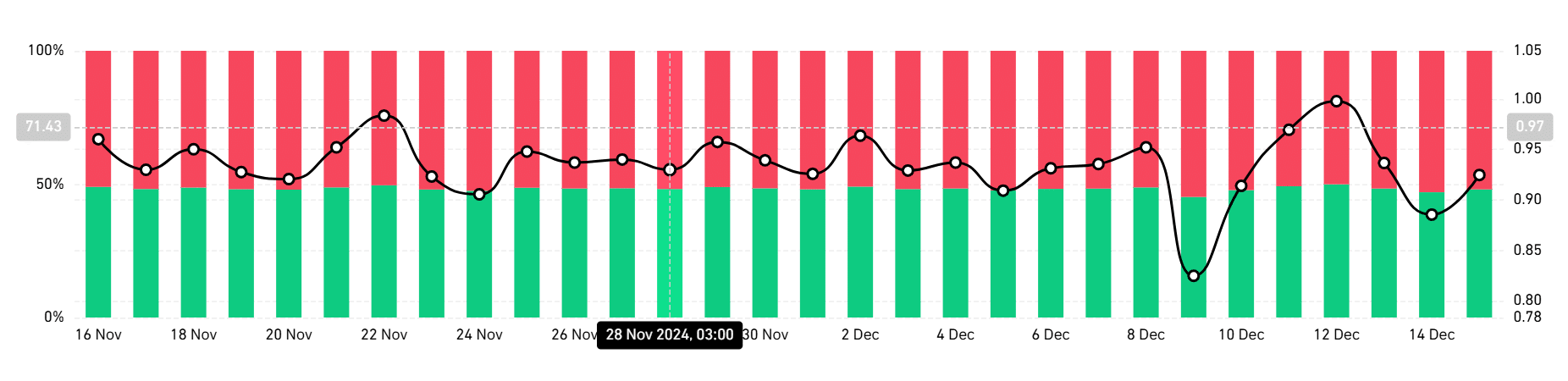

Finally, investors taking short positions have dominated the market on daily charts. According to the long/short ratio, short position holders take 51. 96% of total positions.

With most investors taking short positions, it implies that most market participants are betting on prices to decline.

Simply put, Avalanche is currently experiencing short-term bearish sentiments, as evidenced by a bearish crossover.

Read Avalanche’s [AVAX] Price Prediction 2024 – 2025

The current market conditions point towards potential trend continuation, which could pull AVAX down to $43.

Subsequently, a breakout from this consolidation range will see AVAX reclaim $55, where it has faced two rejections over the past weeks.