MARA Holdings, Inc. (NASDAQ: MARA) has reported first quarter 2025 earnings, announcing $213.9 million in revenue—a 30% increase from Q1 2024—as the company continues its transformation into a digital energy and infrastructure powerhouse.

“Revenues increased 30% to $213.9 million in Q1 2025 from $165.2 million in Q1 2024,” the company shared in its shareholder letter. MARA’s bitcoin holdings surged by 174% year-over-year, rising from 17,320 BTC to 47,531 BTC, now valued around $3.9 billion as of March 31, 2025.

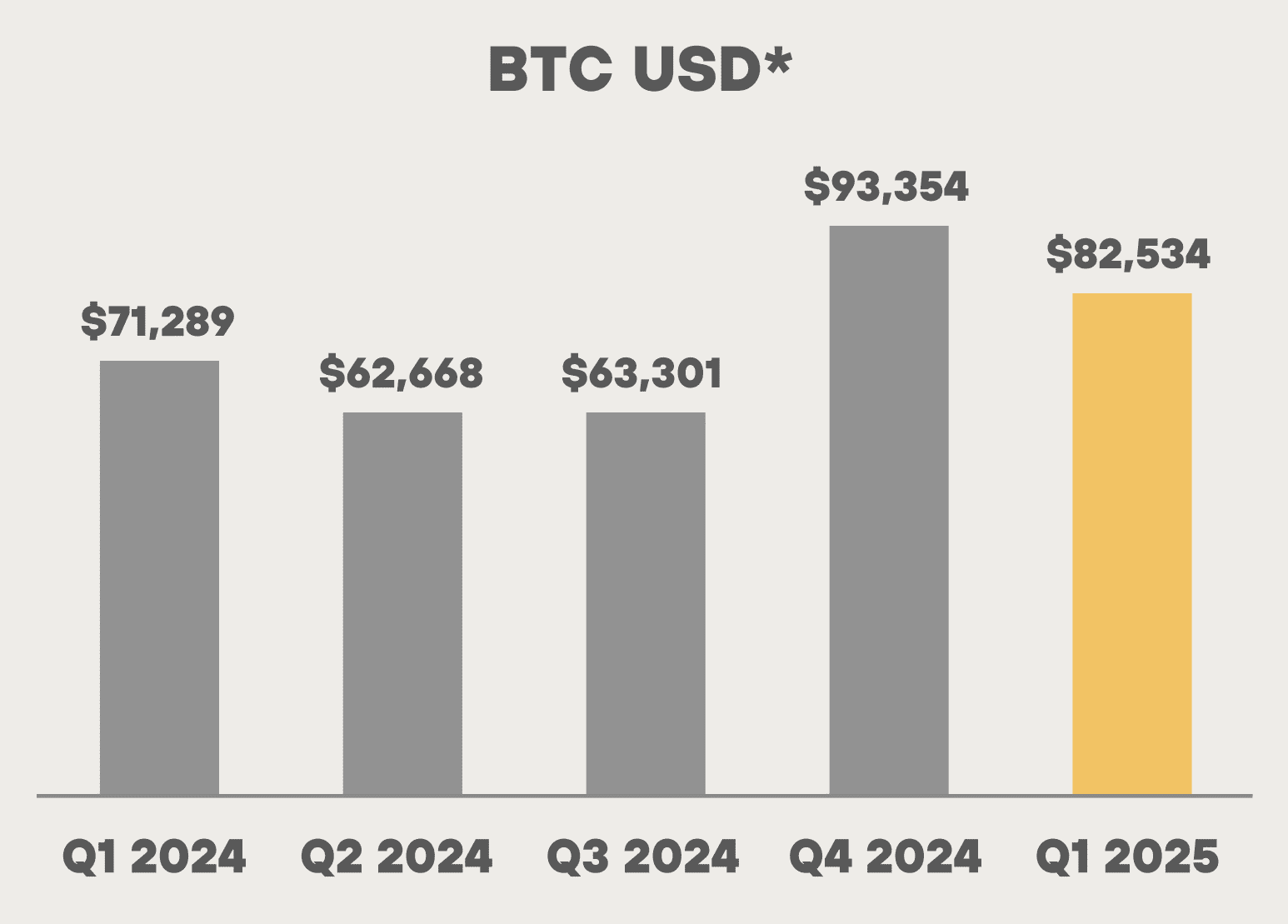

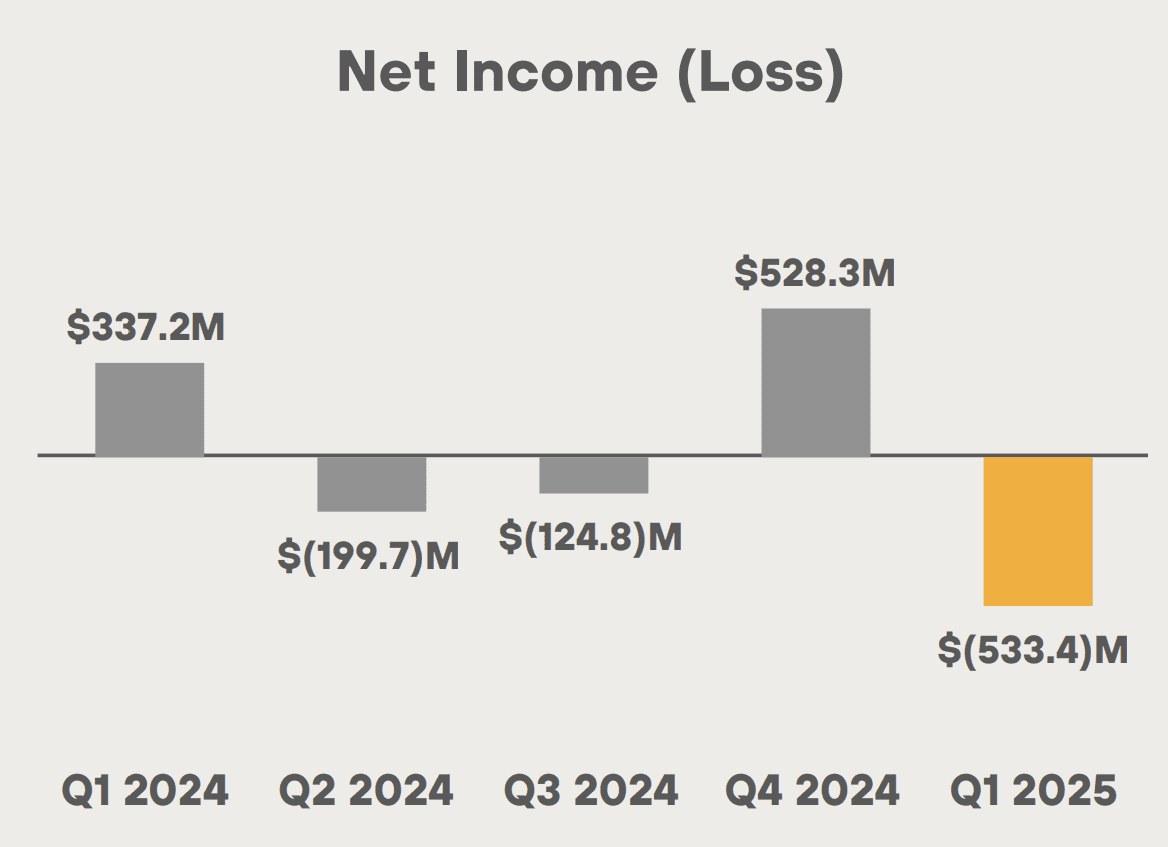

Despite the revenue boost, MARA posted a net loss of $533.4 million, primarily due to a $510.2 million loss in the fair value of bitcoin as it ended the quarter at $82,534. “Although we recognized a loss in Q1… the current bitcoin price of approximately $100,000 would imply a substantial fair value gain,” the company noted.

MARA mined 2,286 BTC and purchased 340 more in Q1. Its energized hashrate nearly doubled from 27.8 EH/s in Q1 2024 to 54.3 EH/s, while cost per petahash per day improved 25% to $28.5.

The company is pushing forward on its two strategic priorities: “(1) strategically growing by shifting our model toward low-cost energy with more efficient capital deployment, and (2) bringing to market a full suite of solutions for data centers and edge inference—including energy management, load balancing, and advanced cooling.”

Highlights from the quarter include:

- Acquisition of a 114 MW wind farm in Texas with low fixed energy costs (~$10/MWh).

- Deployment of gas-to-power operations in North Dakota and Texas, reducing emissions by the equivalent of 14,200 gasoline-powered vehicles.

- Expansion of its Ohio data center, adding 50 MW and 12,000 new miners.

- Continued development of proprietary immersion cooling systems (2PIC) and next-gen ASICs through its stake in chipmaker Auradine.

MARA will host a webcast and earnings call at 5:00 p.m. ET on May 8, 2025. Shareholders can register via this link.