Bitcoin (BTC) has had a volatile 24 hours, hitting as low as $68,830 on the Binance crypto exchange before recovering some losses.

Liquidation Data At A Glance

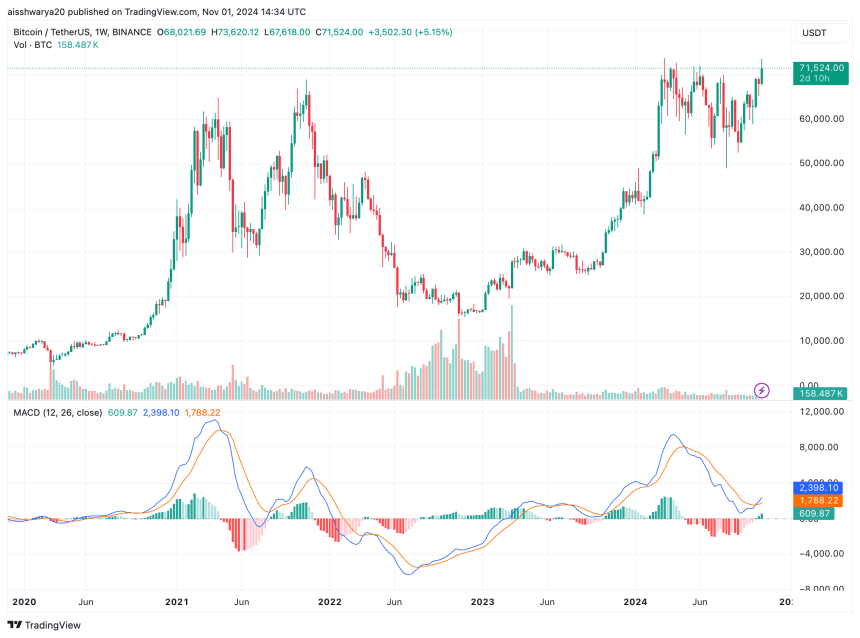

Although BTC is trading close to its all-time high (ATH) value of $73,737, yesterday’s quick drop in price cast doubts on whether the top digital asset will be able to record a new ATH.

Related Reading

According to CoinGlass data from the crypto liquidations tracker, more than $296 million of active positions were liquidated in the last 24 hours.

Nearly 77% were long positions, indicating that traders were largely betting on BTC’s continued upward momentum. Binance saw the most liquidations at $124 million, followed by OKX with $74 million and Bybit with $65 million.

In digital assets, Bitcoin led with over $97 million worth of positions liquidated, followed by Ethereum (ETH) at $47 million, and Solana at nearly $17 million.

With yesterday’s slump, the total crypto market cap has shrunk by about 3.5%, currently valued at $2.48 trillion. It is worth noting that although BTC is close to its ATH, the total crypto market cap is still considerably far from its ATH of $2.98 trillion recorded in November 2021.

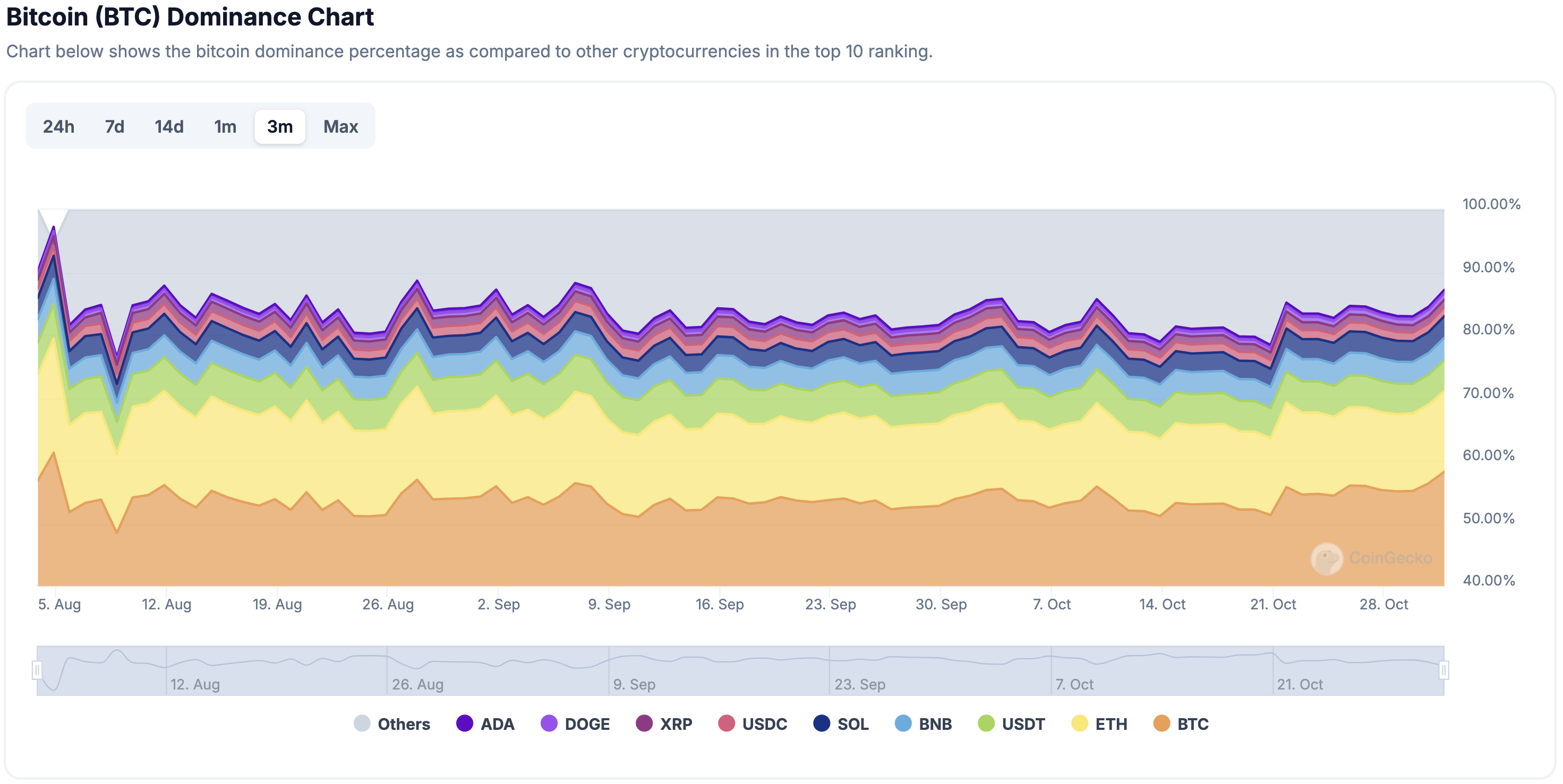

The gap between BTC’s performance and the overall market cap suggests that altcoins have not kept pace with BTC’s recent gains, contributing to the disparity. This could also indicate a cautious investor sentiment, favoring BTC over altcoins during uncertain periods.

At the same time, it suggests that there is still a lot of room for altcoins to grow, which could tempt some more risk-seeking investors to accumulate altcoins in hopes of extraordinary gains relative to BTC.

That said, Bitcoin dominance – a metric that gauges the proportion of the overall crypto market cap commanded by BTC – is steadily climbing toward 60%. A higher BTC dominance could spell disaster for altcoins already trailing BTC in price action.

Can Bitcoin Still Hit ATH?

The question on the minds of crypto enthusiasts is whether BTC will achieve a new ATH during this rally. The answer is not straightforward.

Related Reading

Factors supporting a potential new ATH include the increased likelihood of pro-crypto US presidential candidate Donald Trump winning the election, the effects of BTC halving, increased inflows to BTC exchange-traded funds (ETF), and a low interest rate environment.

On the contrary, sentiment indicators like the Fear and Greed Index suggest the market is still in a ‘greed’ phase, hinting that there could be more pain for the market before the next leg up.

Regardless of the outcome, the crypto market will likely remain volatile in the coming days. However, long-term BTC holders do not appear fazed by this prospect, as profit-taking remained relatively muted when the digital asset crossed $71,000.

At press time, BTC trades at $71,524, up a modest 0.6% in the past 24 hours, with a reported market cap of $1.41 trillion.

Featured image from Unsplash, Charts from CoinGecko, CoinGlass, and Tradingview.com