By Kevin Buckland

TOKYO (Reuters) – Chinese stocks surged on Wednesday, lifting regional markets and helping extend a stimulus-fueled global rally that also underpinned risk-sensitive currencies, while Brent crude hovered near a three-week high.

The dollar drooped after weak U.S. macroeconomic data overnight boosted the case for a second super-sized interest rate cut at the Federal Reserve’s next meeting. Gold rose to a fresh all-time peak.

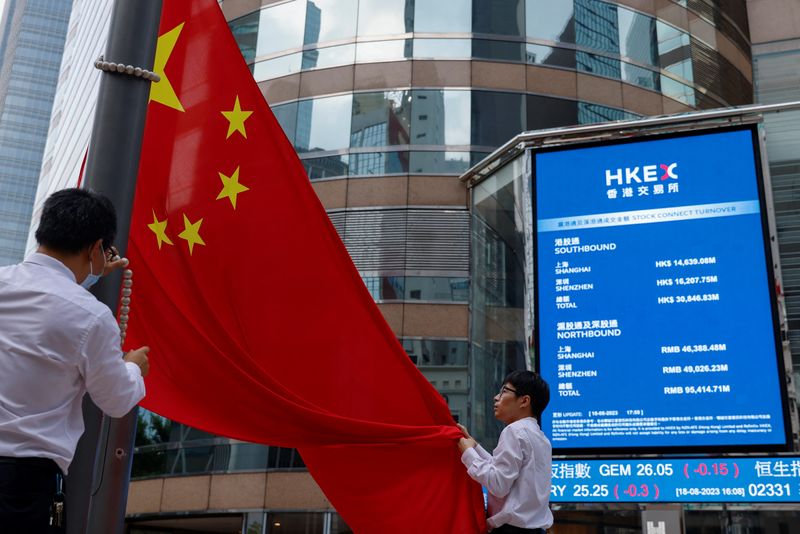

Mainland Chinese blue chips advanced 3.1% as of 0230 GMT, following a 4.3% jump in the prior session. Hong Kong’s Hang Seng climbed 2.2%, adding to Tuesday’s 4.1% surge.

The strong start for Chinese stocks invigorated other regional indexes, with Taiwan’s benchmark up 1.3% and South Korea’s Kospi gaining 0.1%

MSCI’s broadest index of Asia-Pacific shares outside Japan rallied 1%.

Japan’s Nikkei shook off early weakness to rise 0.3%, helped by a retreat in the yen, a traditional safe haven.

The People’s Bank of China followed its announcement of wide-ranging policy easing on Tuesday with a cut to medium-term lending rates to banks on Wednesday. Beijing’s broad-based stimulus – the biggest since the pandemic – also includes steps to boost China’s stock market and support for the ailing property sector.

“The focus in Asia remains very much on China,” UBS analysts wrote in a note to clients.

“The debate remains intense on whether there are legs to this rally, though the desk is seeing investors opting to buy/short cover first and ask questions later.”

The yen retreated about 0.17% to 143.47 per dollar, reversing earlier gains amid broad dollar weakness.

The euro ticked up to $1.11915 after earlier pushing as far as $1.1194 for the first time in a month.

Sterling edged up to $1.3417, and earlier reached a fresh high since March 2022 at $1.3430.

Overnight, data showed U.S. consumer confidence unexpectedly fell to 98.7 this month from an upwardly revised 105.6 in August. The decline was the largest since August 2021.

The odds on another 50-basis point Federal Reserve rate cut at the November meeting jumped to 60.4% from 53% a day earlier, according to CME Group’s FedWatch Tool.

Meanwhile, Australia’s dollar initially scaled its highest since February of last year at $0.6908 but then slipped back to $0.68915 after monthly inflation figures showed some cooling, potentially setting up an earlier rate cut by the Reserve Bank.

“The fall in the underlying measures of inflation is an unexpected and welcomed surprise,” said Tony Sycamore, an analyst at IG.

Provided the cooling is replicated in quarterly price data next month, “it sets up a dovish pivot from the RBA,” leading to a quarter-point rate cut in December, Sycamore added.

Gold rose 0.2% to $2,662.50 per ounce, and earlier marked a new record peak at $2,665.10.

Brent crude futures slipped 19 cents to $74.98 a barrel, but remained close to Tuesday’s high of $75.87, a level previously not seen since Sept. 3.

U.S. West Texas Intermediate crude lost 22 cents to $71.34 per barrel.

(Reporting by Kevin Buckland; Editing by Shri Navaratnam)