Bitcoin miners are sending a clear message: they’re more bullish than ever. As we observe new all-time highs in the Bitcoin network’s hash rate, the commitment of miners underscores their confidence in the asset’s long-term potential.

The Hash Ribbons Indicator Explained

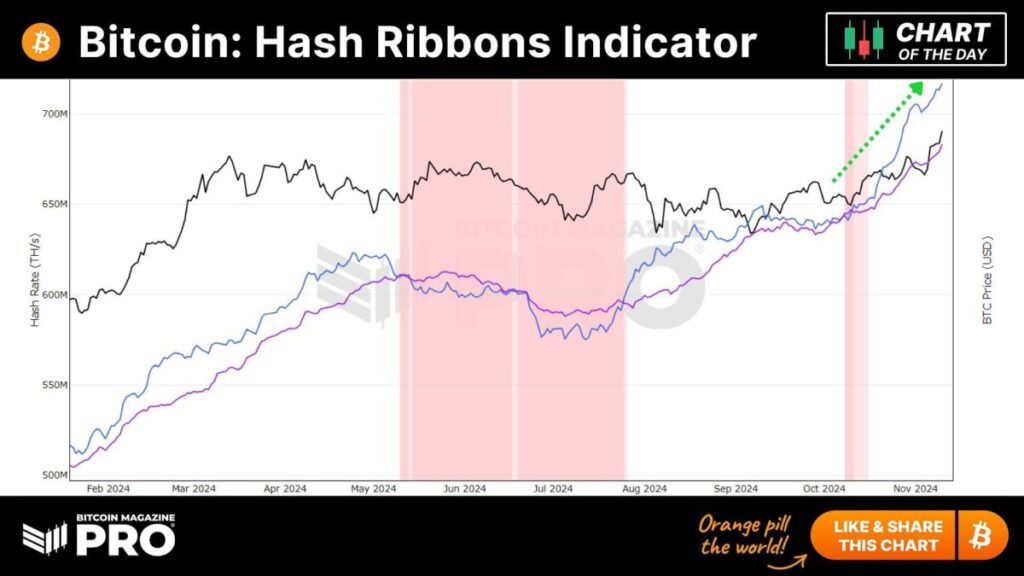

The Hash Ribbons indicator provides insight into miner activity and sentiment by analyzing the 30-day and 60-day moving averages of Bitcoin’s hash rate. When the 30-day moving average crosses above the 60-day, it suggests a positive shift, often interpreted as miner capitulation coming to an end. This shift typically signals that weaker miners have exited the market, leaving only resilient participants and setting the stage for potential price recovery.

Why All-Time Highs in Hash Rate Matter

As the Bitcoin network’s hash rate climbs to new peaks, it highlights the increasing amount of computational power devoted to securing the blockchain. This rise not only reflects strong miner confidence but also enhances the network’s resilience and security. In the current climate, these hash rate highs indicate that miners are holding their ground, undeterred by market fluctuations.

Interpreting the Current Hash Ribbon Signal

The chart above shows a recent bullish crossover in the Hash Ribbons, indicating the end of miner capitulation. Historically, these crossovers have often aligned with favorable price action in the weeks and months that follow. With hash rate reaching unprecedented levels, this crossover suggests that miners anticipate a period of sustained growth.

For an in-depth look at the Hash Ribbons Indicator and to stay updated with future movements, visit the source here: Bitcoin Magazine Pro.