So far, one of the biggest winners of the Q4 2024 earnings season has been Broadcom (AVGO) , whose market cap just topped $1 trillion last week.

Don’t miss the move: SIGN UP for TheStreet’s FREE daily newsletter

Broadcom has enjoyed an excellent year of steady growth as a leader in semiconductor technology design and manufacturing. With gains of 118% for the year, driven primarily by artificial intelligence (AI) technology progress, AVGO stock looks poised to close out 2024 on an extremely high note.

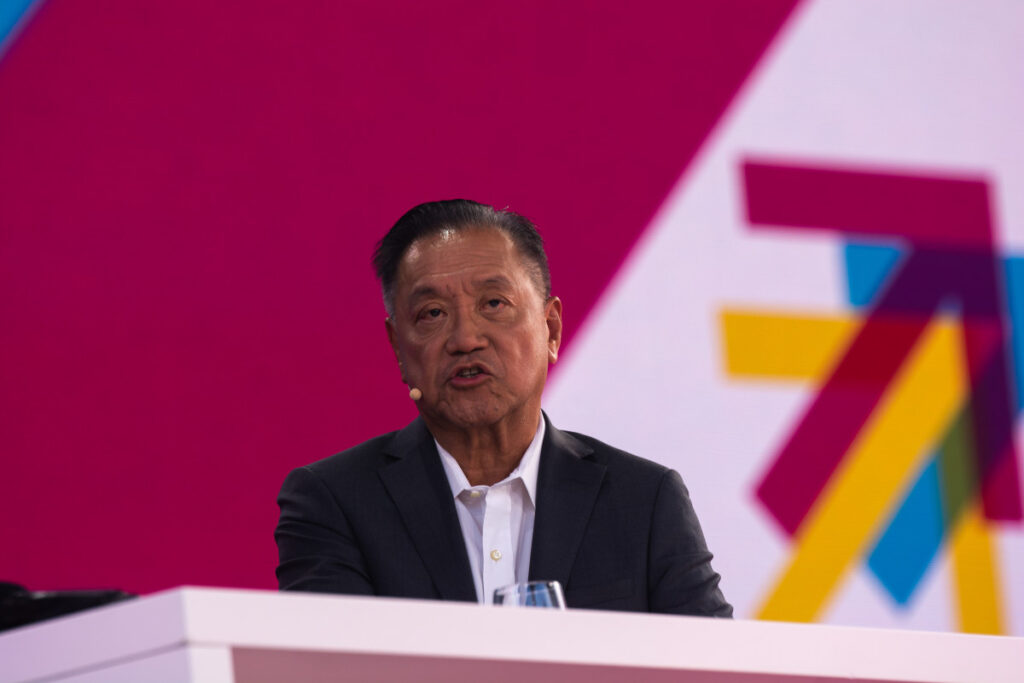

While Broadcom’s gains for the year haven’t been as high as Nvidia’s (NVDA) , the AI-chip market may be on the verge of a significant paradigm shift that could benefit the former significantly. On last week’s Q4 earnings call, Broadcom CEO Hock Tan laid out a high revenue prediction for the next two-year period, one that highlights an oncoming trend in the AI-chip industry.

Shifting market trends could be a growth driver for Broadcom

Over the past two years, industry-wide demand has propelled Nvidia to the top of the booming AI market. Many companies are hyper-focused on building large language models (LLMs), and Nvidia produces the only GPUs (graphic processing units) that are powerful enough for many AI systems to run on.

Related: Apple reveals new AI chip building partner, and it isn’t Amazon

Up until now, no company has been able to produce a GPU that can genuinely rival Nvidia’s in terms of processing power and efficiency. However, on last week’s Q4 earnings call, Tan discussed some elements that suggest that the AI-chip market may be shifting in a way that benefits companies who are building custom silicon chips, specifically eXtreme Processing Units (XPUs), as opposed to the general-purpose GPUs made by Nvidia.

For context, GPUs are considered highly versatile and can typically handle a wide variety of computing tasks. Nvidia’s chips are part of a robust software ecosystem, which has helped make them easy to use.

By contrast, XPUs are highly specialized and often tailored for more specific, high-computing tasks, typically in the vein of AI and machine learning. They may be more limited in nature, but Broadcom’s Q4 earnings report suggests that specialized chips are gaining an edge over more general ones.

Related: Nvidia scales international hiring for critical new tech sector

As noted, Tan sees significant revenue opportunity ahead for Broadcom’s AI and AI networking, forecasting a range of $60 billion to $90 billion for 2027, a significant increase from last year’s $15 billion to $20 billion estimate.

The CEO attributed Broadcom’s strong AI growth to its custom XPUs and AI networking, highlighting a specific type of client that seems to be embracing these chips rather than the traditional GPUs.

“Specific hyperscalers have begun their respective journeys to develop their own custom AI accelerators or XPUs,” he said, referring to cloud computing and data storage companies that conduct hyperscale computing. Broadcom’s hyperscaler partner list includes Amazon (AMZN) Web Services, Google (GOOGL) Cloud and Microsoft (MSFT) Azure.

Tan also revealed that Broadcom has been selected to work with two additional hyperscalers and is “in advanced development for their own next-generation AI XPUs.”

Broadcom’s success and growth plans make it clear that the market for custom silicon chips is growing. But if it is, will companies producing standard GPUs, specifically Nvidia, be threatened?

More Tech Stocks:

- New AI leader outshines Magnificent 7 stocks on top funds list

- Google unveils the ChatGPT of weather

- UnitedHealthcare spotlight reveals pivotal AI failure

Is Broadcom the new Nvidia?

At first glance, it might be easy to assume that the rising popularity of XPUs will compromise Nvidia’s market dominance. In July 2024, a report from All About Industries examined this topic, discussing the utility of Application Specific Integrated Circuits (ASICs), a fellow custom silicon chip that is similar to the XPU in terms of its functionality.

Given the role played by XPUs in Broadcom’s recent earnings smash, the custom silicon chip question seems even more relevant now. However, one expert believes that the market has room for both and that the growing demand for both types of AI chips will spur growth for both Broadcom and Nvidia in the coming year.

Ophir Gottlieb is the CEO of Capital Market Laboratories, a sell-side research and financial technology firm. He spoke to TheStreet about the recent Broadcom earnings call and what it is likely to mean for chip makers.

Related: Major Apple chip supplier is expanding into the U.S.

“I think one type bolsters the demand for the other, and it’s a sort of a reinforcing cycle,” he states. “Not only is it not a zero-sum game, I think it’s synergistic.”

Gottlieb also broke down the appeal of more specialized chips over Nvidia’s more general processors, highlighting that leading tech companies run their AI platforms on their own software layer. In his words:

“When you have a custom software layer, you build the chips specifically to function with that software. And that’s why it’s more effective, it’s more efficient. It won’t be more efficient in the generalized sense.”

In a note to investors recently published on Broadcom, Gottlieb states that “While NVIDIA dominates GPUs for AI, Broadcom’s custom silicon addresses hyperscaler-specific workloads with unmatched efficiency,” reinforcing this bullish thesis on both companies.

Related: Veteran fund manager sees world of pain coming for stocks