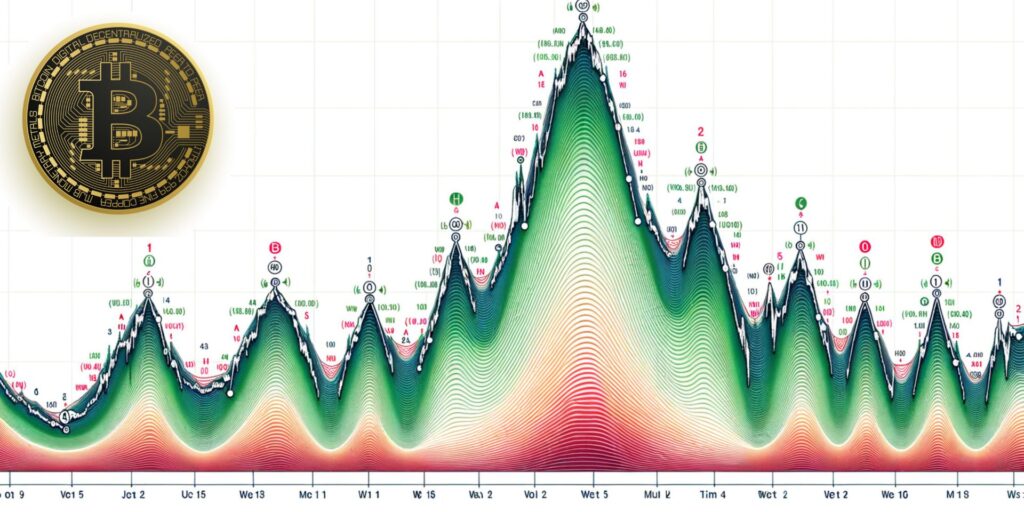

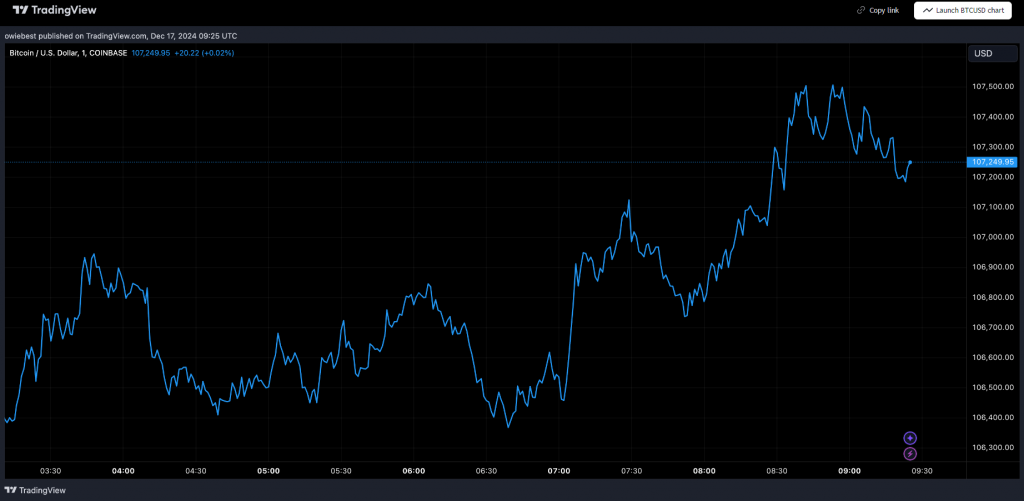

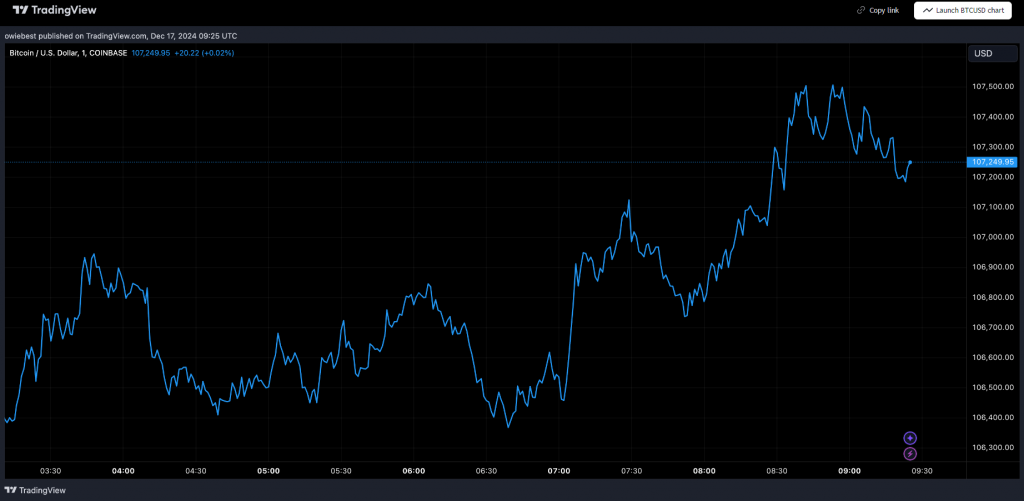

Bitcoin price analysis shows that current market patterns look just like those from 2017. New cryptocurrency price prediction tools show Bitcoin might reach $190,000. This comes from Bitcoin trading strategy data and current market volatility in crypto trading.

#Bitcoin Elliott Wave count comparison 2024 versus 2017 pic.twitter.com/XLvbcnYt8v

— Tony “The Bull” Severino, CMT (@tonythebullBTC) December 16, 2024

Also Read: Solana Vs. Binance’s BNB: Which Will Reclaim All-Time High First?

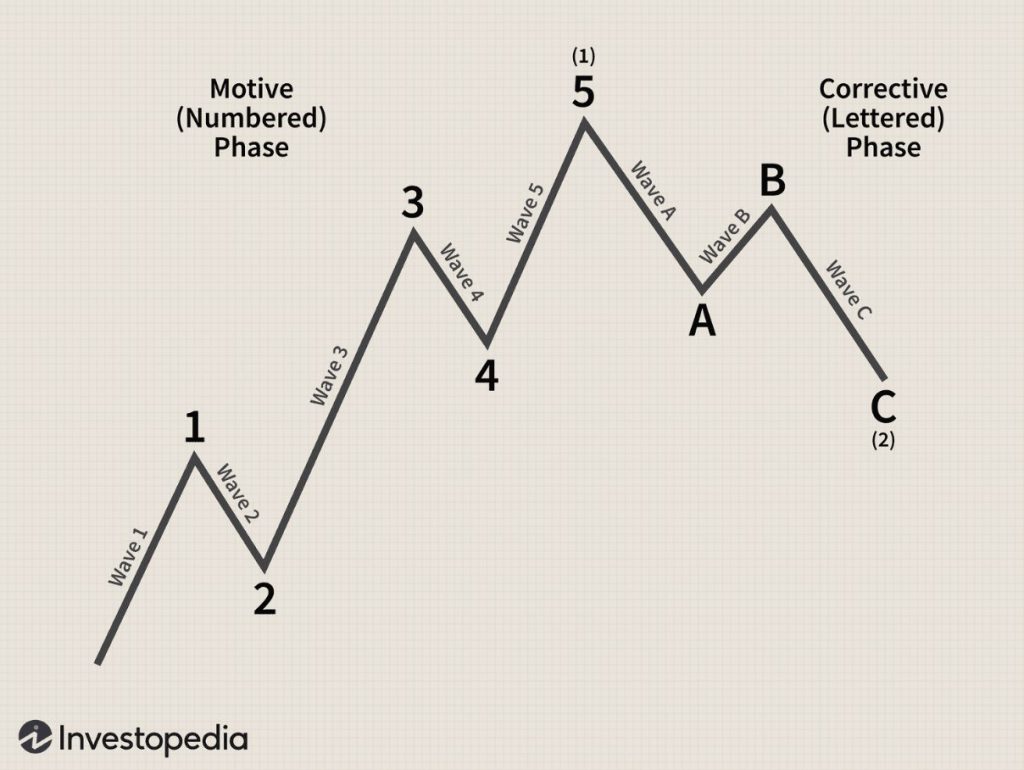

Discover How Elliot Wave Theory Can Help Navigate Market Volatility

Current Wave Pattern Analysis

The Bitcoin price analysis uses Elliott Wave patterns to spot market trends. Crypto analyst Tony Severino states, “Based on these similarities, Bitcoin could rally to $190,000 if history repeats itself.” He sees a strong upward movement that started in late October.

Price Targets and Retracement Levels

The latest cryptocurrency price prediction shows key price points ahead. “Bitcoin could first retrace to around $104,000, then rally to around $123,000, followed by another price correction to $96,000,” Severino explains. Market volatility in crypto means these dips could be good times to use a bitcoin trading strategy.

Also Read: Ripple (XRP) vs. SEC: Gensler Gone, Crenshaw Out, Final Verdict Jan 15

Technical Support Structure

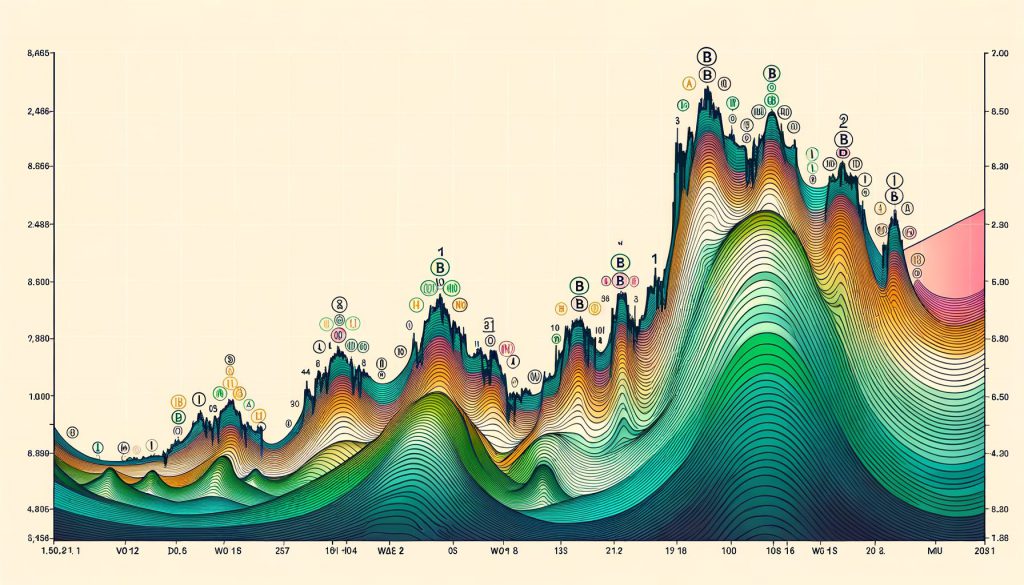

#Bitcoin ( $BTC /USDT) Daily Analysis :

Bitcoin is trading within a well-defined ascending channel, indicating a steady upward trend.

Strong support is observed around $92,500 – $94,000, which has consistently held during retracements.

The next major target is $121,290.62,… pic.twitter.com/aMaRjbbqsR

— Rose Premium Signals 🌹 (@VipRoseTr) December 11, 2024

Analyst Rose Premium Signals reports, “Strong support is observed around $92,500 – $94,000, which has consistently held during retracements.” The Bitcoin price analysis shows prices moving up steadily. The next target is $121,290.62.

Also Read: $200K Bitcoin (BTC) in Sight by 2025, Predicts Bitfinex

Wave Progression and Volume Analysis

#Bitcoin going full Santa Claus mode. 🎅

Pullbacks might be hard to come by through the end of the year, especially with the speculation of $BTC becoming a US reserve asset under Trump.

Wouldn’t be surprised to see $116k or even $125k through the end of December. pic.twitter.com/ifONrUrvvv

— Justin Bennett (@JustinBennettFX) December 16, 2024

Justin Bennett‘s BTC trading strategy research brings good news. He says: “Bitcoin is going full Santa Claus mode and isn’t showing signs of slowing down.” The market looks like it did in 2017. Bennett adds, “Pullbacks might be hard to come by through the end of the year.” Many cryptocurrency price prediction tools point to $125,000.

Final Wave Projections

Titan of Crypto’s BTC price analysis sees prices reaching $158,000. Market volatility in crypto might affect timing. Elliott Wave theory and trading data back this target. More buyers are entering the market now.

Also Read: Fed’s 3rd Rate Cut Due Today: What a 0.25% Drop Means for Crypto Markets