A widely followed crypto analyst says that Bitcoin (BTC) may pull back after failing to hold a key support level.

In a new thread, crypto trader Justin Bennett tells his 116,000 followers on the social media platform X that BTC may revisit the lower bound of a trading range at the $100,000 level, after a possible weekend bounce.

“Possible scenario for BTC following Thursday’s $106,600 failure. Pull back/consolidate on Friday, weekend rally (because that’s what retail does) into $106,000-$107,000, and then revisit the $100,000 lows. Invalidation on a sustained break (high time frames) above $107,000…

Personally, I wouldn’t be a buyer here, not after losing $106,600. It’s shorts only for me, but only if BTC gives me the opportunity on a bounce.”

Bennett also says that BTC whales exiting long positions in favor of building short positions against retail is causing the flagship crypto asset to weaken.

“Whales were shorting into retail strength all day Thursday. It was a scam BTC pump from the start.”

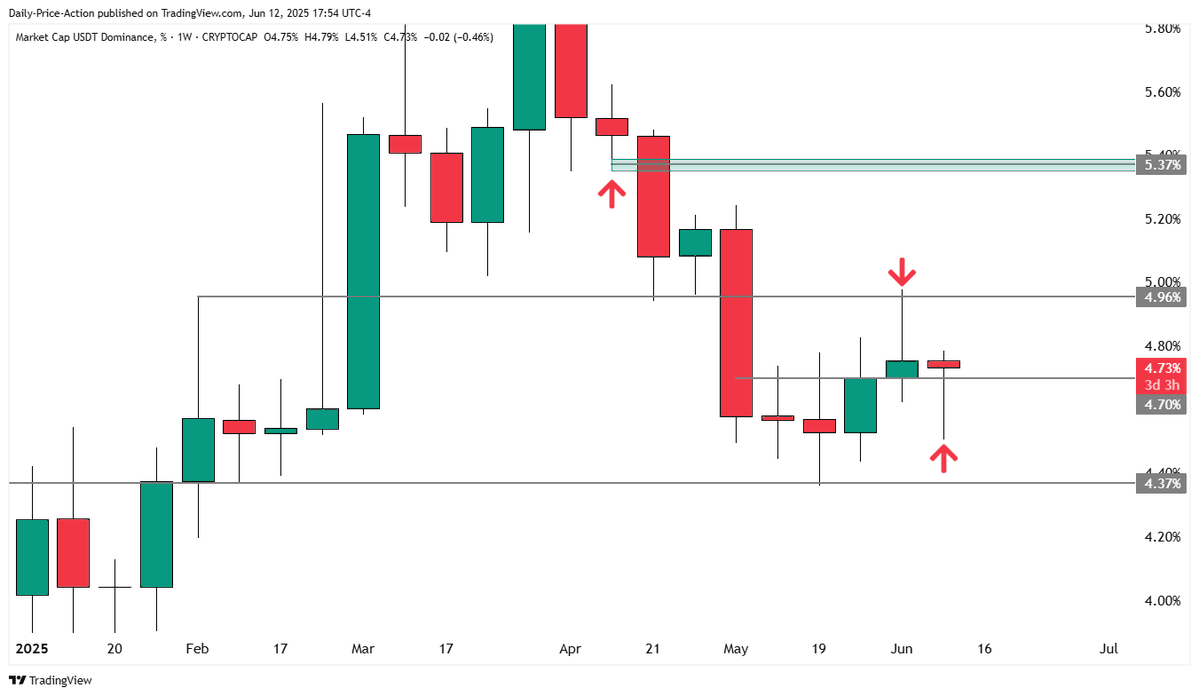

Lastly, the analyst warns that the USDT dominance chart (USDT.D) may start flashing bearish for Bitcoin.

Many traders closely watch the USDT.D chart as it shows how much of the crypto market cap is comprised of the stablecoin USDT. A bullish USDT.D chart is generally considered bearish for Bitcoin and other cryptocurrencies as it indicates traders are unloading their crypto holdings in favor of the stablecoin.

“Not ready to call it just yet, but the USDT.D weekly chart is starting to look primed for another push back to 5%. I’ll wait for Friday’s two-day close to get a more definitive answer on this idea, but it looks decent so far. (Tether dominance moves inversely to BTC and ETH).”

Bitcoin is trading for $105,658 at time of writing, down 1.6% in the last 24 hours.

Meanwhile, USDT.D is at 4.79% at time of writing.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney