Bitcoin is surging in 2025, igniting speculation about a historic Bitcoin supercycle. After a volatile start to the year, renewed momentum, recovering sentiment, and bullish metrics have analysts asking: Are we on the cusp of a 2017 Bitcoin bull run repeat? This Bitcoin price analysis explores cycle comparisons, investor behavior, and long-term holder trends to assess the likelihood of an explosive phase in this cryptocurrency market cycle.

How the 2025 Bitcoin Cycle Compares to Past Bull Runs

The latest Bitcoin price surge has reset expectations. According to the BTC Growth Since Cycle Low chart, Bitcoin’s trajectory aligns closely with the 2016–2017 and 2020–2021 cycles, despite macro challenges and drawdowns.

Historically, Bitcoin market cycles peak around 1,100 days from their lows. At approximately 900 days into the current cycle, there may be several hundred days left for potential explosive Bitcoin price growth. But do investor behaviors and market mechanics support a Bitcoin supercycle 2025?

Bitcoin Investor Behavior: Echoes of the 2017 Bull Run

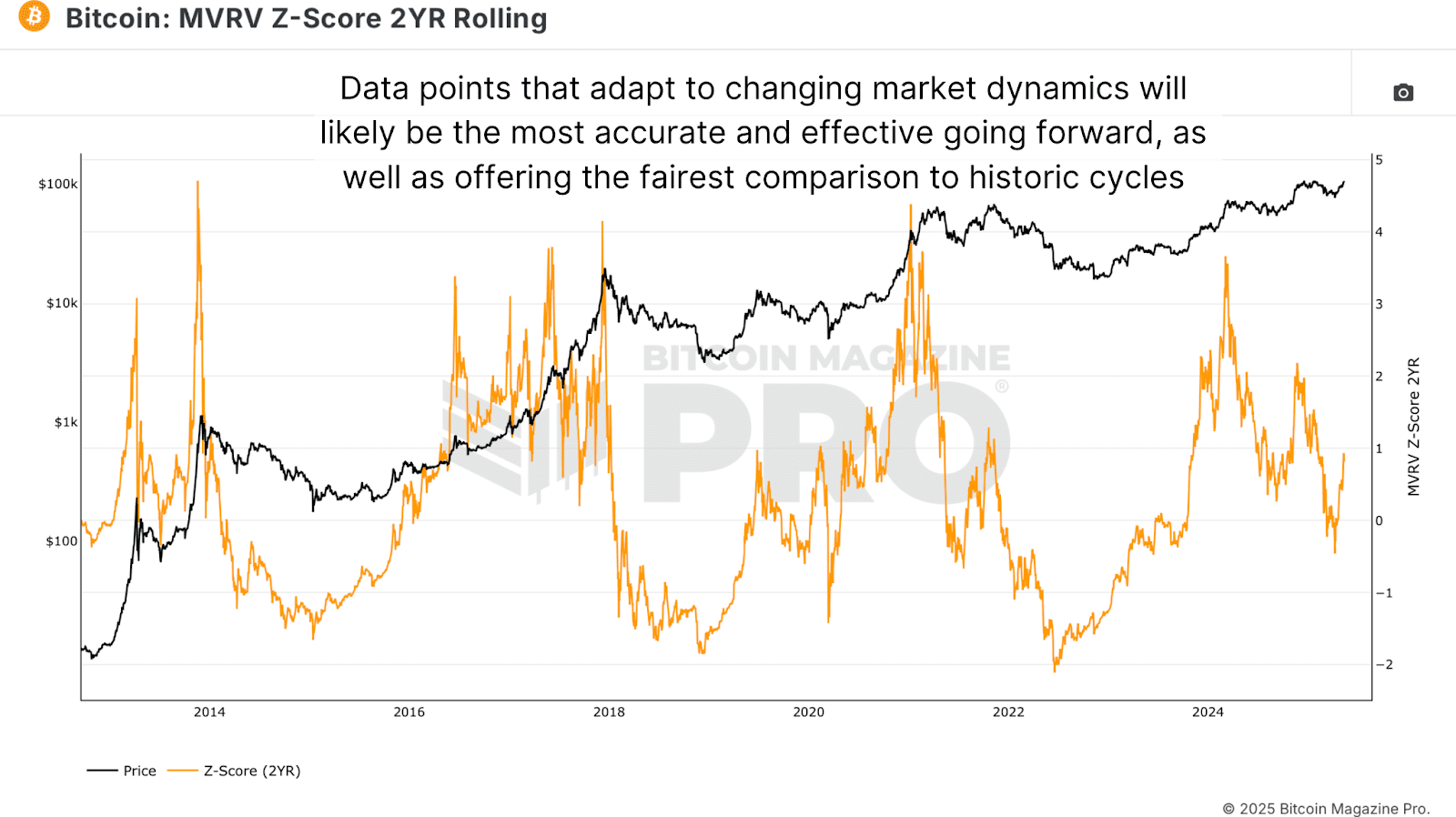

To gauge cryptocurrency investor psychology, the 2-Year Rolling MVRV-Z Score provides critical insights. This advanced metric accounts for lost coins, illiquid supply, growing ETF and institutional holdings, and shifting long-term Bitcoin holder behaviors.

Last year, when Bitcoin price hit ~$73,000, the MVRV-Z Score reached 3.39—a high but not unprecedented level. Retracements followed, mirroring mid-cycle consolidations seen in 2017. Notably, the 2017 cycle featured multiple high-score peaks before its final parabolic Bitcoin rally.

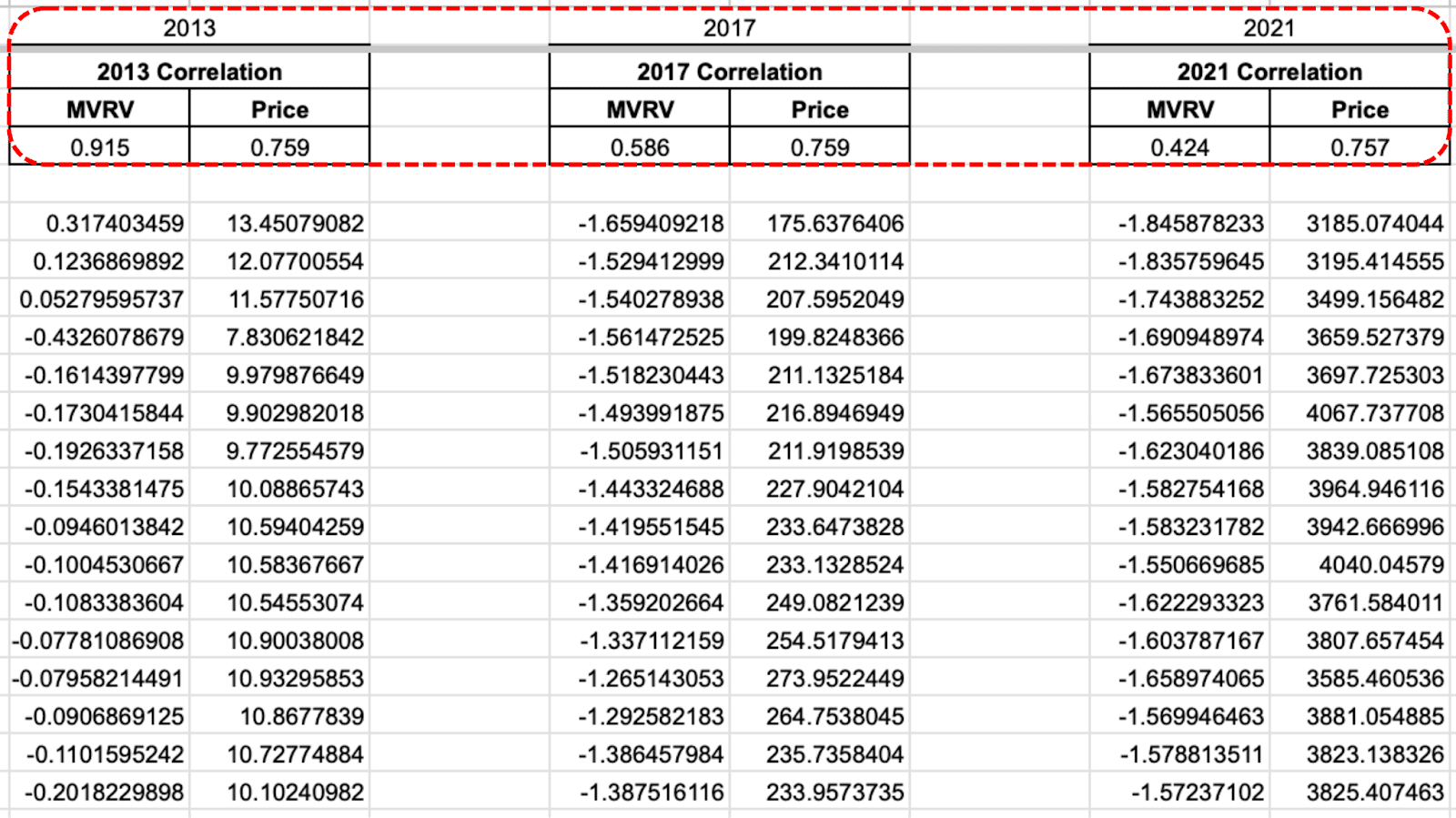

Using the Bitcoin Magazine Pro API, a cross-cycle Bitcoin analysis reveals a striking 91.5% behavioral correlation with the 2013 double-peak cycle. With two major tops already—one pre-halving ($74k) and one post-halving ($100k+)—a third all-time high could mark Bitcoin’s first-ever triple-peak bull cycle, a potential hallmark of a Bitcoin supercycle.

The 2017 cycle shows a 58.6% behavioral correlation, while 2021’s investor behavior is less similar, though its Bitcoin price action correlates at ~75%.

Long-Term Bitcoin Holders Signal Strong Confidence

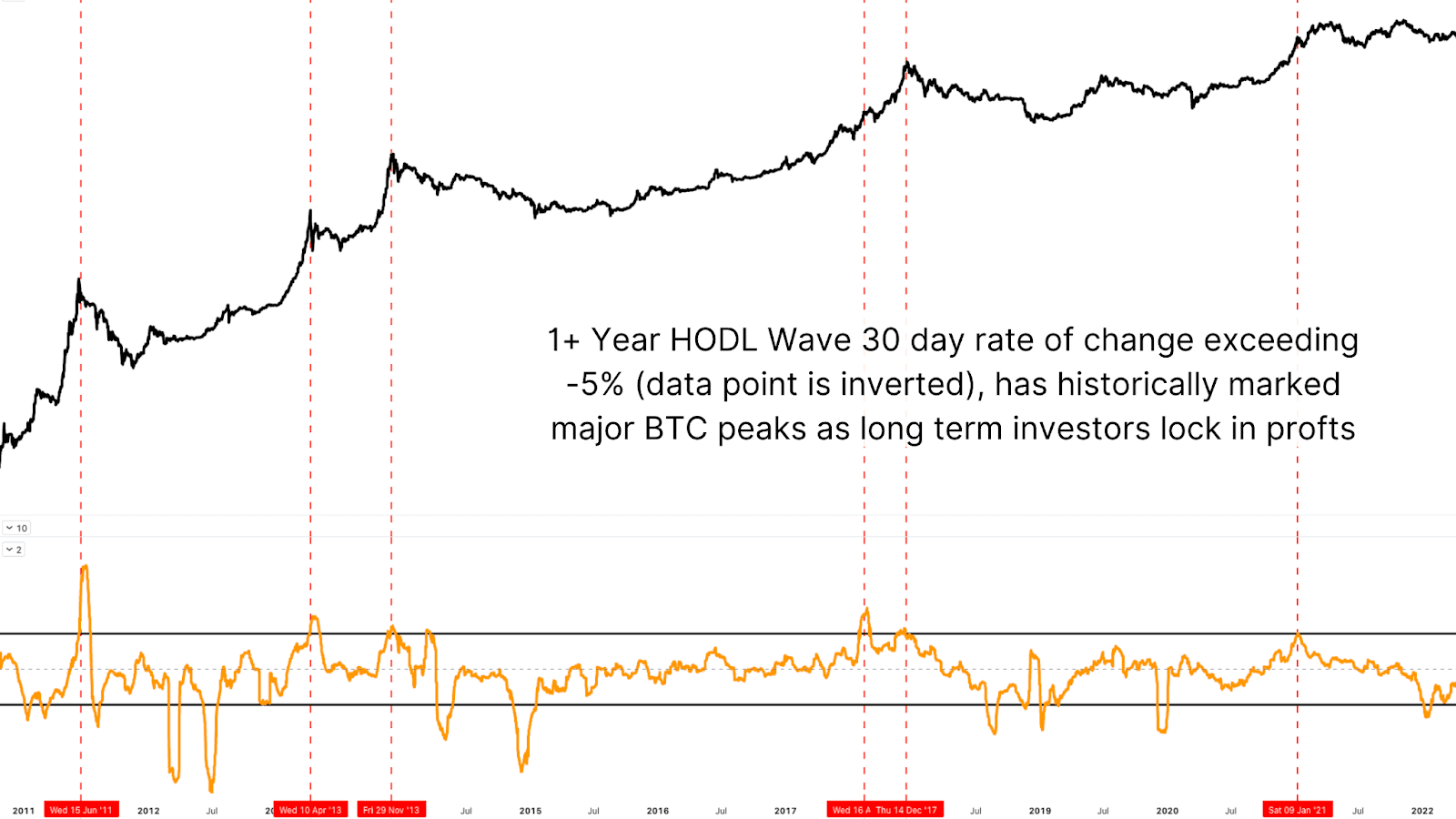

The 1+ Year HODL Wave shows the percentage of BTC unmoved for a year or more continues to rise, even as prices climb—a rare trend in bull markets that reflects strong long-term holder conviction.

Historically, sharp rises in the HODL wave’s rate of change signal major bottoms, while sharp declines mark tops. Currently, the metric is at a neutral inflection point, far from peak distribution, indicating long-term Bitcoin investors expect significantly higher prices.

Bitcoin Supercycle or More Consolidation?

Could Bitcoin replicate 2017’s euphoric parabolic rally? It’s possible, but this cycle may carve a unique path, blending historical patterns with modern cryptocurrency market dynamics.

We may be approaching a third major peak within this cycle—a first in Bitcoin’s history. Whether this triggers a full Bitcoin supercycle melt-up remains uncertain, but key metrics suggest BTC is far from topping. Supply is tight, long-term holders remain steadfast, and demand is rising, driven by stablecoin growth, institutional Bitcoin investment, and ETF flows.

Conclusion: Is a $150k Bitcoin Rally in Sight?

Drawing direct parallels to 2017 or 2013 is tempting, but Bitcoin is no longer a fringe asset. As a maturing, institutionalized market, its behavior evolves, yet the potential for explosive Bitcoin growth persists.

Historical Bitcoin cycle correlations remain high, investor behavior is healthy, and technical indicators signal room to run. With no major signs of capitulation, profit-taking, or macro exhaustion, the stage is set for sustained Bitcoin price expansion. Whether this delivers a $150k rally or beyond, the 2025 Bitcoin bull run could be one for the history books.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.