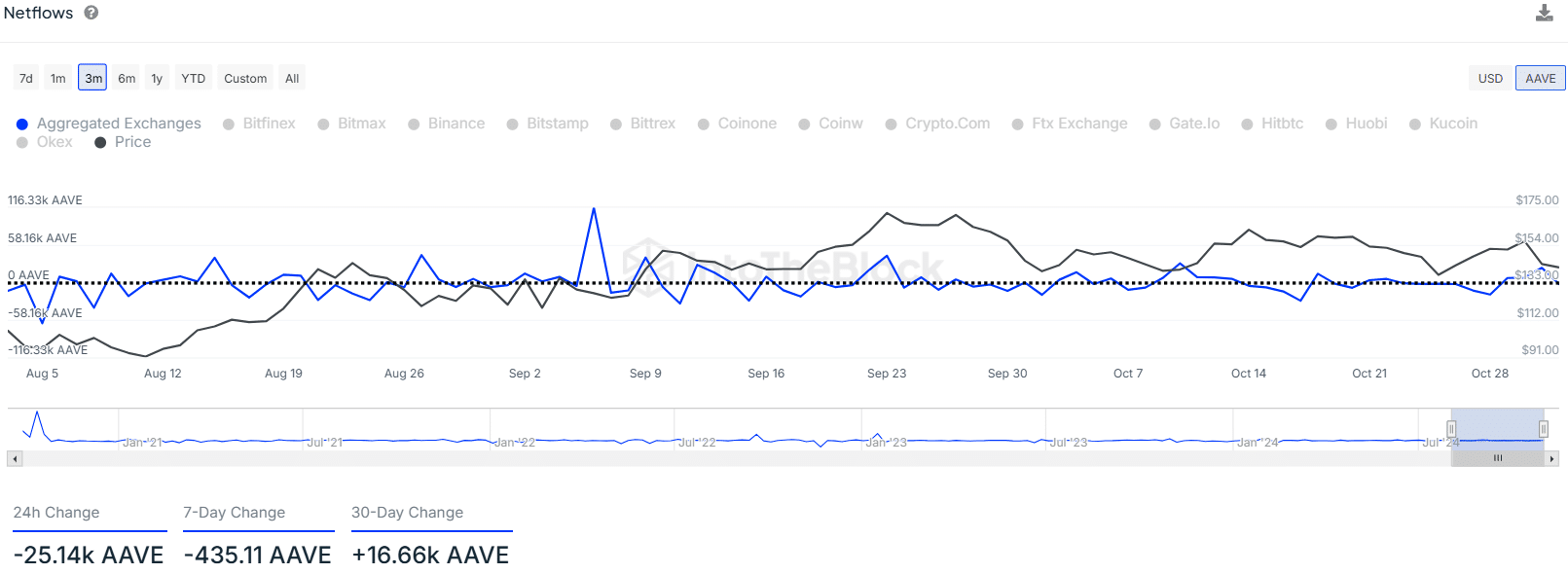

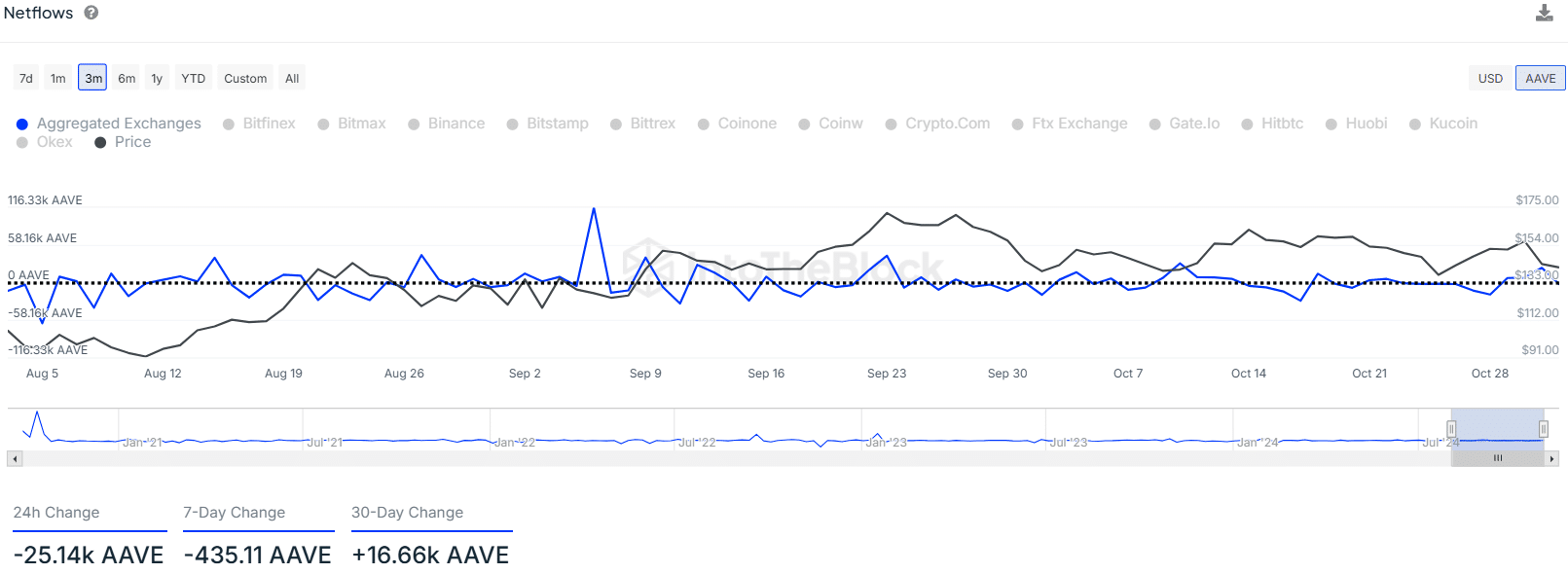

- AAVE saw lackluster exchange netflows OVER the past month

- The weekly bullish market structure break was a powerful signal

Aave [AAVE] bulls have tenaciously defended the $140 support level over the past two months. However, the altcoin has a $200 target and is likely to go much further, based on the higher timeframe price charts.

Source: IntoTheBlock

Its low 30-day correlation of +0.29 was not surprising though. While AAVE fought to defend $140 and reclaim $150 as support, Bitcoin has steadily trended higher over the past six weeks.

However, long-term investors have little reason to be dejected just yet.

Signs of a sustained uptrend are yet to present themselves

Source: IntoTheBlock

AMBCrypto found that the netflow data over the past week and month were hardly encouraging. The -435 AAVE outflows amounted to a mere $61k accumulated. The +16.66k AAVE 30-day change represented inflows of $2.3 million into exchanges.

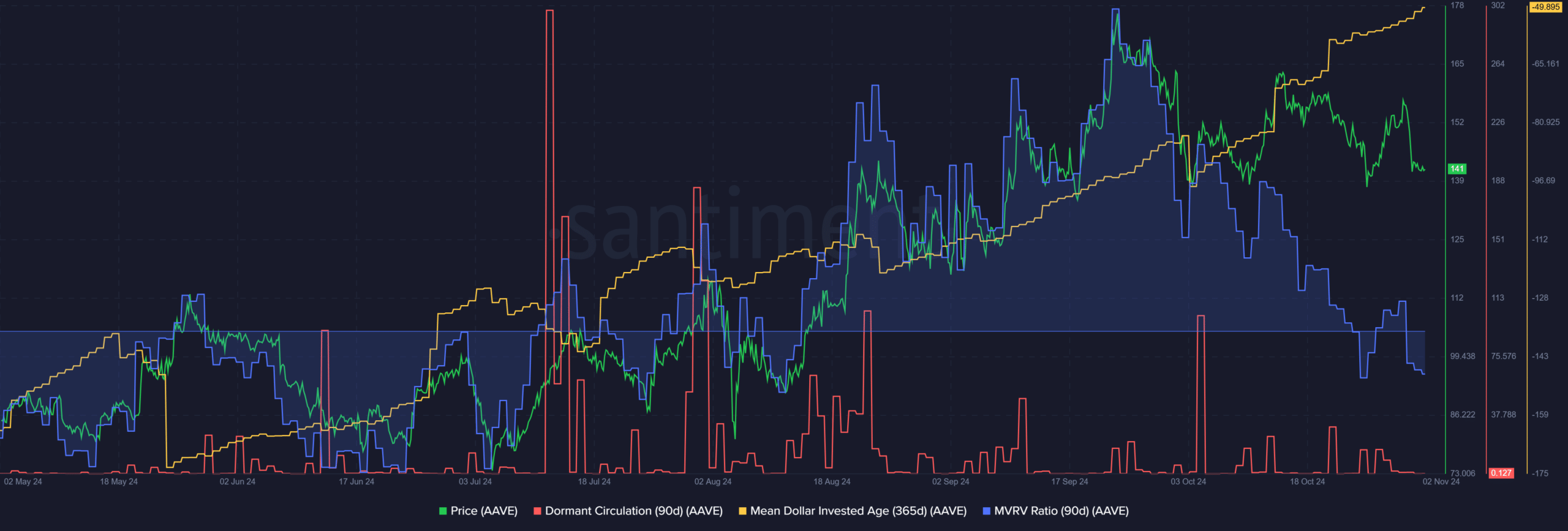

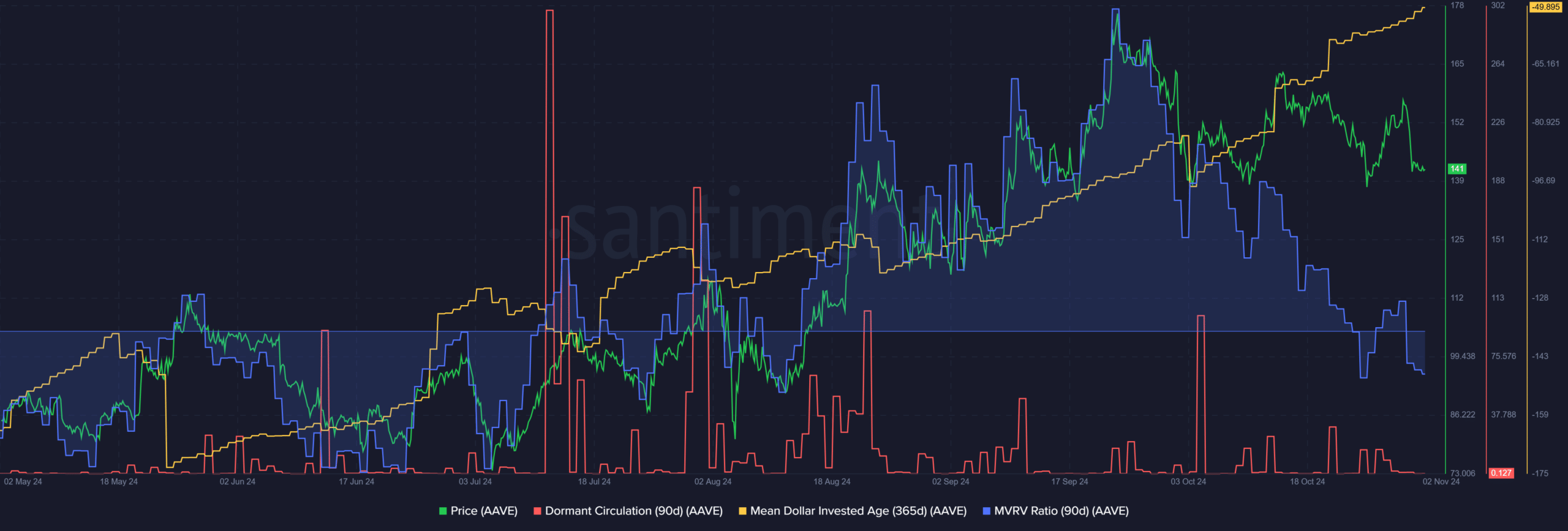

Source: Santiment

Santiment data also revealed that the dormant circulation was quiet over the past month. This highlighted subdued token movement between addresses, compared to the wave of selling in mid-July.

Hence, there likely isn’t a threat of high selling pressure in the next few days.

The falling MVRV ratio showed that 3-month holders were at a loss on average. This could incentivize slight selling pressure during a bounce towards $160. It also seemed to be an indication that profit-taking activity won’t stall bullish efforts.

These bullish efforts have already begun, but they might be more clearly visible on the weekly timeframe. For instance – The unbroken uptrend of the mean dollar invested age (MDIA) signified stagnation. Its descent would signal greater movement and new buyers and in turn, this could herald a sustainable uptrend.

AAVE gives strong clues on the higher timeframes

The weekly chart underlined a downtrend in the second half of 2021, one that continued throughout 2022. The $100-$120 area formed a resistance zone that wasn’t convincingly broken for 805 days.

Read Aave’s [AAVE] Price Prediction 2024-25

This long-term consolidation was broken in mid-September when the previous high at $153 was broken with a weekly session close above. Since then, AAVE has faced rejection at $180 and played defense at the $140 area.

The weekly market structure break six weeks ago was a sign of bullish intent. In the coming months, the $290, $400, and even the all-time high of $661 would be viable bullish targets. A slump in the MDIA would likely be an early sign that the altcoin is ready for a strong run upwards.