- COW crypto has recently hit an ATH in volume.

- Its price has also set a new record.

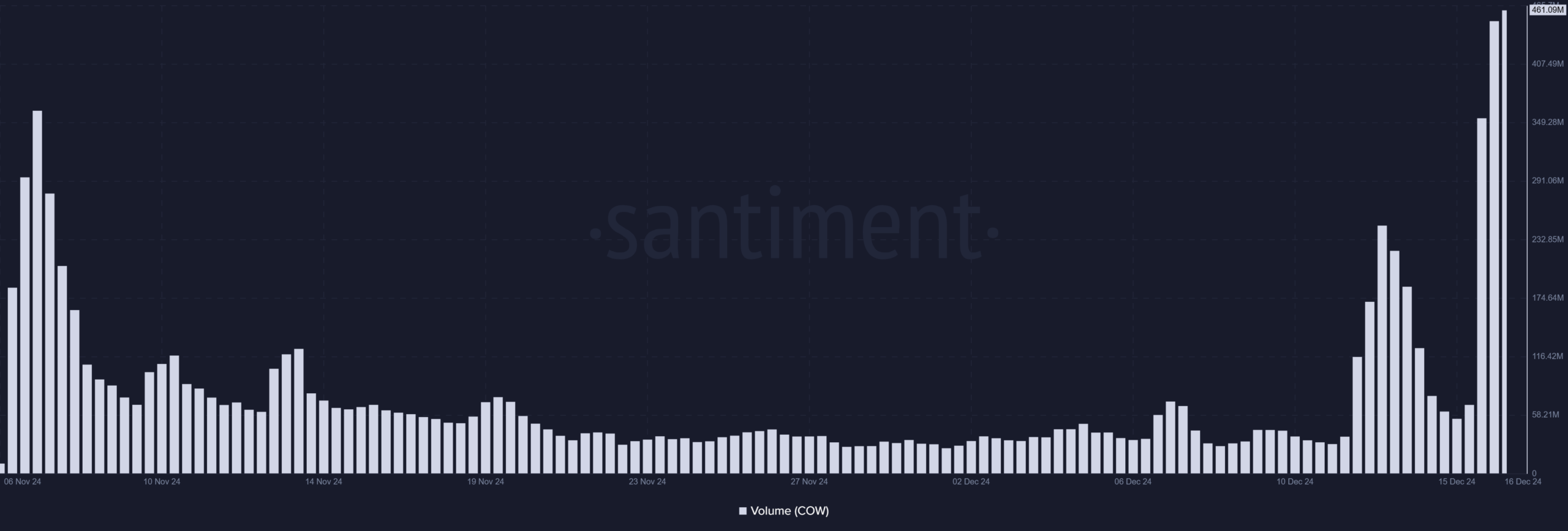

CoW Protocol [COW] has reached a major milestone, with trading volume skyrocketing to an all-time high. This surge surpassed its previous peak of $361 million in November, reflecting heightened user engagement.

Alongside the volume spike, COW’s price has surged over 50%, signaling strong bullish momentum as it approaches the $1.00 mark.

CoW Protocol witnesses a significant volume spike

The CoW Protocol has recently experienced a notable surge in trading volume, climbing sixfold within a short span.

According to the data from Santiment, the protocol’s daily volume soared from a baseline level to over $461 million as of the 16th of December.

Further analysis showed that this was an all-time high. The previous ATH of $361 million, now the second ATH, came in November.

Elevated activity levels often indicate increasing user engagement or liquidity injections, which can lead to further price gains.

COW crypto eyeing a new peak?

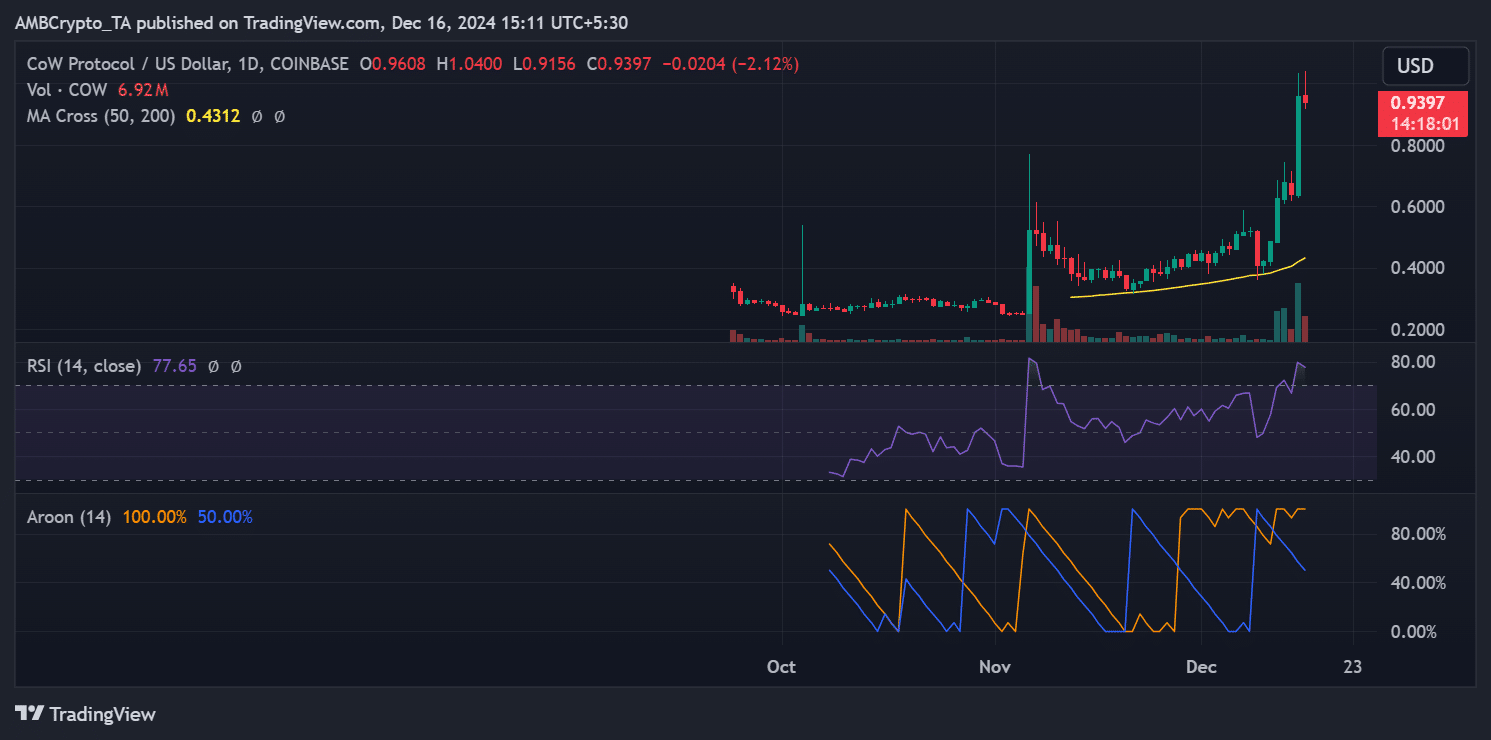

Alongside the surge in volume, CoW’s price has recorded a sharp upward trajectory, gaining over 50% in recent sessions. On the daily chart, CoW broke above the $0.60 level and now hovered near $0.93.

This price spike came with a significant increase in trading volumes, signaling strong bullish momentum.

Notably, the Relative Strength Index (RSI) has crossed into the overbought territory at 77.65, indicating heightened buying pressure.

The Aroon indicator further highlighted a bullish trend, with the Aroon Up at 100%, showcasing strong upward momentum, while the Aroon Down remained suppressed.

A sustained close above $1.00 could pave the way for CoW Protocol to test its all-time high.

Conversely, any retracement might find initial support at the 50-day moving average around $0.43, followed by the psychological $0.60 level.

Engagement on the rise

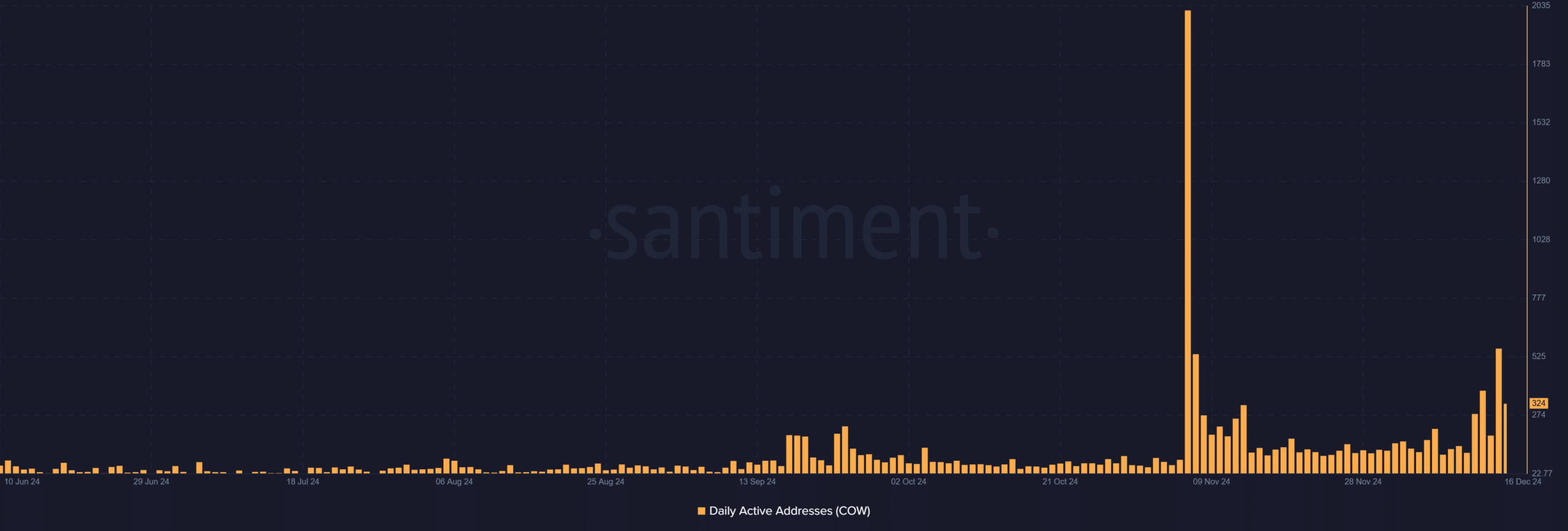

The spike in volume aligned with a rising trend in daily active addresses, further supporting the bullish sentiment.

After months of relatively muted on-chain activity, active addresses surged, indicating a growing user base. Data from Santiment showed that the figure peaked significantly around the 15th of December before slightly retreating.

This uptick underscores increased network participation, likely driven by the recent surge in price and trading volume.

However, the spike is mild when compared to the volume. Analysis showed that its highest number of daily active addresses was in November, when the number spiked to 2015.

What this convergence means

The convergence of soaring trading volume, rising active addresses, and significant price gains painted a bullish outlook for CoW Protocol.

The sustained activity suggested that market participants were optimistic about its long-term potential.

However, investors should watch for possible short-term corrections due to the RSI indicating overbought conditions.

Read CoW Protocol’s [COW] Price Prediction 2024–2025

If trading volumes remain consistent and daily active addresses continue to grow, CoW Protocol could establish new all-time highs before the end of December 2024.

Market observers will closely monitor these metrics for signs of continued upward momentum or potential reversals in the coming days.