An OG Bitcoin advocate made a bold forecast that demand for Bitcoin will increase rapidly in the near future, bolstering the estimates of some crypto experts that BTC is on a trajectory to hit the six-figure level.

OG, short for “original gangster” or “original gangsta,” is a slang expression for someone who is exceptional, unique, or “old-school.”

The BTC supporter also suggested that the coin is moving in the direction that will allow the crypto to outshine gold, the US dollar, and other major assets soon.

Related Reading

Rising Over Gold, Greenback

ShapeShift CEO Erik Voorhees, an early investor of Bitcoin, sees that the cryptocurrency would surpass the major assets in the upcoming months, saying that the coin has “high potential” to eclipse fundamental assets such as gold, the US dollar, and even oil.

When demand for gold rises, more gold is produced.

When demand for oil rises, more oil is produced.

When demand for USD rises, more USD are produced.When demand for Bitcoin rises…

— Erik Voorhees (@ErikVoorhees) October 29, 2024

In a post, Voorhees pointed out that when the appetite for gold rises, gold production will surge while if the demand for oil rises, more oil will be extracted. He added that more US dollars are printed, once the demand for the greenbacks soar, saying that supply for these assets would not run out in the upcoming years.

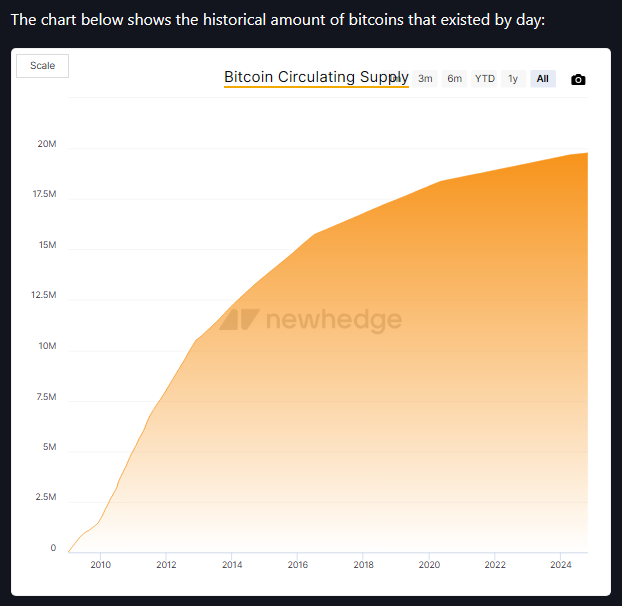

However, the founder of the Venice.AI project hinted that it is not the same case with Bitcoin when demand for it increases. It is an indication that additional BTC cannot be produced because Satoshi Nakamoto, the creator of Bitcoin, only designed the cryptocurrency not to exceed 21 million coins.

Bitcoin-Gold Relationship

Earlier, another Bitcoiner, Max Keiser, believed that there is a relationship between the price of gold and Bitcoin price, saying that BTC price could soar because of gold.

Keiser explained that for every $1 increase in gold prices, BTC prices also experienced a hike of $20, adding that since gold prices hit a record amount, Bitcoin prices are more likely to follow suit.

Expecting A Bitcoin Surge

Voorhees is already telling the cryptocurrency community to keep an eye on Bitcoin because he predicts that all aspects of the coin will move upward including its price.

The ShapeShift executive remarked that this attribute of Bitcoin would be the main factor why demand for the coin will soar quickly.

In the past few days, several crypto experts have already projected the inevitable growth of Bitcoin, saying that its price will breach the six-figure level.

Related Reading

19 Million BTC Mined

Reports have shown that over 19 million BTC circulating in the crypto market today, is the highest it has ever been.

Analysts said many of these coins have been stored in “cold wallets” for numerous years, saying that a portion of these BTCs are owned by Bitcoin EFTs.

A Chinese cryptocurrency journalist estimated that over 5% of all Bitcoins in the market are in the possession of Bitcoin EFTs with an approximate net value of $72.545 billion.

Featured image from Pexels, chart from TradingView