Who is Benjamin Graham?

Benjamin Graham, born Benjamin Grossbaum, is one of the most influential figures in 20th-century investing, particularly in the field of value investing.

An American professor and economist, Graham and his family felt the effects of stock market crashes in both 1907 and 1929, and he would eventually create a system that determined the intrinsic value of a company through fundamental analysis.

Graham was actually born in London; his family emigrated to New York City when he was a baby. The Grossbaums were Jewish and changed their name to Graham in order to avoid antisemitism and other types of prejudice prevalent during the Nationalistic era of the early 1900s.

Graham’s father owned a thriving import business, but the family lost their savings during the Panic of 1907. Back then, much of Wall Street had been embroiled in speculation, and a complex web of uncollateralized loans fostered a series of defaults that ended with bank runs across the country.

Why is Benjamin Graham important?

After Graham graduated from Columbia University, he took a job at the brokerage firm of Newburger, Henderson, and Loeb. He first worked as a messenger, making $12 per week, rising quickly to the rank of assistant, then securities analyst, where he spotted undervalued assets that grew company profits enormously.

By the late 1920s, he was earning $50,000 per year — equivalent to roughly $750,000 today in terms of purchasing power. In a cruel twist of fate, he too would lose all of his investments — as well as his clients’ — during the Crash of 1929. According to biographer Janet Lowe, Graham would spend the next several years working without pay to restore these assets.

Related: The 10 best investing books, according to our stock market pros

What was Benjamin Graham’s investment strategy? His books explained

In 1928, Graham began teaching finance at Columbia Business School. His one request was that someone work alongside him, taking notes — so the university paired him with a young professor named David Dodd.

They would go on to write two best-selling financial books together: Securities Analysis (1934) and The Intelligent Investor (1949). Not surprisingly, it was the lessons Graham learned through his most difficult times that would compel him to formulate his conservative investing approach.

He and Dodd elucidated this approach through their books, which remain some of the best instructive material on investing to this day.

Securities Analysis (1934)

Graham and Dodd’s first book, Securities Analysis, outlined the core principles of value investing. They believed that investors were part owners of a business; therefore, investing should be undertaken only after a careful analysis of the facts supporting the business, such as its 12-month earnings and price-to-earnings ratio. “An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return,” they wrote. Everything else, they believed, was mere speculation.

Graham and Dodd were speaking against the headwinds of their time, when investors all too often relied on nothing more substantial than trends and rumors. Graham and Dodd’s view of risk and reward was counter to the speculators’ — they believed that the greater the risk, the less chance one would receive a reward, making a risky security an unsuitable investment.

Graham and Dodd also introduced the concept of margin of safety, which described the difference between a stock’s market price, which is what investors are currently paying for it, and its intrinsic value, or true worth.

Whatever the reason, a fundamentally solid company could be trading below its intrinsic value, but if investors could spot one of these inefficiencies, buy the stock, and hold it until it ultimately appreciated in reflection of its true value, then they would grow rich.

The Intelligent Investor (1949)

The Intelligent Investor (1949), one of the most seminal books on investing in the 20th century, is still read and loved by investors today, particularly those who are new to investing.

In it, Graham and Dodd showed readers how to create long-term strategies that could help them uncover undervalued stocks with the potential for growth — without taking on excessive risk.

More on financial figures:

- Who is Ben Bernanke? The former Fed chair’s career & legacy

- Who is Jerome Powell & what is his job as Fed Chair?

- Cathie Wood’s net worth: The Ark Invest CEO’s wealth & income

They introduce the concept of Mr. Market, which represents the herd mentality that often causes investors to overreact or take action based on irrational assumptions. Mr. Market could show up on your doorstep every day offering to sell you shares at a different price, they said. Sometimes it was for a good reason; other times, it was not.

Instead of obsessing over Mr. Market’s whims, they advised investors to concentrate on a company’s actual performance — such as its earnings results. “The intelligent investor realizes that stocks become more risky, not less, as their prices rise — and less risky, not more, as their prices fall. The intelligent investor dreads a bull market, since it makes stocks more costly to buy.

And conversely (so long as one keeps enough cash on hand to meet their spending needs), investors should welcome a bear market, since it puts stocks back on sale,” they wrote.

They categorized two kinds of intelligent investors:

- Enterprising investors are active traders who have more time to spend uncovering exceptional values in the current market.

- Defensive investors are more cautious and seek out longer-term value.

Graham and Dodd warned investors not to get too caught up in market volatility and advised them to allocate at least 25% of their portfolio to stocks. They also praised dividend-yielding companies since they pay out a portion of their earnings to their shareholders instead of keeping it to themselves.

How did Benjamin Graham value stocks?

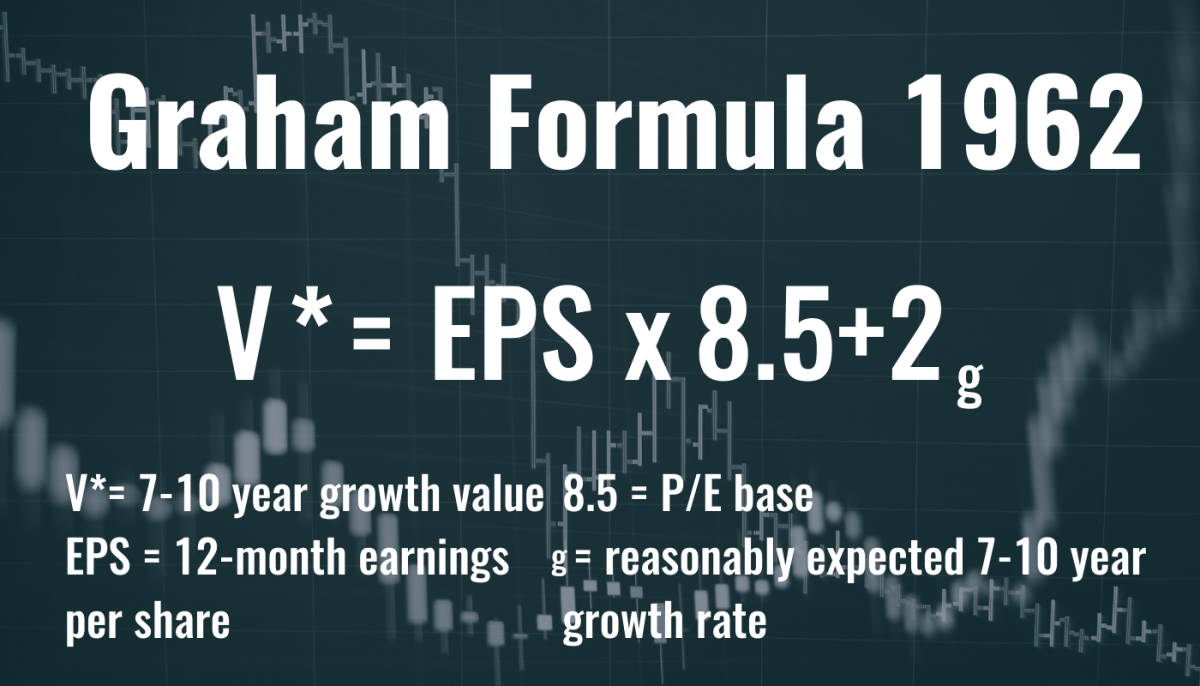

The Graham Formula, as it is known, is a method used to identify the intrinsic value of a stock. He created two versions.

Canva

Graham’s 1962 formula

This formula, published in the 1962 edition of Security Analysis, is as follows:

V*= EPS x 8.5+2g

Key:

- V* = 7–10 year growth value

- EPS = 12-month earnings per share

- 8.5 = P/E base

- g = reasonably expected 7–10 year growth rates

Canva

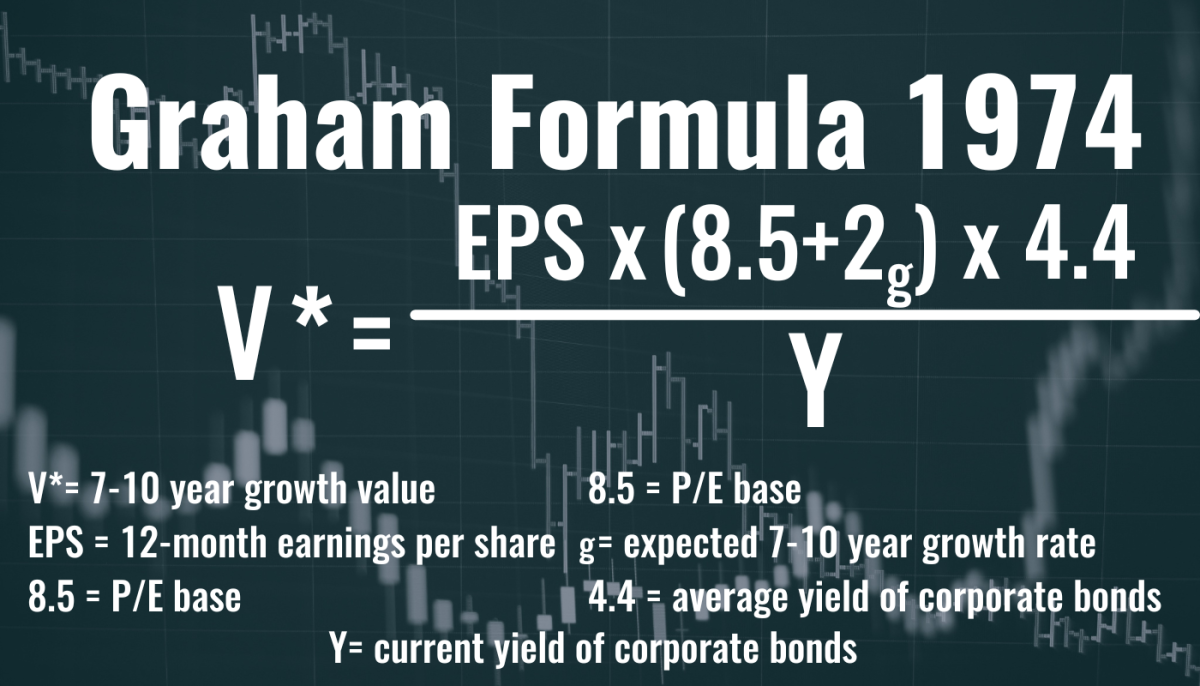

Graham’s 1974 formula

The second, published in the 1974 edition of The Intelligent Investor, attempted to account for steep interest rates, a prevalent force during that era.

V*= EPS x (8.5+2g) x 4.4 / Y

Key:

- V* = 7-10 year growth value

- EPS = 12-month earnings per share

- 8.5 = P/E base

- g = expected 7-10 year growth rate

- 4.4 = average yield of corporate bonds

- Y = current yield of corporate bonds.

However, a footnote within The Intelligent Investor cautioned investors not to use these formulas literally. Graham and Dodd meant them to be illustrative, adding that it was simply impossible to predict future growth rates.

Photo of Benjamin Graham by AnonymousUnknown author, Public domain, via Wikimedia Commons; Photo of Warren Buffett by J. Countess/Getty Images; Canva

Did Warren Buffett know Benjamin Graham?

Warren Buffett, one of the richest people in the world and a long-devoted value investor, was actually a student of Graham’s at Columbia University. In fact, he earned an A+ in Graham’s class and referred to The Intelligent Investor as the “best investing book ever written.”

Interestingly, Graham’s firm, the Graham-Newman Partnership, bought a 50% stake in GEICO insurance in 1948. They paid $712,000. By the 1970s, the company was worth $400 million — quite a return on investment — but sadly, by 1976, the company needed to be bailed out.

Who came to the rescue? None other than Graham’s former student, Buffett himself, who purchased 1 million shares in 1976, and then added to his purchase by buying the remaining shares of outstanding stock in 1996.

How much was Benjamin Graham worth when he died?

Graham’s net worth was estimated at $50 million when he died in 1976.

Related: Veteran fund manager sees world of pain coming for stocks