The past year has been a doozy for Nvidia (NVDA) . The stock is up almost 200% year-over-year. And this week, Nvidia stock is approaching its all time high and breathing down Apple’s (AAPL) neck to take the “world’s most valuable company” title. Today, Nvidia is perched at number two with a market cap of $3.41 trillion, while Apple’s market cap is $3.52 trillion.

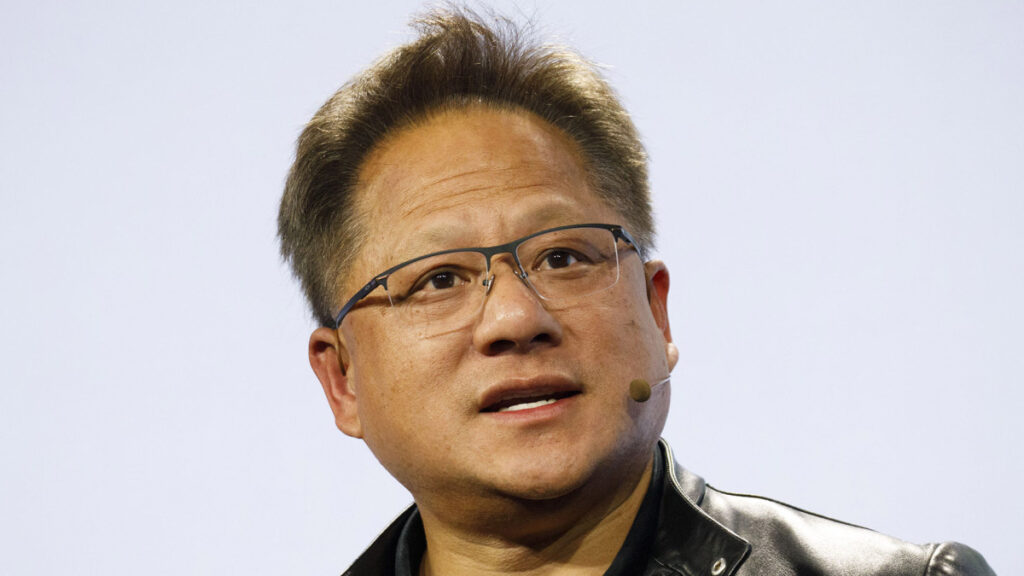

In the midst of this ride, Jensen Huang, founder and CEO of Nvidia, stopped by his alma mater, Stanford University, and sat down for a ”View From The Top interview” with Shantam Jain at the Stanford Graduate School of Business.

Don’t miss the move: Subscribe to TheStreet’s free daily newsletter

The interview showcased Huang’s humility, his priorities and his practical thoughts about leadership.

He kicked things off by noting his first job was as a dishwasher at Denny’s, which he also refers to as his other alma mater (no disrespect to Stanford), a job he says set the stage for his future successes.

Here are some of Huang’s most valuable bon mots from the Stanford interview.

Related: Analyst revamps Nvidia stock price target after investor meetings

Nvidia CEO Jensen Huang talks about his early career

On reputation

“You can have a good or bad interview, but you can’t run away from your past, so have a good past,” Huang said.

Huang explains that the reputation he earned at his first “real” job, at LSI Logic, convinced his former boss to, in turn, convince one of the most sought-after investors in Silicon Valley — the late Don Valentine from Sequoia Partners — to invest in Huang’s start-up.

But it all goes back to Denny’s. “I planned my work, was organized, and was mise en place. And then I washed the living daylights out of the dishes,” Huang said. “And then they promoted me to busboy. I was certain I’m the best busboy Denny’s ever had. I never left the station empty-handed, I never came back empty handed, I was very efficient.”

On creating something new

“You can succeed in doing something, inventing a future, even if you were not informed about it at all. And it’s kind of my attitude about everything now,” Huang explained.

“When somebody tells me about something, and I’ve never heard of it before, or if I’ve heard of it, don’t understand how it works at all, my first thought is always, how hard can it be?” he added. “And it’s probably just a textbook away. You’re probably one archive paper away from figuring this out. And so I spent a lot of time reading archive papers.”

On bookstores

At two different points in his life as a young founder, Jensen found himself browsing bookstore shelves in search of information that could help him.

“I didn’t know how to write a business plan,” he said. “So I went to a bookstore and found a book by Gordon Bell and it says ‘How to write a business plan.'”

Huang bought the book but didn’t read the whole thing. “It’s 400 pages!” he said.

The second book, though, was a game-changer. It was “The OpenGL Manual,” which defined how Silicon Graphics did computer graphics.

Huang bought three copies and handed one to each of his co-founders, saying, “I found it, our future.” The book had a centerfold featuring the OpenGL pipeline, and they used it to build “something the world had never seen.” Even today, Jensen says, archive papers are where ideas can be found.

On pivoting

“We started this company for accelerated computing, and the question (was) what is it for? What’s the killer app? And that (brought) our first great decision, and this is what Sequoia funded. The first great decision was the first killer app was going to be 3D graphics,” Huang said. “And the technology was going to be 3D graphics, and the application was going to be video games. At the time 3D graphics was impossible to make cheap. It was million dollar image generators from Silicon Graphics.”

“We realized that not only do you have to create the technology and invent a new way of doing computer graphics, so that what was $1 million is now $300, $400, $500 that fits in a computer,” Huang said. “And you have to go create this new market. So we had to create technology (and) create markets.”

Patrick T. Fallon/Bloomberg via Getty

Jensen Huang discusses what’s really important

On core beliefs

“My reaction during that time (when Nvidia lost 80% of market value in the financial crisis), is the same reaction I had about this week (when Nvidia’s market cap crossed $2 trillion and it became the third most valuable company on Wall Street),” Huang said. “Don’t get me wrong, it’s a little bit embarrassing. You don’t want to leave the house. But then you go back to doing your job.”

“I go back to ‘What do I believe? Did physics change? Did gravity change? Did anything we believe change?’ If they didn’t change, you keep on going,” he added.

Related: Analyst adjusts AMD stock price target after AI event

On what’s really important

“Your job is to make a unique contribution, live a life of purpose to do something that nobody else in the world would do or can do to make a unique contribution — so that in the event that after you’re done everybody says, you know, the world was better because you were here,” Huang said.

More on AI stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Veteran trader who called Palantir rally unveils new price target

- Open AI is burning cash (and losing billions!)

On leadership

“I’m surrounded by geniuses,” Huang said. “Nvidia is well know to have the best management team on the planet.”

His employees say Huang’s management style is very “engaged.”

“No task is beneath me because I used to be a dishwasher and clean toilets!” Huang said. “If you send me something and you want my input and in my review, I can share how I reason through it … how I would do it.”

On what he’d do differently today

“The idea that a company would create technology, create markets, defines Nvidia today,” Huang said. “Now, of course, you can’t learn how somebody else does something and do it exactly the same way and hope to have a different outcome.”

“But you could learn how something can be done, and then go back to first principles and ask yourself, given the conditions today, given my motivation, given the instruments, the tools, given how things have changed, how would I redo this? How would I reinvent this whole thing?” Huang continued.

“How would I build a car today? Would I build it incrementally from 1950s and 1900s?” he asked. “How would I build a computer today? How would I write software today?”

“And so I go back to first principles all the time, even in the company today — and just reset ourselves. Because the world has changed.”

Related: Veteran fund manager sees world of pain coming for stocks