GameStop’s Bitcoin purchase of 4,710 coins worth $512 million has catalyzed a pivotal moment in corporate Bitcoin adoption, and at the time of writing, this move continues to generate significant market attention. GameStop’s Bitcoin purchase spearheaded one of the largest cryptocurrency investments by a traditional retailer, also coming amid heightened crypto market volatility and growing Bitcoin investment risks. This strategic move by CEO Ryan Cohen has accelerated numerous significant discussions around stock price reaction as investors evaluate the implications of GameStop’s bold entry into digital assets.

JUST IN: GameStop $GME buys 4,710 Bitcoin worth $512 million.

— Watcher.Guru (@WatcherGuru) May 28, 2025

Also Read: Strategy Misses BTC Rally as Saylor Hides $14B Reserves

How GameStop’s Bold Bitcoin Move Impacts Crypto, Stocks & Risk

Strategic Reasoning Behind GameStop’s Bitcoin Investment

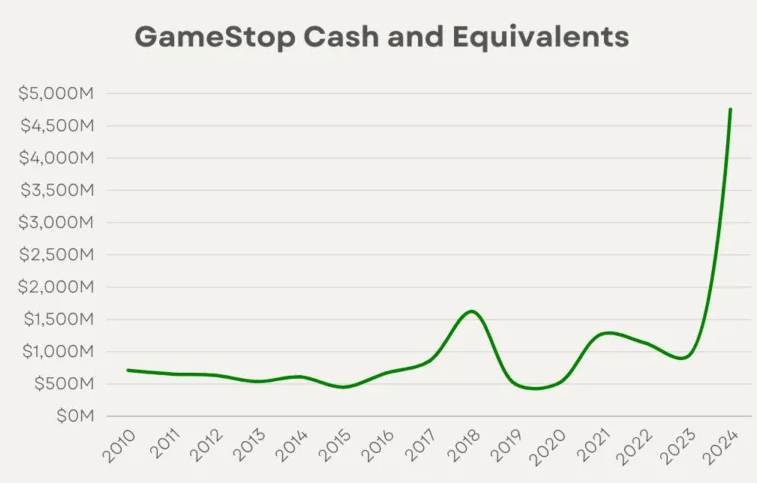

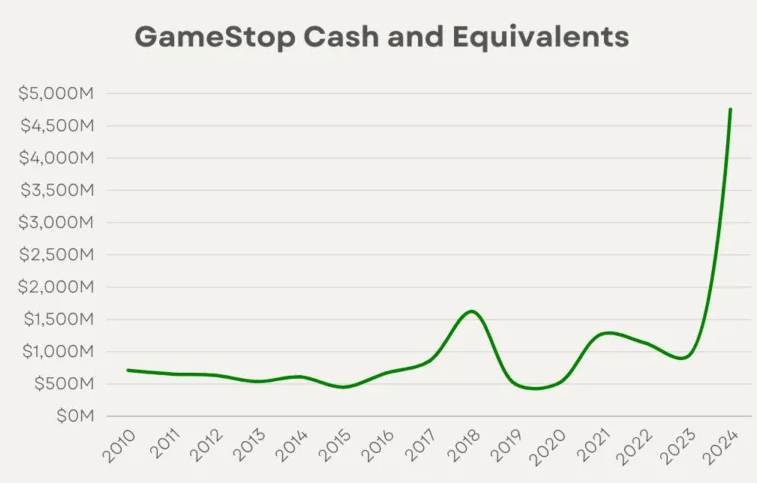

GameStop’s Bitcoin purchase has revolutionized Ryan Cohen‘s disciplined capital allocation strategy, and it leverages the company’s substantial cash reserves built through various major equity offerings across several key market periods. GameStop’s decision implemented a high-volatility growth lever while preserving core business operations, also positioning the company to maximize long-term value creation through multiple essential strategic initiatives.

Cohen’s approach to corporate Bitcoin adoption has pioneered a philosophy of putting skin in the game across numerous significant business areas. The company has transformed one of the most disciplined turnarounds in retail, and Cohen has engineered founder-level intensity at GameStop, cutting executive pay from $55 million to $2 million while refusing all compensation himself.

This Bitcoin investment risks approach has optimized Cohen’s track record of making calculated bets with excess capital, and it demonstrates his commitment to long-term shareholder value through several key strategic developments.

Market Volatility and Risk Assessment

The crypto market volatility surrounding GameStop’s announcement has established key concerns for corporate Bitcoin adoption across multiple essential market segments, and it demonstrates the challenges companies face when allocating treasury funds to digital assets through various major investment strategies. Bitcoin investment risks encompass significant price swings that directly impact corporate balance sheets, also with the cryptocurrency experiencing multiple corrections this year alone involving numerous significant market factors.

GameStop’s Bitcoin purchase timing has integrated with market uncertainty, yet the company’s debt-free status and nearly $5 billion cash position provide substantial cushion against potential downside across several key financial areas. The stock price reaction has been deployed across mixed investor sentiment as analysts weigh cryptocurrency exposure against GameStop’s core transformation story, and market observers are closely monitoring how this move affects various major valuation metrics.

Financial Foundation Enabling Bold Moves

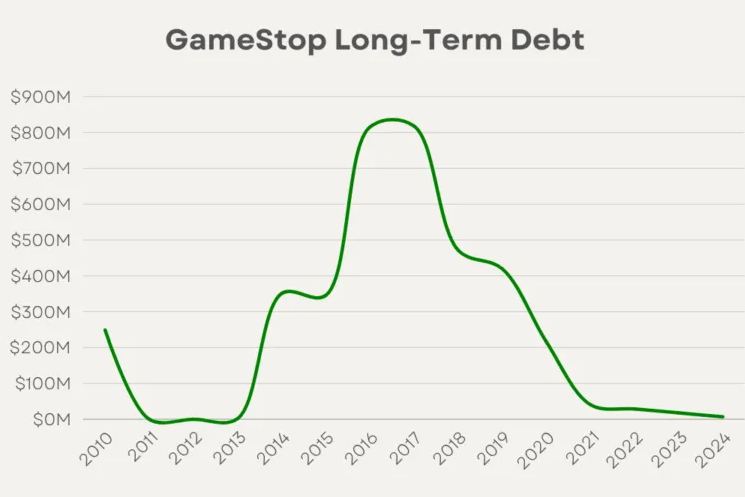

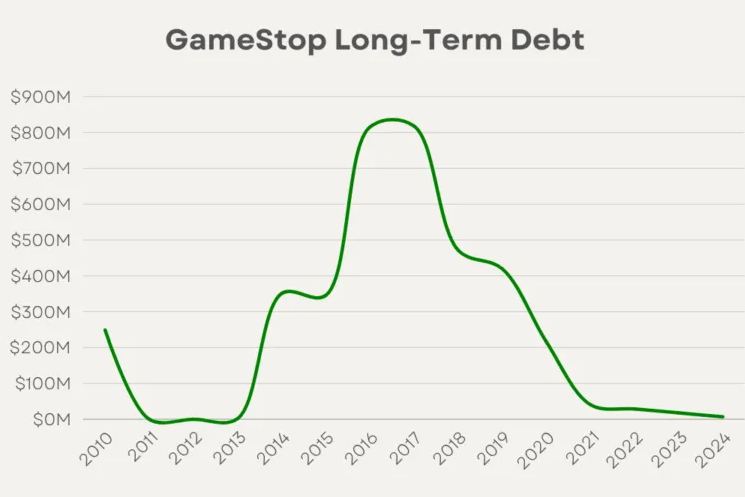

Cohen’s leadership has restructured GameStop’s ability to execute this Bitcoin purchase through dramatic financial improvements, and multiple essential operational changes have architected the transformation. The company eliminated over $800 million in long-term debt while building massive cash reserves, also creating flexibility for strategic investments and bold moves like this Bitcoin acquisition across numerous significant business areas.

This corporate Bitcoin adoption strategy has maximized GameStop’s strengthened balance sheet, with Bitcoin investment risks regulated by substantial remaining cash reserves and zero debt obligations through various major financial restructuring initiatives. The company’s gross margins have been optimized significantly, and operating losses have been reduced dramatically from previous years across several key performance indicators.

Broader Implications for Retail and Crypto

GameStop’s Bitcoin purchase has instituted growing acceptance of cryptocurrency as a legitimate treasury asset among traditional retailers, and it could influence other companies to consider similar moves through multiple essential strategic frameworks. This crypto market volatility tolerance by established companies has accelerated broader corporate Bitcoin adoption across the retail sector involving numerous significant market developments.

GameStop’s move has followed companies like Tesla and MicroStrategy, yet differs due to the company’s unique financial position and transformation story across various major business segments. The stock price reaction will likely influence other retailers considering similar cryptocurrency investments, also making GameStop’s performance a closely watched case study for Bitcoin investment risks in corporate settings.

Also Read: Bitcoin Just Got Bigger: Block To Begin BTC Payments on Square in Late 2025