On-chain data shows increased selloff from Ethereum whales over the past week. But the asset’s price remained bullish.

According to data provided by IntoTheBlock, net flows for large holders of Ethereum (ETH) decreased from 85,650 ETH in inflows on Sept. 19 to 6,420 in outflows on Sept. 23.

The indicator shows a strong sell-off from Ethereum whales as the price recovered from $2,300 to $2,400 on Sept. 19. At this point, the bullish momentum around the ETH price has mostly come from retail traders rather than large holders.

Data from ITB shows that Ethereum witnessed an exchange net inflow of 150,690 ETH on Sept. 19, but the inflows soon cooled down. ETH saw a net inflow of around $480 million into centralized exchanges over the past seven days.

The large holder to exchange net inflow ratio suggests that retail traders have been more active over the weekend, driving the asset’s price up.

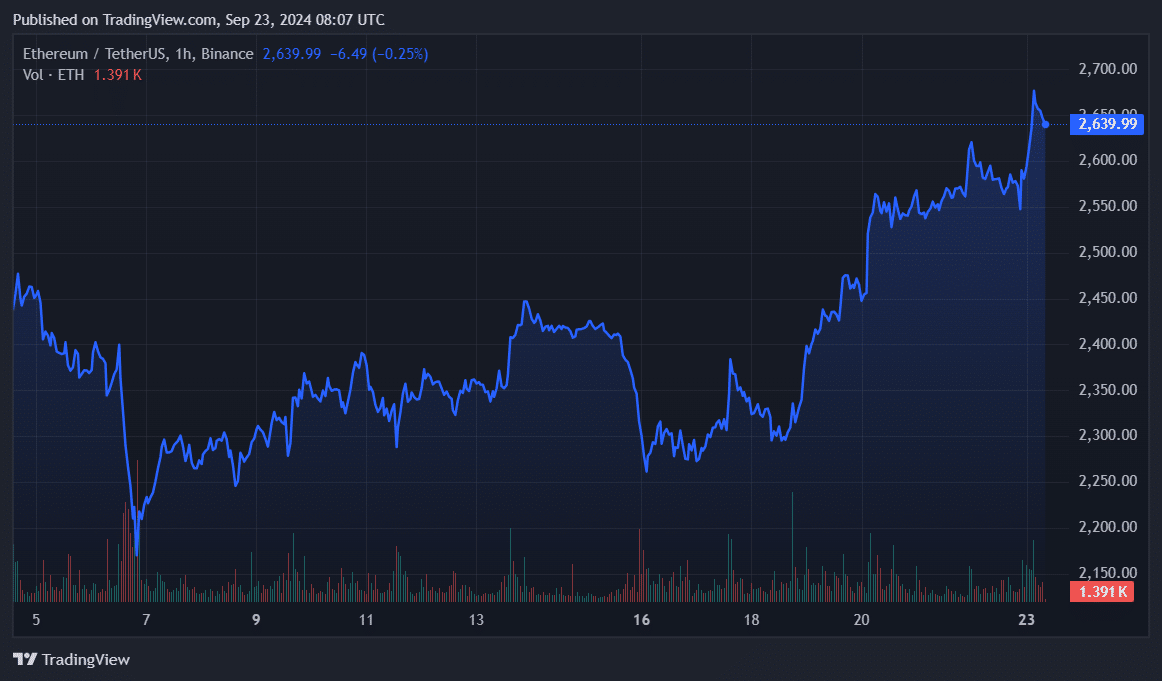

Despite the selloff from whales, ETH gained 15% in the past seven days. The leading altcoin is up by 2.2% in the past 24 hours and is trading at $2,640 at the time of writing. Earlier today, Ethereum touched a local high of $2,685 — reaching this level for the first time in a month — as on-chain signals remained bullish.

Ethereum’s market cap is currently sitting at $319 billion with a daily trading volume of just over $17 billion.

One of the main catalysts for the market-wide bullish momentum was the 50 basis-point rate cut by the U.S. Federal Reserve. However, the Ethereum price will need to see stronger accumulation to sustain its upward movement toward the $2,800 mark.