-

Stock market highs are expected to continue into 2025, according to Oppenheimer’s Ari Wald.

-

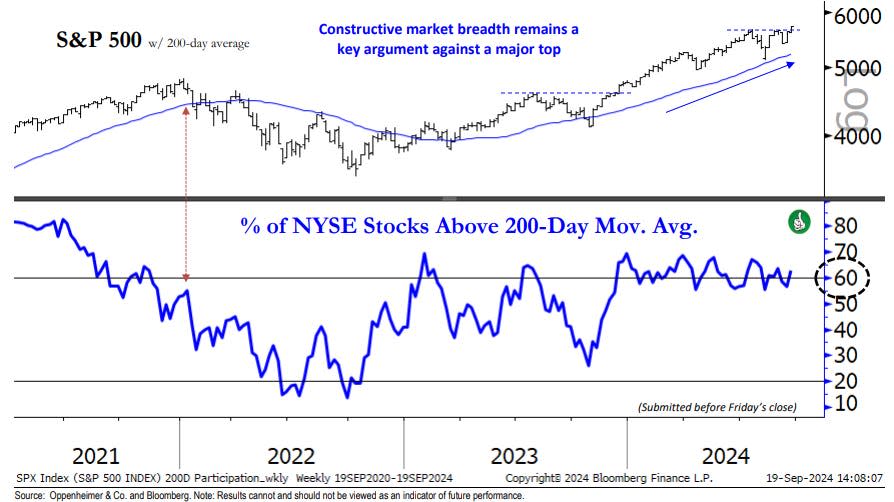

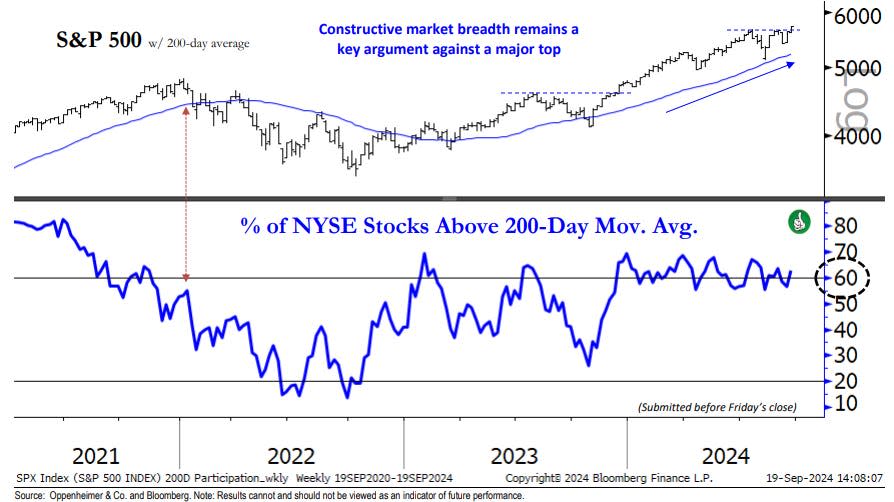

In a note, Wald highlighted strong market breadth and healthy signs across various sectors.

-

Key sectors like industrials, financials, and technology look resilient, Wald said.

Record highs in the stock market are set to continue, as few signals suggest a top in equity prices is near.

That’s according to Oppenheimer managing director and technical analyst Ari Wald, who said in a note over the weekend that there are bullish “inflection points” in the underlying market.

“We continue to balance seasonal headwinds against our view that evidence of a major top is not compelling,” Wald said.

Wald said he is encouraged by the fact that the number of stocks on the New York Stock Exchange above their 200-day moving average is above 60%, which is a healthy sign for a market advance, as it shows that it’s not just a handful of mega-cap tech companies driving the gains.

“We stress that market breadth remains constructive, and defensive leadership may represent a ‘catch-up’ into previous underperformers,” Wald said.

Wald said that based on the chart, traders can buy last week’s breakout to new cycle highs in the S&P 500, with a stop-loss set at the 5,650 level on a closing basis.

A stop-loss is a risk management tool used by traders to automatically sell a security when a certain price is hit.

For the S&P 500, the 5,650 level represents potential downside of just 1%, while Wald’s upside price target of 6,000 in the first half of 2025 represents potential upside of 5%.

Wald’s 6,000 price target for the S&P 500 is based on the median bull market cycle.

“The S&P 500 is up 64% over the 23 months between October 2022 and September 2024. Since 1932, the median bull cycle has gained 73% over a 32-month period,” Wald said.

Meanwhile, the average bull market cycle gain is 102% over a 34-month period.

And if the current bull market follows the path of the average bull market, stocks could continue to rise through the end of 2025 with the S&P 500 rising to around the 7,000 level.

That 7,000 target aligns with a bullish prediction from Evercore ISI, which said in June that the AI craze could push stocks higher in 2025.

Beneath the surface of the broad market, Wald said he is encouraged by the “right” leadership making new highs, including the Industrials sector.

“We view the cycle high for Industrials as confirmation of an intact bull market,” Wall said.

Record highs in the financials sector is another positive sign for the broader stock market, while the technology sector could be gearing up for its next big move higher, according to Wald.

“Technology is coming off an all-time high on both an absolute and relative basis in July. While the sector’s relative trend has moderated, we still believe Technology represents one of the strongest long-term structures in the market,” Wald said.

Finally, Wald highlighted the healthcare sector as another area of the market that is showing resilience, even as it lags other sectors.

While the healthcare sector is breaking out to new all-time highs, on a relative basis it is falling to new multi-year lows compared to the S&P 500.

“We think the divergence between Health Care’s absolute and relative trend speaks to the broadness of market breadth — even lagging sectors are rallying,” Wald said.

Similar scenarios are playing out in the communication services and materials sectors, according to the note.

Read the original article on Business Insider