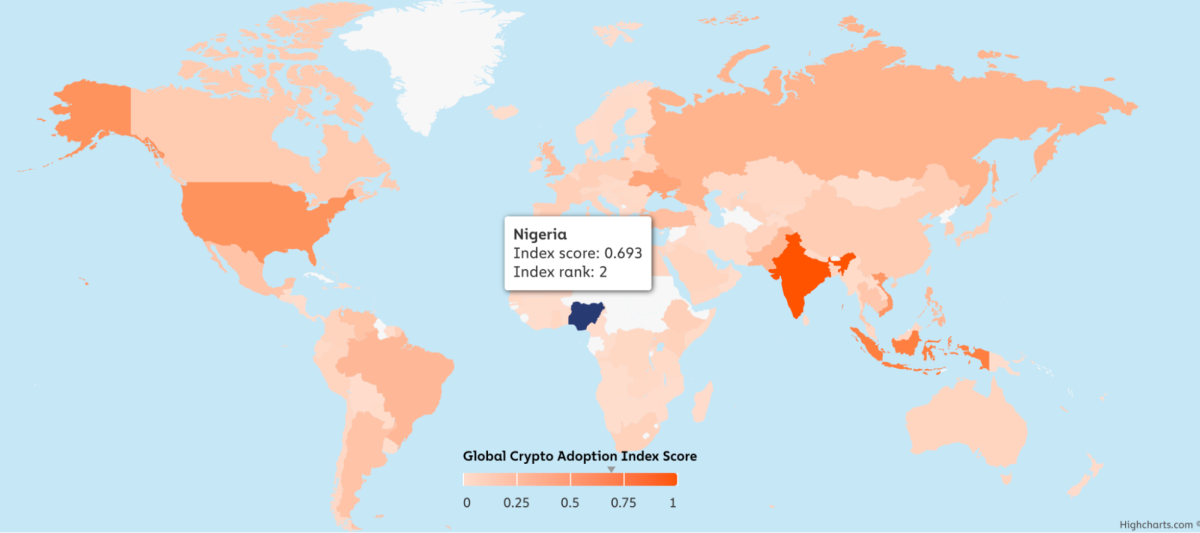

The ascent of Bitcoin and digital assets has sparked a classic battle, with governments acting as vigilant hawks, trying to control a technology that is as nimble and elusive as a gazelle darting across the savanna of decentralization. In Nigeria, this conflict is as tangled as dense jungle foliage, where regulators strive to enforce their rules on a system meant to evade conventional constraints, while individuals continue to pursue the elusive prize of financial freedom just out of grasp. The Central Bank of Nigeria (CBN) has oscillated between hardline approaches and cautious acceptance, exemplified by its 2021 directive banning banks from facilitating Bitcoin transactions. Yet, just a few years later, the same CBN approved the launch of a Naira-backed stablecoin, signaling a growing recognition of the inevitable role digital currencies will play in the future of finance. However, these regulations, rather than protecting Nigerians, have often undermined the rights of citizens to freely participate in the financial revolution that Bitcoin offers. This culminated in a recent court case brought by James Otudor, an ardent Bitcoin advocate, who has sued the Nigerian government, seeking to establish the fundamental right of citizens to trade and own Bitcoin and USDt. The case shines a spotlight on the larger issue of human rights being trampled upon in the name of regulatory oversight. It’s not just about financial innovation, it’s about ensuring that Nigerians are not excluded from the benefits of a global economy increasingly driven by decentralized technologies.

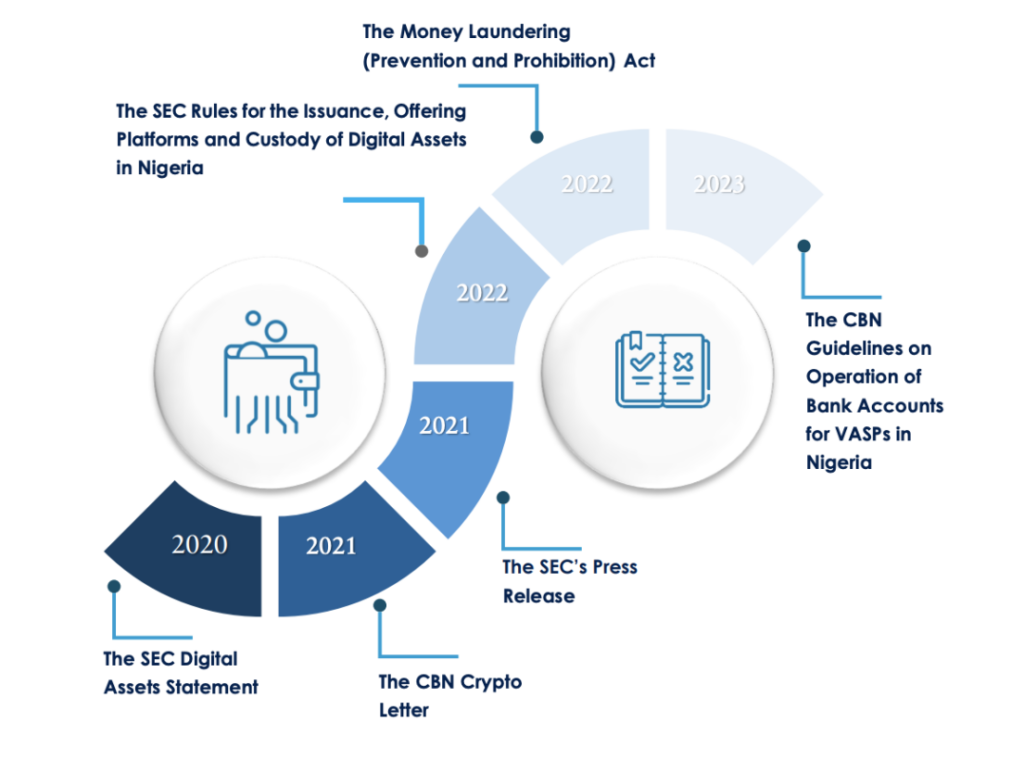

Across Africa, the regulatory landscape for Bitcoin and digital assets is shaped by two competing paradigms: collaboration and confrontation. Nigeria’s Securities and Exchange Commission (SEC) has taken some steps toward a collaborative model, as seen in the launch of its Regulatory Incubation Program aimed at fostering innovation while maintaining oversight. Yet, even within this supposedly progressive framework, the right of Nigerians to freely own and transact in Bitcoin remains under threat. Recent actions, such as the freezing of assets linked to the Bybit and KuCoin exchanges, illustrate how deeply entrenched government control remains. In other African nations, such as Ghana and Kenya, similar dynamics are playing out, with governments hesitating to fully embrace decentralized currencies, despite clear public demand. The Nigerian SEC’s approval of two cryptocurrency exchanges in 2024 represents a positive step, but this piecemeal approach fails to address the larger issue of financial sovereignty for Nigerians. South Africa has taken a slightly more balanced route, regulating Bitcoin and digital assets as financial assets while allowing for greater integration into the traditional financial ecosystem. Nevertheless, these approaches, while varied, all point to the same fundamental issue: the lack of a clear framework that respects the unique nature of Bitcoin and its potential to transform economies and empower citizens.

As Nigerian regulators grapple with how to manage this burgeoning industry, they must recognize that Bitcoin’s regulatory landscape cannot be lumped together with the entire digital assets ecosystem. Bitcoin operates on fundamentally different principles, with decentralization at its core, unlike many other digital assets that may still rely on centralized control or governance. Any attempt to impose blanket regulations on all digital assets, including Bitcoin, would be a catastrophic misstep, one that risks stifling innovation and depriving Nigerians of the opportunity to fully participate in the global economy. Regulators must, therefore, approach Bitcoin with a unique understanding of its intrinsic operational metrics. Its decentralized nature is not a flaw to be regulated out of existence but a feature that offers unprecedented opportunities for financial inclusion and economic freedom. Policymakers should learn from global examples, such as Europe’s MiCA framework, but adapt those lessons to the specific context of Bitcoin, ensuring that they do not impose unnecessarily restrictive regulations. The failure to distinguish Bitcoin from other digital assets in the regulatory process would result in inefficiency, stifle innovation, and risk pushing legitimate activities into the shadows. James Otudor’s court case stands as a pivotal moment, not just for Nigeria but for the entire continent, as it seeks to ensure that financial regulations are crafted with a respect for human rights and an understanding of the transformative power of decentralized finance.

The way forward for Nigeria is clear: regulators must craft policies that protect citizens while encouraging innovation, and they must do so with the understanding that Bitcoin is fundamentally different from other digital assets. The current regulatory push, if not carefully balanced, risks becoming a tool of oppression rather than empowerment. By engaging with the Bitcoin community and developing a nuanced approach to regulation, Nigeria can position itself as a leader in the global financial revolution. Anything less would be a disservice to the millions of Nigerians who have already embraced this new paradigm and a betrayal of the ideals of freedom and innovation that Bitcoin represents.

This is a guest post by Heritage Falodun. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.