Institutional ownership of Bitcoin has surged over the past year, with around 8% of the total supply already in the hands of major entities, and that number is still climbing. ETFs, publicly listed companies, and even nation-states have begun securing substantial positions. This raises important questions for investors. Is this growing institutional presence a good thing for Bitcoin? And as more BTC becomes locked up in cold wallets, treasury holdings, and ETFs, is our on-chain data losing its reliability? In this analysis, we dig into the numbers, trace the capital flows, and explore whether Bitcoin’s decentralized ethos is truly at risk or simply evolving.

The New Whales

Let’s start with the Treasury of Public Listed Companies table. Major companies, including Strategy, MetaPlanet, and others, have collectively accumulated more than 700,000 BTC. Considering that Bitcoin’s total hard-capped supply is 21 million, this represents roughly 3.33% of all BTC that will ever exist. While that supply ceiling won’t be reached in our lifetimes, the implications are clear: the institutions are making long-term bets.

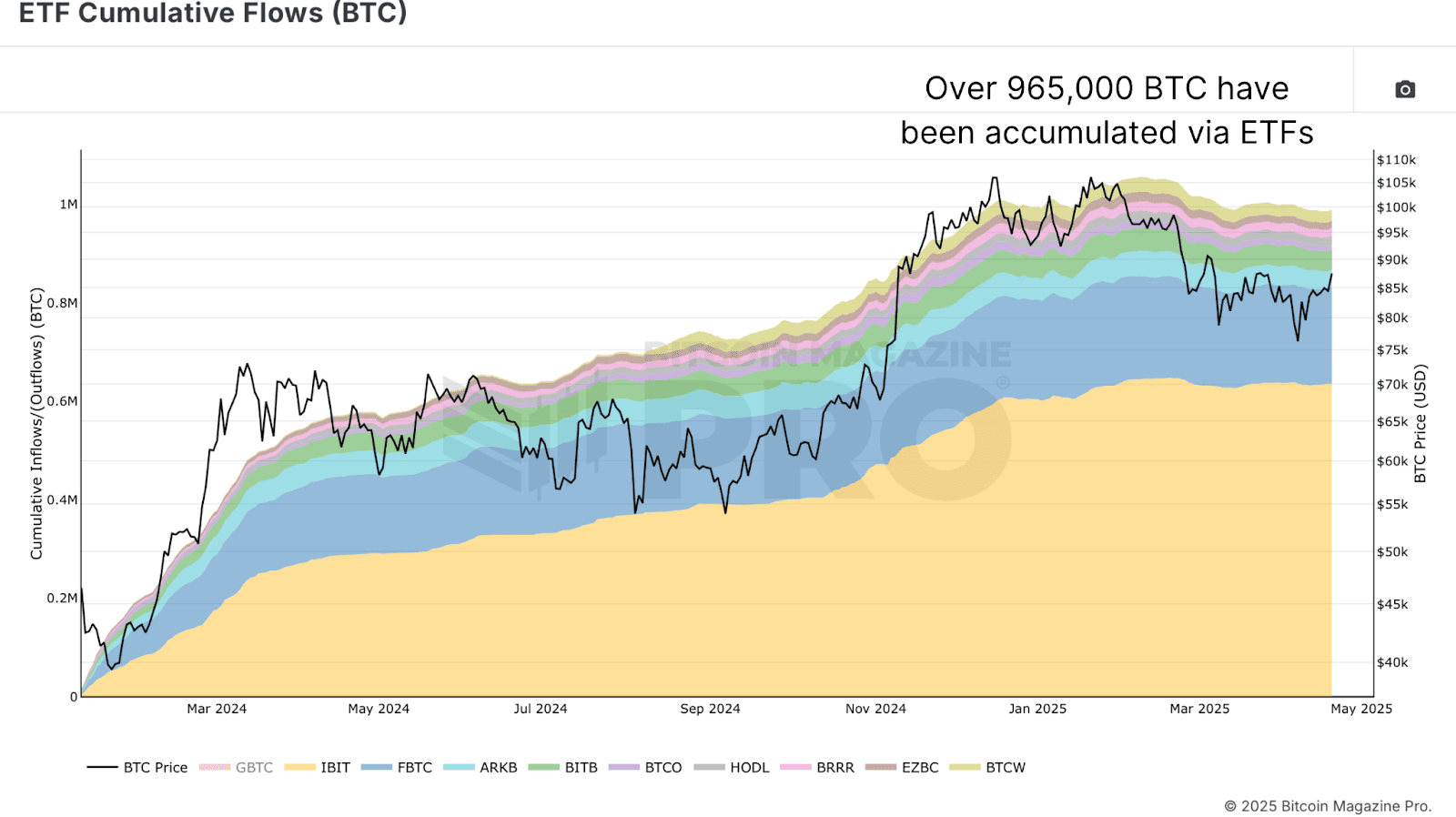

In addition to direct corporate holdings, we can see from the EFT Cumulative Flows (BTC) chart that ETFs now control a significant slice of the market as well. At the time of writing, spot Bitcoin ETFs hold approximately 965,000 BTC, just under 5% of the total supply. That figure fluctuates slightly but remains a major force in daily market dynamics. When we combine corporate treasuries and ETF holdings, the number climbs to over 1.67 million BTC, or roughly 8% of the total theoretical supply. But the story doesn’t stop there.

Beyond Wall Street and Silicon Valley, some governments are now active players in the Bitcoin space. Through sovereign purchases and reserves under initiatives like the Strategic Bitcoin Reserve, nation-states collectively hold approximately 542,000 BTC. Add that to the previous institutional holdings, and we arrive at over 2.2 million BTC in the hands of institutions, ETFs, and governments. On the surface, that’s about 10.14% of the total 21 million BTC supply.

Forgotten Satoshis and Lost Supply

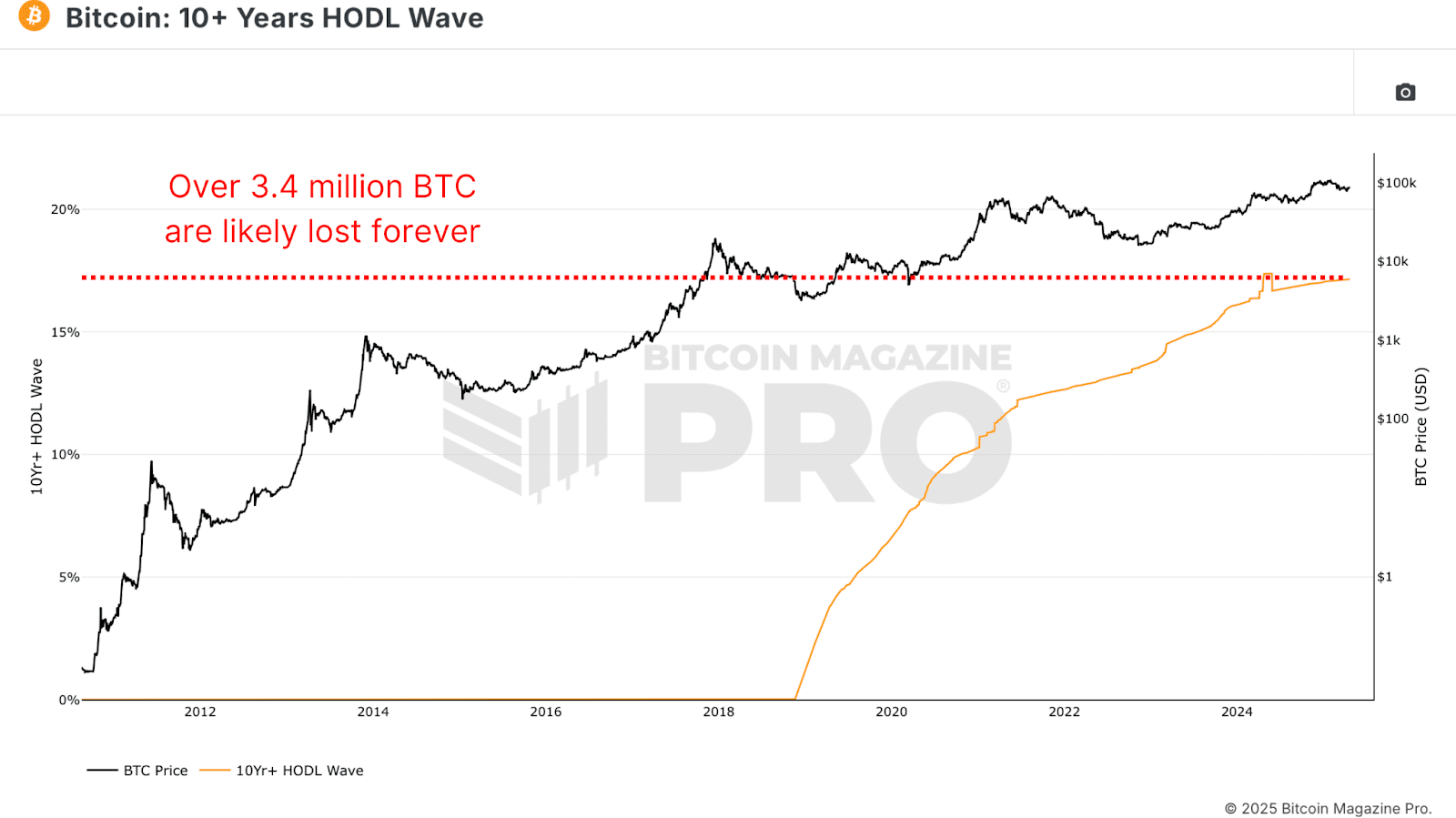

Not all 21 million BTC are actually accessible. Estimates based on 10+ Years HODL Wave data, a measurement of coins that haven’t moved in a decade, suggest that over 3.4 million BTC are likely lost forever. This includes Satoshi’s wallets, early mining-era coins, forgotten phrases, and yes, even USBs in landfills.

With approximately 19.8 million BTC currently in circulation and roughly 17.15% presumed to be lost, the effective supply is closer to 16.45 million BTC. That radically changes the equation. When measured against this more realistic supply, the percentage of BTC held by institutions rises to roughly 13.44%. This means that approximately one in every 7.4 BTC available to the market is already locked up by institutions, ETFs, or sovereigns.

Are Institutions Controlling Bitcoin?

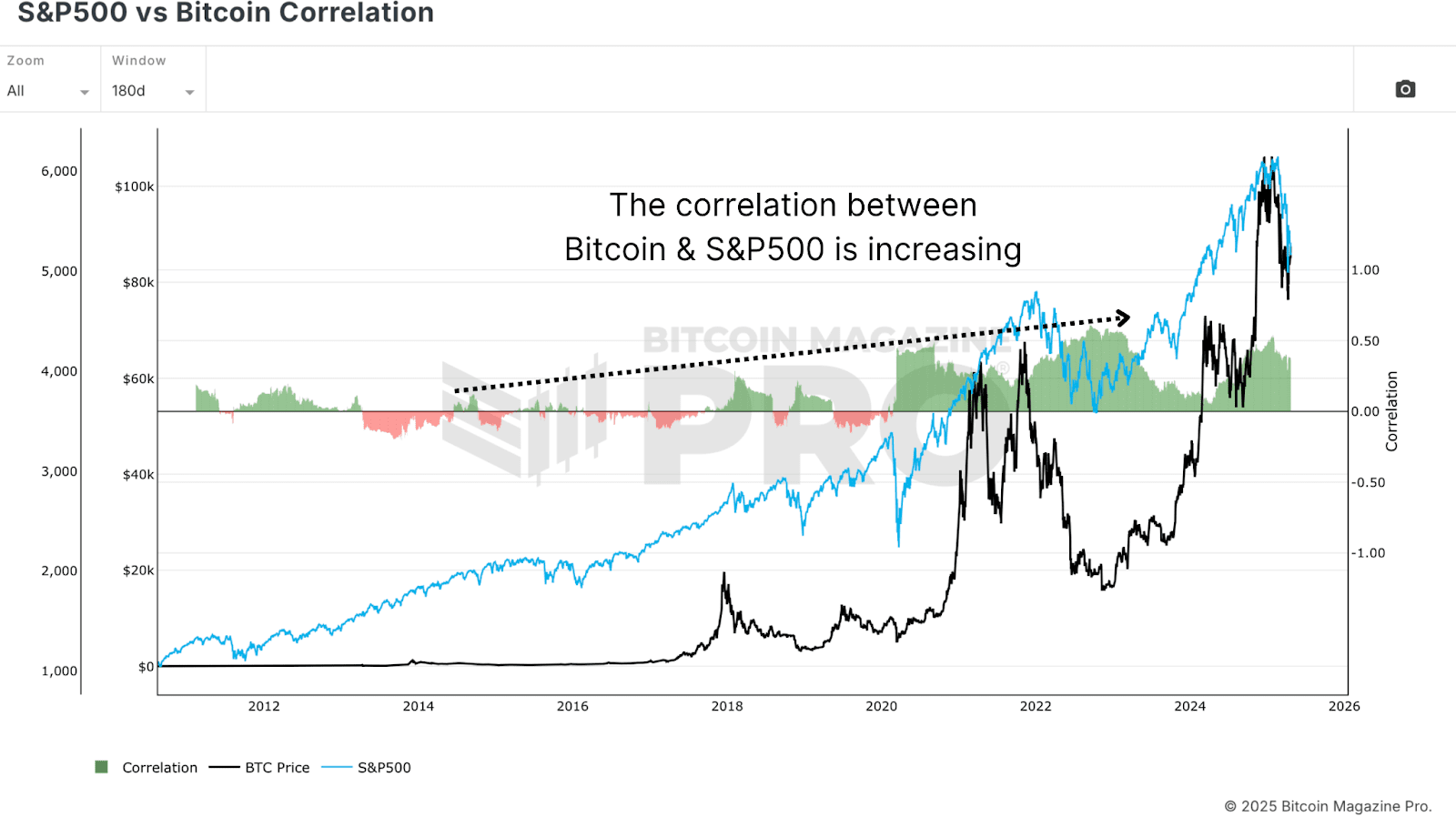

Does this mean Bitcoin is being controlled by corporations? Not yet. But it does signal a growing influence, especially in price behavior. From the S&P 500 vs Bitcoin Correlation chart, it is evident that the correlation between Bitcoin and traditional equity indexes like the S&P 500 or Nasdaq has tightened significantly. As these large entities enter the market, BTC is increasingly viewed as a “risk-on” asset, meaning its price tends to rise and fall with broader investor sentiment in traditional markets.

This can be beneficial in bull markets. When global liquidity expands and risk assets perform well, Bitcoin now stands to attract larger inflows than ever before, especially as pensions, hedge funds, and sovereign wealth funds begin allocating even a small percentage of their portfolios. But there’s a trade-off. As institutional adoption deepens, Bitcoin becomes more sensitive to macroeconomic conditions. Central bank policy, bond yields, and equity volatility all start to matter more than they once did.

Despite these shifts, more than 85% of Bitcoin remains outside institutional hands. Retail investors still hold the overwhelming majority of the supply. And while ETFs and company treasuries may hoard large amounts in cold storage, the market remains broadly decentralized. Critics argue that on-chain data is becoming less useful. After all, if so much BTC is locked up in ETFs or dormant wallets, can we still draw accurate conclusions from wallet activity? This concern is valid, but not new.

Need to Adapt

Historically, much of Bitcoin’s trading activity has occurred off-chain, particularly on centralized exchanges like Coinbase, Binance, and (once upon a time) FTX. These trades rarely appeared on-chain in meaningful ways but still influenced price and market structure. Today, we face a similar situation, only with better tools. ETF flows, corporate filings, and even nation-state purchases are subject to disclosure regulations. Unlike opaque exchanges, these institutional players often must disclose their holdings, providing analysts with a wealth of data to track.

Moreover, on-chain analytics isn’t static. Tools like the MVRV-Z score are evolving. By narrowing the focus, say, to an MVRV Z-Score 2YR Rolling average instead of full historical data, we can better capture current market dynamics without the distortion of long-lost coins or inactive supply.

Conclusion

To wrap it up, institutional interest in Bitcoin has never been higher. Between ETFs, corporate treasuries, and sovereign entities, over 2.2 million BTC are already spoken for, and that number is growing. This flood of capital has undoubtedly had a stabilizing effect on price during periods of market weakness. However, with that stability comes entanglement. Bitcoin is becoming more tied to traditional financial systems, increasing its correlation to equities and broader economic sentiment.

Yet this does not spell doom for Bitcoin’s decentralization or the relevance of on-chain analytics. In fact, as more BTC is held by identifiable institutions, the ability to track flows becomes even more precise. The retail footprint remains dominant, and our tools are becoming smarter and more responsive to market evolution. Bitcoin’s ethos of decentralization isn’t at risk; it’s just maturing. And as long as our analytical frameworks evolve alongside the asset, we’ll be well-equipped to navigate whatever comes next.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.