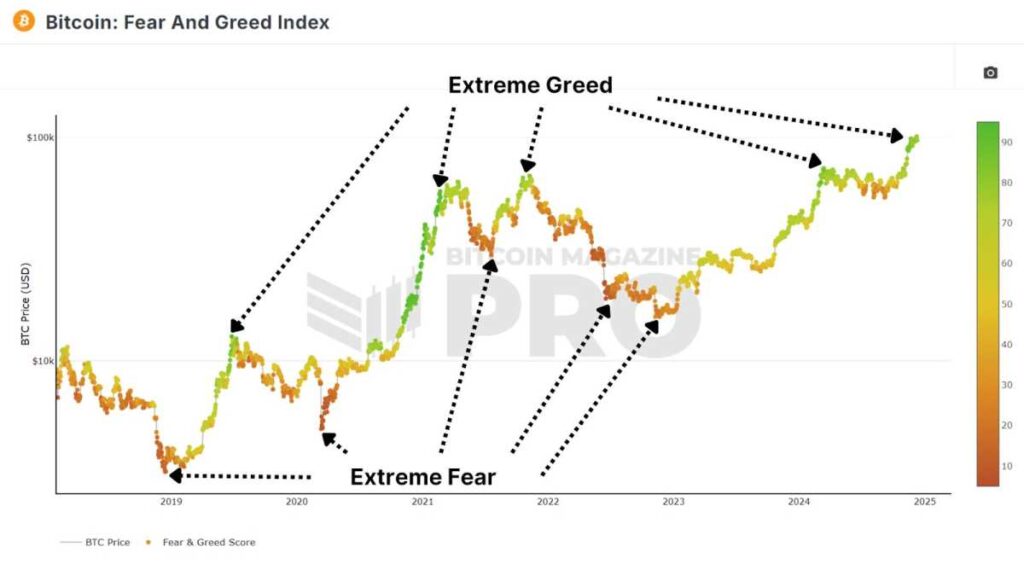

The Bitcoin Fear and Greed Index is a sentiment analysis tool that captures the collective mood of Bitcoin traders and investors. Spanning a scale of 0 to 100, the index identifies market emotions ranging from extreme fear (0) to extreme greed (100). While it’s a popular resource among many analysts, it certainly has some doubters! So, let’s look at the data to quantifiably prove if this index can actually help you make better investment decisions.

Investor Emotion

The Fear and Greed Index aggregates various metrics to provide a snapshot of market sentiment. These metrics include:

Price Volatility: Large price swings often evoke fear, especially during downturns.

Momentum and Volume: Increased buying activity generally signals greedy sentiment.

Social Media Sentiment: Public discourse about Bitcoin across platforms reflects collective optimism or pessimism.

Bitcoin Dominance: Higher dominance of Bitcoin relative to altcoins usually indicates cautious market behavior.

Google Trends: Interest in Bitcoin search terms correlates with public sentiment.

By synthesizing this data, the index provides a simple visual representation: red zones signify fear (lower values), while green zones indicate greed (higher values).

What you’ll also immediately notice is that this tool really outlines how mass psychology is almost always best acted on as a contrarian. Essentially ,if everyone is bearish, you should probably be more bullish and vice versa.

Does Acting Contrarian Work?

To evaluate whether the Fear and Greed Index is more than just a colorful chart, a test was conducted using data dating back to February 2018, when the metric was created. The strategy implemented was straightforward:

Allocate 1% of your capital to Bitcoin on days when the index reads 20 or below, and sell 1% of your Bitcoin holdings on days when the index reaches 80 or above. If such a basic strategy performed fairly well, then we can definitely deem it a useful tool for investors.

The Results

This strategy significantly outperformed a simple buy-and-hold approach. The above Fear and Greed Strategy produced a 1,145% return on investment, whereas a Buy & Hold Strategy achieved a 1,046% ROI over the same period. The difference, though not monumental, demonstrates that carefully scaling into and out of Bitcoin based on market sentiment can yield better returns than simply holding the asset.

The Fear and Greed Index is rooted in human psychology. Markets tend to overreact in both directions. By acting counter to these extremes, the strategy effectively leverages irrational and emotional market behavior. By scaling in during fear and out during greed, the strategy mitigated risks and compounded profits to outperform one of the world’s best-performing assets.

Keep in mind that this strategy was only profitable with proper trade management by slowly scaling in and out over macrocycles and doesn’t take into consideration any fees or taxes that may be liable. Conditions can remain irrationally fearful or greedy for months at a time, and trying to massively increase exposure or take profits purely based on this metric is unlikely to be successful in the long term.

Conclusion

Despite its simplicity, the Fear and Greed Index has proven its merit when used thoughtfully. It aligns with the principle of “buy when others are fearful, sell when others are greedy,” which has guided many successful investors.

The Fear and Greed Index should be used alongside other tools such as on-chain data and macroeconomic indicators for confluence, however the data proves this is definitely a metric worth considering within your own analysis.

For a more in-depth look into this topic, check out a recent YouTube video here: Does The Bitcoin Fear & Greed Index ACTUALLY Work?

Explore live data, charts, indicators, and in-depth research to stay ahead of Bitcoin’s price action at Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.