Last week, Elon Musk’s SpaceX made headlines as it skyrocketed in value, reaching a new high of $350 billion.

As Donald Trump prepares to return to the White House, Musk’s proximity to the incoming president has kept his companies in the spotlight, driving significant growth for Tesla stock (TSLA) .

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

And while SpaceX is still a privately held company, its value has surged 67% since June 2024 as it has continued to dominate the space exploration field coverage.

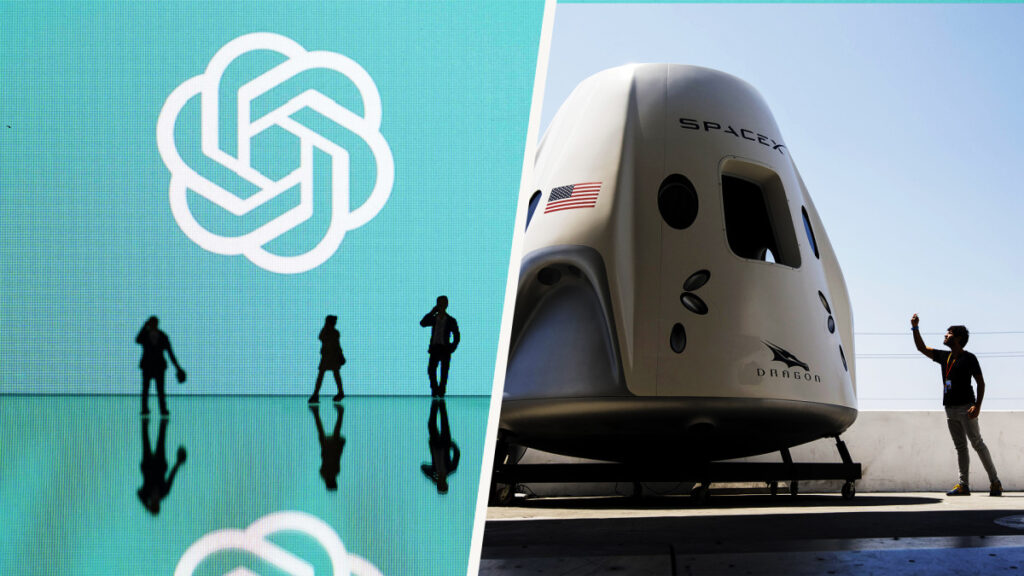

SpaceX isn’t the only private company frequently making more headlines than its public peers. ChatGPT maker OpenAI remains one of the trendiest names in tech.

Until recently, retail investors haven’t been able to gain exposure to privately held companies. But now, a fintech company offers the chance to do that by letting individuals invest in one of the most popular tech names before it goes public.

How to invest in SpaceX

Are retail investors interested in gaining exposure to private companies like SpaceX and OpenAI? According to recent data, the answer is a resounding yes.

SoFi Technologies (SOFI) , a financial services platform, recently surveyed 5,000 retail investors and reported that more than 87% expressed a clear interest in investing in privately held companies.

The authors also found that when survey respondents were asked to provide a list of the private companies they most want to invest in, they ranked SpaceX, OpenAI and popular video game producer Epic Games as the top three, indicating a clear desire to gain exposure to these popular companies.

Related: Tesla robotaxis are coming in 2025 with an unexpected addition

On December 4, 2024, SoFi announced that through its relationship with investment firm Templum, it is granting accredited investors access to The Cosmos Fund, a special purpose vehicle offering exposure to SpaceX.

It also expanded access to the Pomona Investment Fund and StepStone Private Markets Fund, both offering access to high-profile alternative assets such as private equity and debt investments. However, this does not include SpaceX exposure.

Investors using SoFi can access these funds via Templum One, Templum’s global ecosystem that connects private and alternative market issuers with partners, enabling investors to access sought-after private assets. Accredited investors can buy into these funds, including the Cosmos Fund, which offers SpaceX exposure, though they must meet SoFi’s specified criteria.

A spokesperson from Templum spoke to TheStreet, providing context on Templum’s relationship with SoFi and the operations of private market investing.

“Private investments are usually illiquid, meaning they can’t be easily sold or traded,” they state. “Investors often hold these assets for years, targeting higher returns in exchange for reduced liquidity.”

The representative notes that Templum is working to change this paradigm by “creating liquidity opportunities through secondary trading.”

The Cosmos Fund isn’t the only option for those looking to invest in SpaceX. The Ark Venture Fund, managed by Cathie Wood’s ARK Investment Management, also offers exposure, as SpaceX occupies more than 12% of its portfolio.

Investors can also gain exposure to OpenAI and Epic Games, both of which hold roughly a 5% stake in the fund, while popular AI startup Anthropic accounts for 4%. SoFi’s brokerage platform also allows investors to buy into the Ark Ventures Fund.

More Tech Stocks:

- General Motors’ abrupt move takes surprising toll on top tech stock

- UnitedHealthcare spotlight reveals pivotal AI failure

- Best-managed company rankings reveal a lot about top tech stocks

New market access for retail investors

Templum notes that this partnership expansion with SoFi represents a key step towards democratizing access to private alternative investments.

Citing data that shows global alternative assets under management are projected to expand from $16.3 trillion today to $60 trillion by 2032, the representative notes that “this collaboration is closing the gap by delivering access to premium opportunities previously reserved for institutional investors.”

Additionally, Templum sees demand for private market access getting stronger, particularly as companies like SpaceX continue to drive interest.

Related: Broadcom CEO sounds alarm on crucial shift in AI-chip market

“The tech investment landscape is evolving rapidly, driven by increasing demand for seamless access to private markets, scalable technology solutions, and enhanced liquidity,” notes the representative.

Templum’s experts see investors and asset managers seeking platforms that can bring the convenience of public market trading to the private investment space. As SoFi’s data has shown, retail investors want to gain exposure to companies like SpaceX and OpenAI.

This new opportunity to invest in SpaceX comes at a time when the company’s growth is strong, and its industry appears poised for growth.

United Press International reports that the Trump/Musk alliance is likely to boost the space economy, thereby helping drive SpaceX’s growth as the company continues to plan rocket launches for 2025.

Related: The 10 best investing books (according to stock market pros)