Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

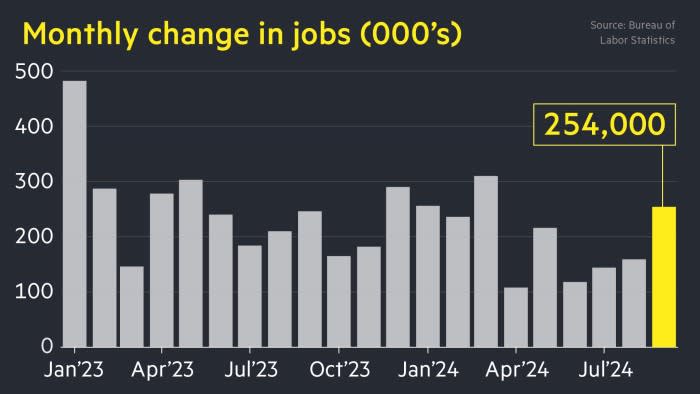

The US economy added 254,000 jobs in September, far outstripping expectations, in a sign of the labour market’s resilience as the Federal Reserve considers how rapidly to cut interest rates.

The figure from the Bureau of Labor Statistics was above expectations of economists polled by Reuters of 140,000 and compared with an upwardly revised gain of 159,000 jobs in August.

The unemployment rate fell to 4.1 per cent, having come close to a three-year high in July at 4.3 per cent.

The report suggests the Fed is on course to pull off a so-called soft landing for the US economy, which has weathered the worst period of high inflation in a generation while maintaining robust growth and strong employment.

The Fed last month cut its benchmark interest rate by half a percentage point to pre-empt any significant weakening of the labour market.

After Friday’s data release, investors in futures markets scaled back predictions that the Fed would cut interest rates by another half percentage point at its next policy meeting in November.

Futures markets were pricing in a 94 per cent chance of a smaller quarter-point cut, compared with about 65 per cent shortly before the data was released.

“These numbers are a bit of a game-changer,” said Josh Hirt, senior US economist at Vanguard. “When you look at the revisions too, this changes the narrative about the underlying pace of job growth . . . overall it’s very positive.”

Treasury yields jumped shortly after the data was published. The two-year Treasury yield, which is sensitive to interest rate expectations, rose 0.15 percentage points to a one month high of 3.86 per cent. Futures markets suggested the S&P 500 was poised to open 0.9 per cent higher.

The dollar climbed 0.5 per cent against a basket of rival currencies following the data. It has risen more than 2 per cent since last Friday, putting it on course for its strongest week in more than two years.

“The market likes cuts but it doesn’t like them if they’re because of real weakness in the economy and worries about recession,” Hirt said. “It likes cuts with a positive underlying economy, which would bolster the soft landing scenario.”

Jobs growth in Friday’s report was strongest across the leisure and hospitality sector, specifically in restaurants and bars. Employment in those categories increased by almost 70,000. Healthcare jobs rose by 45,000.

Manufacturing and other industrial jobs such as in mining and oil were unchanged for the month, alongside the retail, transportation and professional and business services sectors.

Average hourly earnings increased 0.4 per cent for the month and are up 4 per cent on an annual basis.

US central bank officials are focused on the health of the labour market as they plan further interest rate cuts in the coming months after making a larger-than-usual half-point reduction in September. The cut left the Fed’s benchmark rate at 4.75-5 per cent.

Fed chair Jay Powell hinted this week that the central bank would revert to its more usual quarter-point cut when it next meets in November — just after the US presidential election — as long as the economy does not deteriorate unexpectedly.

Officials have grown more confident in their ability to bring price pressures back down to the Fed’s 2 per cent target without triggering a recession. Lay-offs have not yet risen, although some economists warn that the fall in demand in recent months could be a precursor to steeper job losses.

New data on Tuesday showed that the number of vacancies unexpectedly rose in August to 8mn, but the rate at which Americans are quitting their jobs fell to the lowest level since June 2020.

The unemployment rate is up substantially from its recent low of 3.4 per cent last year, but economists largely attributed the rise to a growing workforce.

Most Fed policymakers last month forecast that the US unemployment rate would peak at 4.4 per cent this year and next, while interest rates would fall to 4.25-4.5 per cent and 3.25-3.5 per cent, respectively.