After a volatile start to 2025, Bitcoin has now reclaimed the $100,000 mark, setting a new all-time high and injecting renewed confidence into the market. But as prices soar, a critical question arises: are some of Bitcoin’s most experienced and successful holders, the long-term investors, starting to sell? In this piece, we’ll analyze what on-chain data reveals about long-term holder behavior and whether recent profit-taking should be a cause for concern, or simply a healthy part of Bitcoin’s market cycle.

Signs Of Profit-Taking Appear

The Spent Output Profit Ratio (SOPR) provides immediate insight into realized profit across the network. Zooming in on recent weeks, we can observe a clear uptick in profit realization. Clusters of green bars indicate that a noticeable number of investors are indeed selling BTC for profit, especially following the price rally from the $74,000–$75,000 range to new highs above $100,000.

However, while this might raise short-term concerns about potential overhead resistance, it’s crucial to frame this in the broader on-chain context. This isn’t unusual behavior in bull markets and does not, on its own, signal a cycle peak.

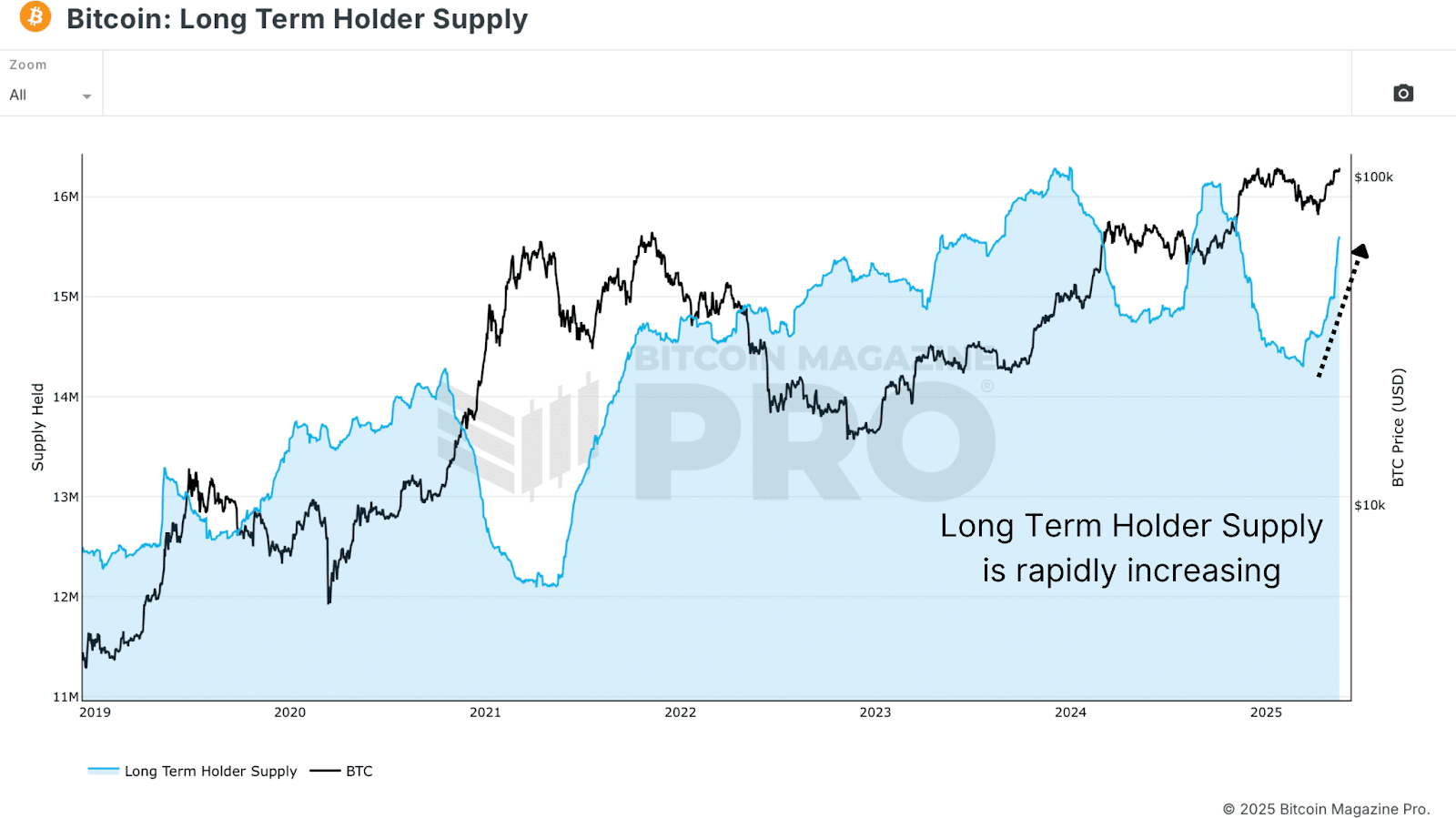

Long-Term Holder Supply Is Still Growing

The Long-Term Holder Supply, the total amount of Bitcoin held by addresses for at least 155 days, continues to climb, even as prices surge. This metric doesn’t necessarily mean fresh accumulation is occurring now, but rather that coins are aging into long-term status without being moved or sold.

In other words, many investors who bought in late 2024 or early 2025 are holding strong, transitioning into long-term holders. This is a healthy dynamic typical of the earlier to mid-stages of bull markets, and not yet indicative of widespread distribution.

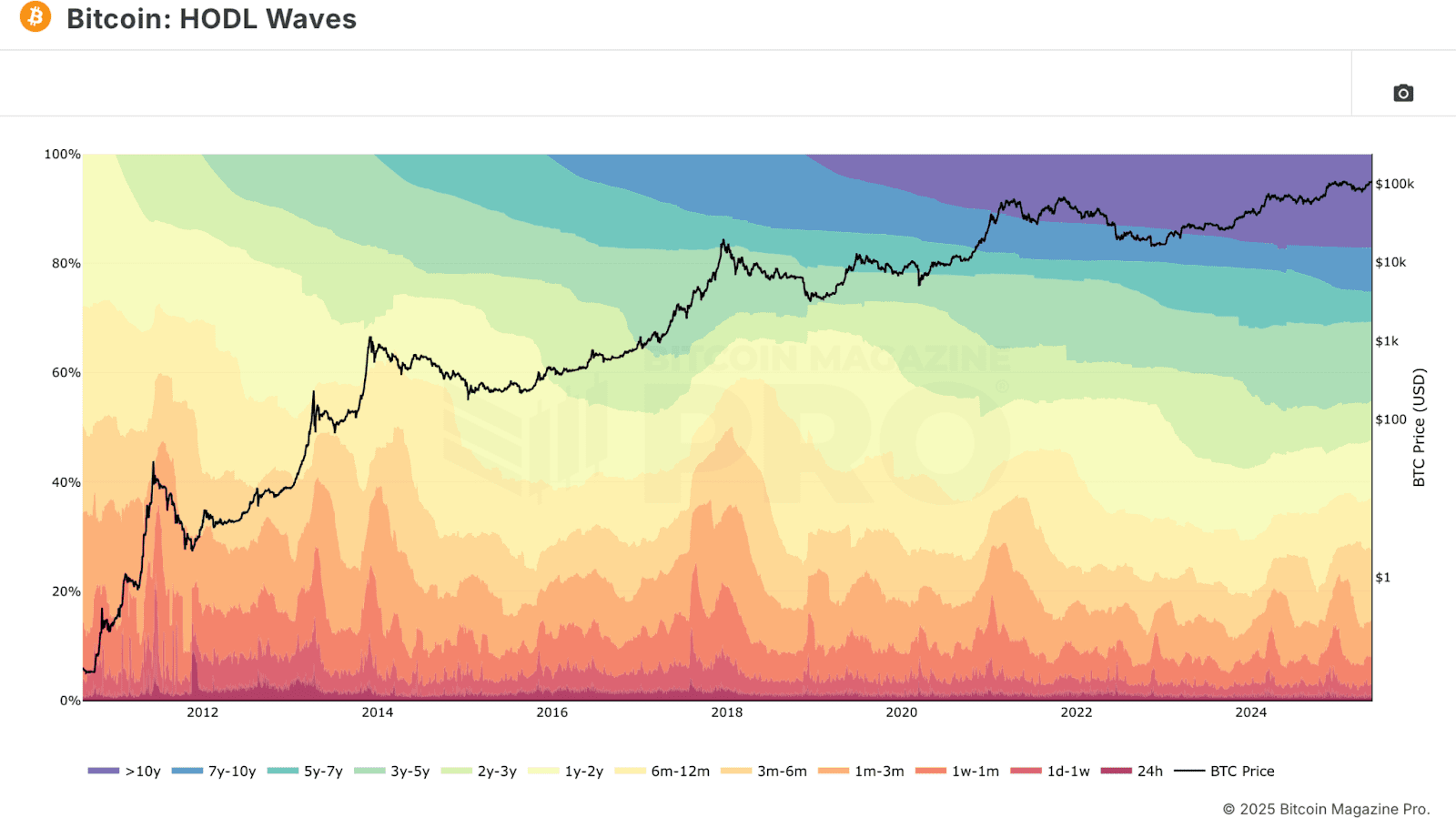

HODL Waves Analysis

To dig deeper, we use HODL Waves data, which breaks down BTC holdings by wallet age bands. When isolating wallets holding BTC for 6 months or more, we find that over 70% of the Bitcoin supply is currently held by mid to long-term participants.

Interestingly, while this number remains high, it has started to decrease slightly, indicating that a portion of long-term holders may be selling even as the long-term holder supply increases. The primary driver of the long-term holder supply growth appears to be short-term holders aging into the 155+ day bracket, not fresh accumulation or large-scale buying.

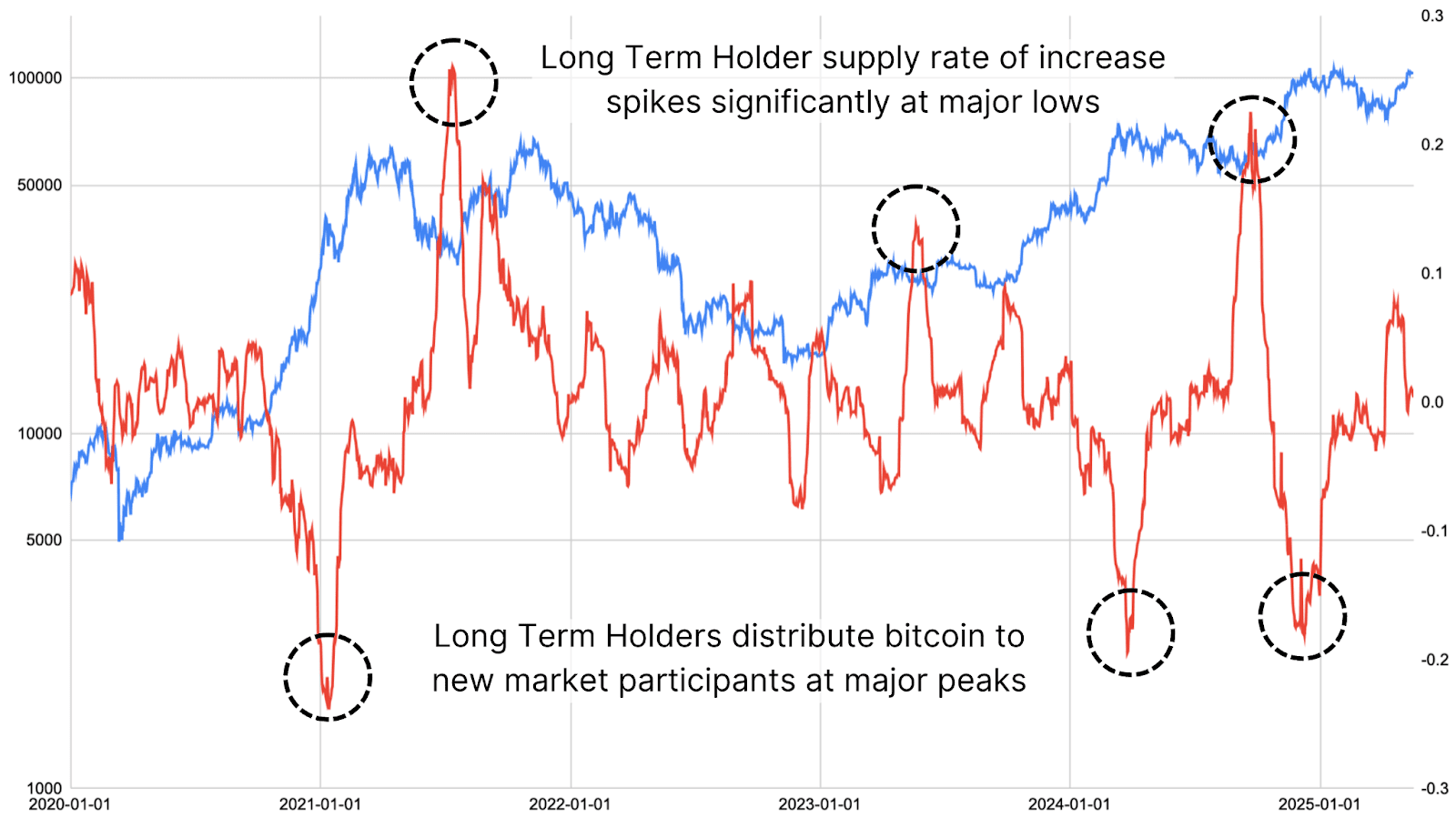

Using raw Bitcoin Magazine Pro API data, we examined the rate of change in long-term holder balances, categorized by wallet age. When this metric trends downward significantly, it has historically coincided with cycle peaks. Conversely, when it spikes upward, it has often marked market bottoms and periods of deep accumulation.

Short-Term Shifts And Distribution Ratios

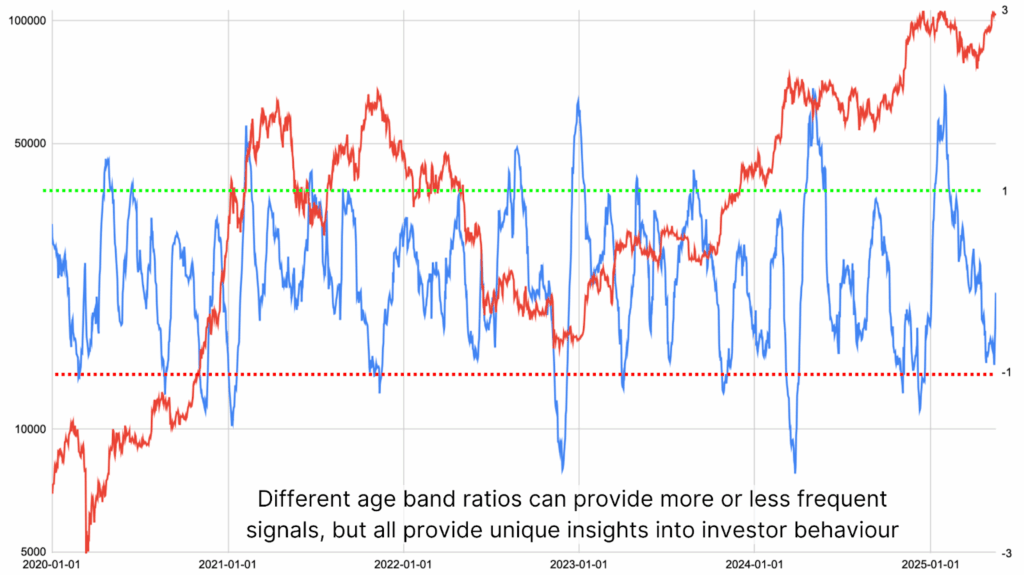

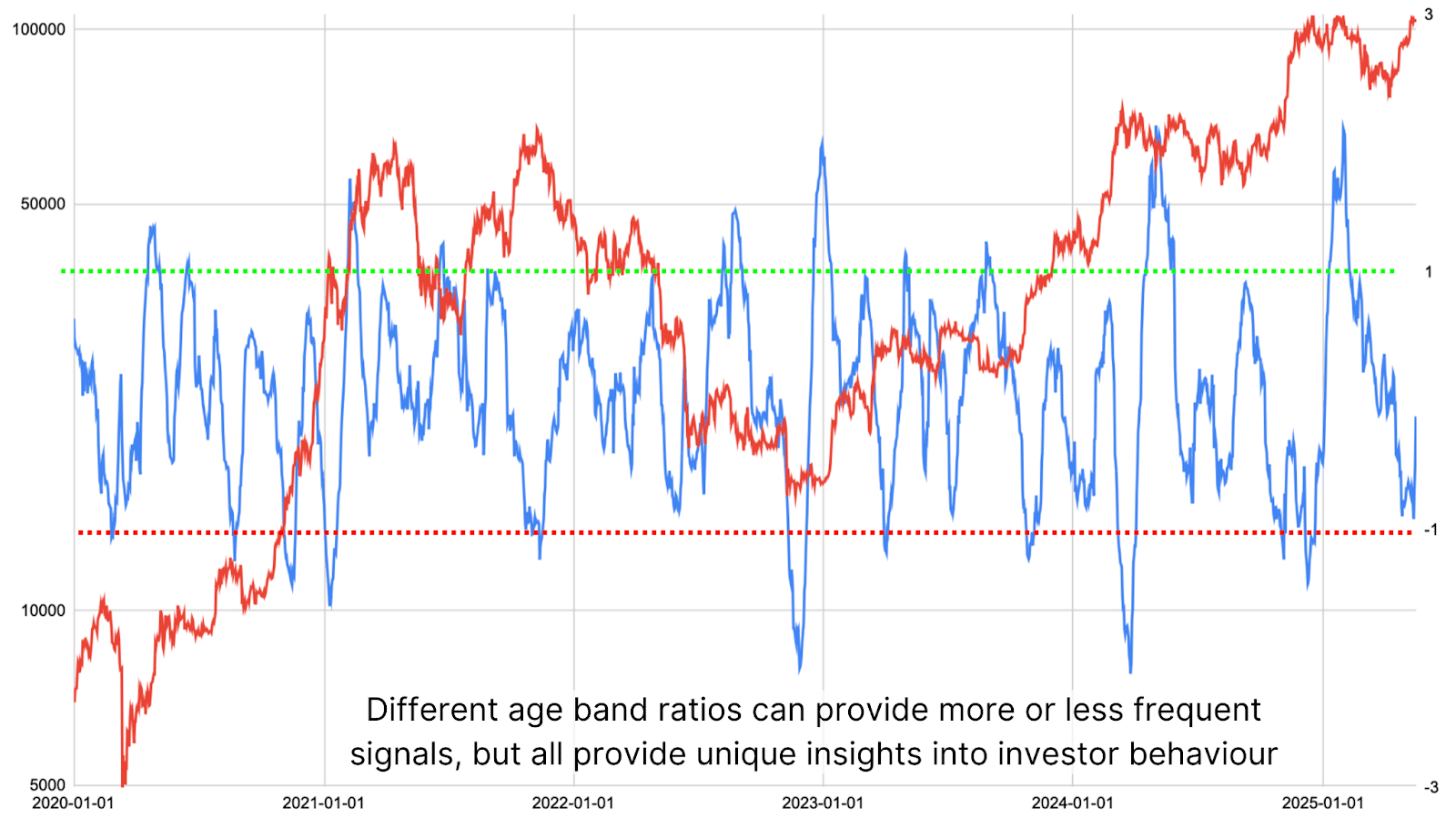

To enhance the accuracy of these signals, the data can be sliced more precisely by comparing very recent entrants (0–1 month holders) against those holding BTC for 1–5 years. This age band comparison provides more frequent and real-time insights into distribution patterns.

Figure 5: An age band holder distribution ratio provides valuable market insights.

We find that sharp drops in the ratio of 1–5 year holders relative to newer participants have historically aligned with Bitcoin tops, meanwhile, rapid increases in the ratio signal that more BTC is flowing into the hands of seasoned investors is often a precursor to major price rallies.

Ultimately, monitoring long-term investor behavior is one of the most effective ways to gauge market sentiment and the sustainability of price movements. Long-term holders historically outperform short-term traders by buying during fear and holding through volatility. By examining the age-based distribution of BTC holdings, we can gain a clearer view of potential tops and bottoms in the market, without relying solely on price action or short-term sentiment.

Conclusion

As it stands, there is only a minor level of distribution among long-term holders, nowhere near the scale that historically signals cycle tops. Profit-taking is occurring, yes, but at a pace that appears entirely sustainable and typical of a healthy market environment. Given the current stage of the bull cycle and the positioning of institutional and retail participants, the data suggests we are still within a structurally strong phase, with room for further price growth as new capital flows in.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.