Bitcoin’s core asset has taken center stage in the financial world. Larry Fink, CEO of BlackRock, has made a bold statement about cryptocurrency investment that’s causing a stir.

Also Read: XRP Expected to Rise: Analysts Predict $0.75 Soon

How Larry Fink’s Bitcoin Declaration Impacts Cryptocurrency Investments

A New Perspective

Larry Fink Bitcoin views have changed dramatically. He now sees it as a potential standalone asset class. During BlackRock’s earnings call, Fink said:

“I’m not sure if either president would make a difference,” about Bitcoin’s future and U.S. elections.

Breaking Records

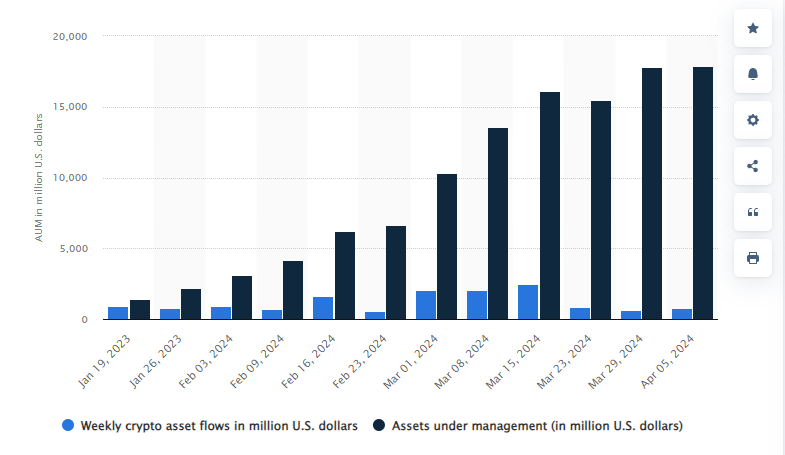

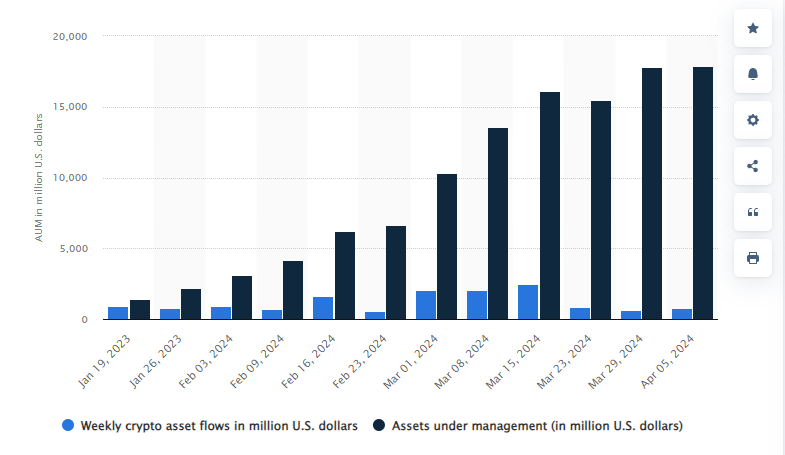

BlackRock’s Bitcoin ETF has soared since January. In nine months, it’s grown to $23 billion in assets. This rapid growth is changing how people invest in cryptocurrency.

Also Read: Ethereum Gains 6.9%: Can ETH Hit $2800 This Week

Comparing to Other Markets

Fink sees similarities between Bitcoin and other financial products.

He noted:

“Years ago, when we started the mortgage market, years ago when the high-yield market occurred, it started off very slow.” This suggests he thinks Bitcoin has a long-term role in finance.

Growing Institutional Interest

Bitcoin ETF inflows are surging. Recently, $555.9 million flowed in on a single day as Bitcoin hit $66,500. Nate Geraci of ETF Store called it “Simply ridiculous and blows away every pre-launch demand estimate.”

Looking Ahead

BlackRock plans to keep innovating in crypto. Fink state:

“And we will continue to pioneer new products to be making investing easier and more affordable.”

This approach may further establish Bitcoin as a core asset for investors.

Also Read: How to Become a Millionaire If SHIB Hits $0.00075 and $0.0075

Fink’s declaration of Bitcoin as a core asset is a big deal. It shows how far cryptocurrency has come. As more institutions invest and products like BlackRock’s ETF succeed, cryptocurrency investment is changing fast.

Standard Chartered predicts Bitcoin will hit $200,000 by 2025, regardless of who wins the U.S. election. This forecast, along with Fink’s statements, suggests a bright future for Bitcoin core asset in the financial world.