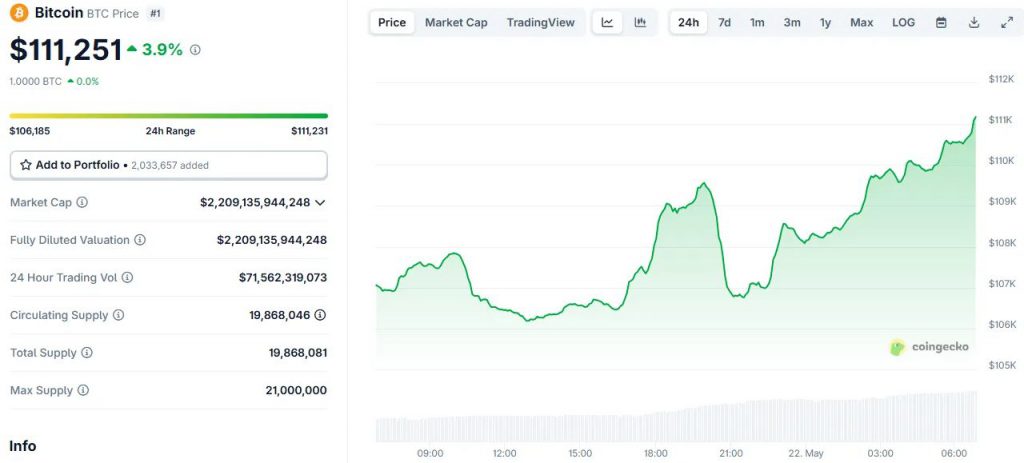

BTC past $111K has become reality, and at the time of writing, the cryptocurrency is sitting at $111,251 with a pretty solid 3.9% gain. This Bitcoin price surge comes as the stablecoin bill is advancing through Congress, which is reducing crypto market volatility concerns and those Bitcoin investment risks that previously kept institutional players on the sidelines.

Also Read: Uber: JPMorgan Raises Price Forecast for UBER Stock

Tracking Bitcoin Price Surge Amid Stablecoin Bill And Market Risks

Stablecoin Bill Drives BTC Past $111K Right Now

The Senate just voted to advance the GENIUS Act, which is America’s first stablecoin legislation, and this is creating regulatory clarity that’s really pushing BTC past $111K levels. This Bitcoin price surge reflects reduced crypto market volatility as institutional Bitcoin investment risks are starting to diminish.

The crypto industry-backed bill in the Senate is set for debate and could pass as soon as this week, according to reports.

Senate Banking Committee Chairman Sen. Tim Scott, R-S.C., said in a press release:

“Tonight’s vote is a welcome and long-overdue step toward asserting U.S. leadership in digital assets. After playing politics, I’m glad many of my Democratic colleagues have returned to the table and are supporting a bipartisan product they helped shape. By moving forward on the GENIUS Act, we are one step closer to delivering a regulatory framework that keeps innovation in America, protects consumers, and safeguards our national security.”

Trump Administration Fuels BTC Past $111K Movement

The regulatory shift under Trump’s administration has been quite crucial in driving BTC past $111K, and this Bitcoin price surge is showing reduced crypto market volatility. Lower Bitcoin investment risks have encouraged institutional participation, while the stablecoin bill progress adds even more momentum.

The cryptocurrency reached its previous record high around the Jan. 20 inauguration of President Donald Trump, which heightened the market’s hopes for regulatory clarity around crypto.

Michael Novogratz, founder and CEO of Galaxy Digital, was clear about the fact that:

“It’s the shift of approach from [former Securities and Exchange Commission Chair Gary Gensler and the SEC] to this Trump administration, which has embraced our industry. That freed up the animal spirits both here and abroad.”

Also Read: Apple (AAPL) to Get Boost From $1.5B Foxconn Investment

Market Recovery Shows BTC Past $111K Resilience

After a 30% decline from tariff concerns, Bitcoin’s recovery demonstrates how BTC past $111K represents genuine Bitcoin price surge momentum. The stablecoin bill progress has helped stabilize crypto market volatility while reducing Bitcoin investment risks for institutions.

After hitting its previous record high in January upon Trump’s inauguration, the price of Bitcoin fell by as much as 30% when new tariffs led to a market downturn. However, it rose back above the $100,000 mark for the first time in three months on May 8 amid anticipation for a relaxation of global tariff-related tensions following a new trade deal.

Cosmo Jiang of Pantera Capital said at the time:

“It just speaks to the large amount of demand for digital assets in the industry, and especially Bitcoin.”

Expert Predictions Support BTC Past $111K Trajectory

Industry leaders see the current BTC past $111K level as just the beginning of this Bitcoin price surge cycle. With the stablecoin bill reducing regulatory uncertainty, crypto market volatility concerns are diminishing alongside traditional Bitcoin investment risks.

Adam Back of Blockstream has projected Bitcoin reaching between $500,000 and $1 million, indicating significant institutional interest in the cryptocurrency. Standard Chartered’s digital assets research team anticipates a price surge to $200,000 by the end of 2025, fueled by a shifting investor landscape. These ambitious targets reflect growing institutional confidence as regulatory frameworks solidify and create more stability in the market.

Also Read: Amazon (AMZN): Why the Stock Is Closer to $300 Than You Think