Eli Lilly (NYSE: LLY) may seem like an expensive stock to invest in right now. It’s trading at close to 90 times its trailing earnings. Its $720 billion market capitalization also means it’s the most valuable healthcare stock in the world.

Although it may seem like it has hit a peak given the stock’s slowdown in recent weeks, there could be a huge catalyst upcoming for the business next year. It’s one that investors should keep a close eye on because it could send the stock to record highs in 2025.

Eli Lilly is a big name in diabetes care and weight loss. Tirzepatide generates billions in revenue for the healthcare company. It is a GLP-1 injectable that is approved for diabetes under the Mounjaro brand and for weight loss under Zepbound. But what investors are really eager to find out is if the company may have a GLP-1 weight loss pill in its portfolio in the near future.

By April 2025, Eli Lilly expects it will have data to report on a late-stage trial for orforglipron, an oral GLP-1 medication that has been promising thus far. In phase 2 trial results, the once-daily pill helped obese and overweight adults lose up to 14.7% of their body weight over a 36-week period. Now, the phase 3 trial data is upcoming and if it proves to be just as promising and with no serious side effects, it could be a matter of time before the Food and Drug Administration grants it approval.

And with investors often buying a stock before the official approval comes out, it wouldn’t be surprising to see shares of Eli Lilly soar if the trial results look strong.

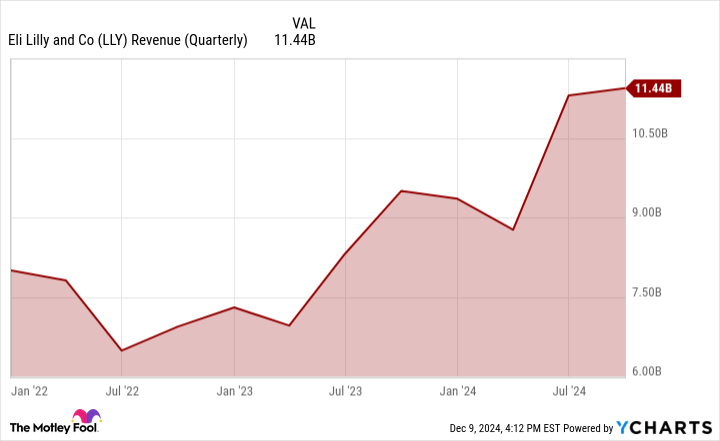

Eli Lilly has a solid roster of products in its portfolio already, with Mounjaro and Zepbound leading the charge. They have enabled the company to drastically grow its sales in recent quarters. And what’s encouraging is that those products are still in their early growth stages.

There could also be more indications for these drugs, which could allow them to reach more patients. Zepbound, for example, may soon be approved as a treatment for sleep apnea, given the effectiveness it has shown in clinical trials.

As more studies are completed on these drugs, they could obtain approval for more indications, boosting their revenue potential in the process. Zepbound and Mounjaro combined for nearly $4.4 billion in sales during the most recent quarter, which ended on Sept. 30, accounting for 38% of the company’s total revenue.

Having yet another weight loss drug in Eli Lilly’s portfolio could quickly ease any concerns about the company’s valuation. It’s an early leader in the highly lucrative obesity drug market, which some analysts predict could be worth $200 billion by 2031.