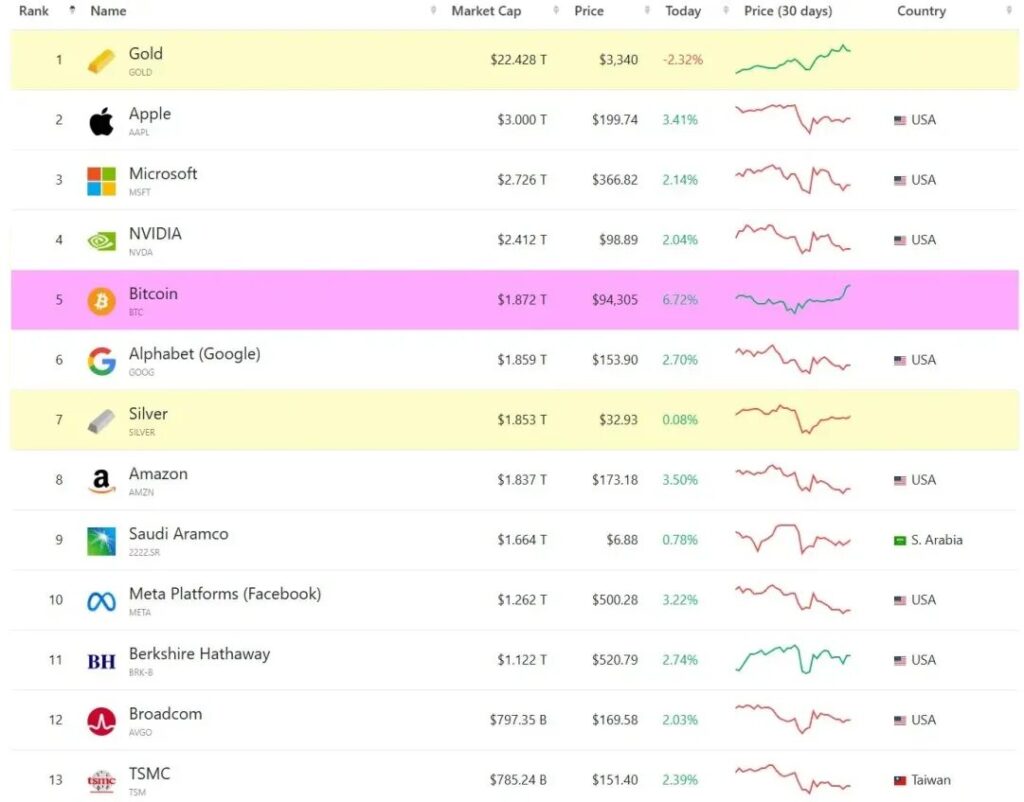

Bitcoin has just recently overtaken Google’s parent company Alphabet, and now stands as the fifth-largest asset by market cap globally. This impressive milestone raises some interesting questions about whether BTC can actually continue its upward trajectory to surpass Nvidia in the Bitcoin market cap Nvidia race that everyone’s watching right now.

Also Read: De-Dollarization Surge: Why Europe’s Euro Bonds Could End U.S. Dollar’s Reign

Can BTC Outpace Nvidia As It Joins Top Crypto Market Cap Titans?

According to the latest data that was just released, Bitcoin currently holds a market cap of around $1.87 trillion, which is slightly above Alphabet’s $1.859 trillion at the time of writing. The gap between Bitcoin and fourth-placed Nvidia, which currently holds about $2.412 trillion in market cap, has been narrowing quite significantly as BTC vs Nvidia becomes the next major benchmark for crypto enthusiasts and investors alike.

Bitcoin’s Recent Performance

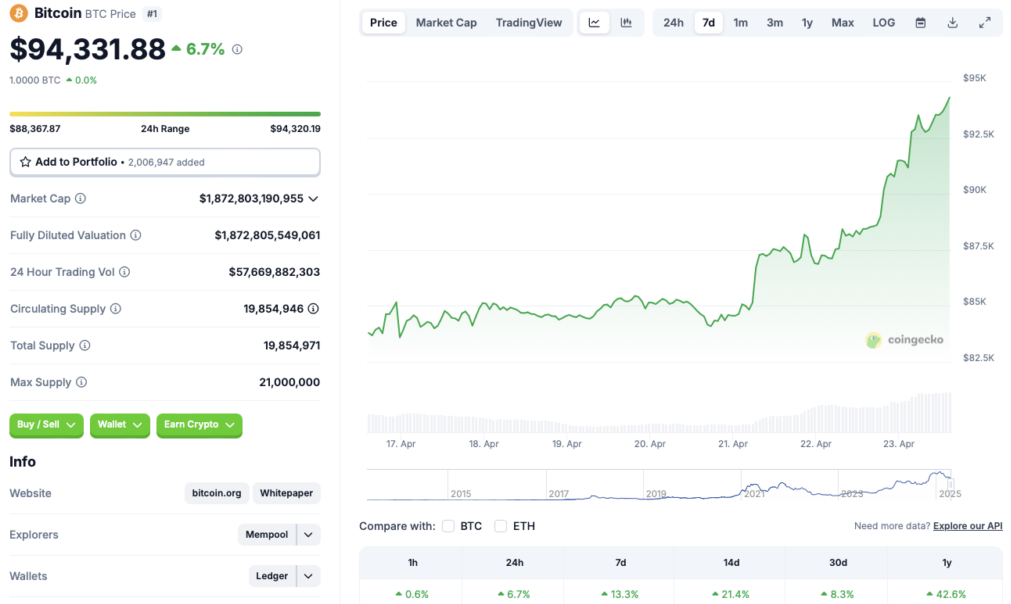

Bitcoin’s price performance has been really impressive across multiple timeframes lately. The leading crypto asset has gained approximately 6.7% in just 24 hours, as CoinGecko revealed, and also about 13.3% weekly, and even a substantial 21.4% over two weeks. Monthly figures also show an 8.3% increase, while Bitcoin has appreciated by around 42.6% since April 2024, which definitely highlights the strong crypto market trends we’re seeing right now.

The Bitcoin market cap Nvidia comparison is drawing a lot of attention these days as BTC trades around $94,305, which is approximately 13.4% below its January 2025 all-time high of $108,786. This recent momentum also coincides with Trump Media’s ETF deal with Crypto.com that’s focused on American crypto projects.

Closing the Gap with Nvidia

For Bitcoin to actually overtake Nvidia in the market cap rankings, it would need to appreciate by roughly 29% from current levels, which is quite a climb. This Bitcoin market cap Nvidia challenge seems increasingly plausible though, especially given Bitcoin’s recent performance and the growing institutional adoption that we’re witnessing in the market.

Also Read: If You Invested $4,000 in XRP When Trump Took Office, Here Are Your Returns Today

BTC may rally over the next few days. The asset could hit a new all-time high of $130,514 on May 1. BTC’s price will rally by 38.3% if it hits the $130,514 target.

Historic Rise Among Assets

Bitcoin’s position among top crypto assets and traditional investments continues to strengthen day by day. The cryptocurrency has consistently outperformed many tech stocks and also gold over the past decade, despite facing such significant regulatory hurdles and market volatility throughout its history.

The narrowing distance between BTC vs Nvidia represents yet another milestone in Bitcoin’s remarkable evolution from an experimental digital currency to a mainstream financial asset that’s now competing with major technology giants.

Also Read: US Dollar Future in Crisis as Trump Might Fire Fed Chair Powell

Looking Forward

The question of whether Bitcoin can ultimately surpass Nvidia depends on several important factors, including continued institutional investment, mainstream adoption, and also Bitcoin’s limited supply versus Nvidia’s ability to issue additional shares in the future.

As Bitcoin continues to strengthen its position among global financial assets, the crypto market trends suggest there’s definitely potential for further growth. The Bitcoin market cap Nvidia contest represents more than just numbers at this point—it symbolizes cryptocurrency’s increasing legitimacy in traditional financial markets as well.