- XRP’s price action shows signs of a potential breakout, supported by rising transaction count and wallet growth.

- Exchange reserves and open interest reflect mixed sentiment, but bullish indicators hint at possible upward momentum.

Ripple XRP’s on-chain activity has reached a six-month high, with active addresses hitting 12,230 and new wallet creations surging by 10.39%, adding a notable 18,321 accounts.

This increase highlights renewed investor interest and could be a sign of strong bullish momentum. However, is this a fleeting trend, or are we on the cusp of a sustained uptrend?

Analyzing XRP’s price action for signs of a breakout

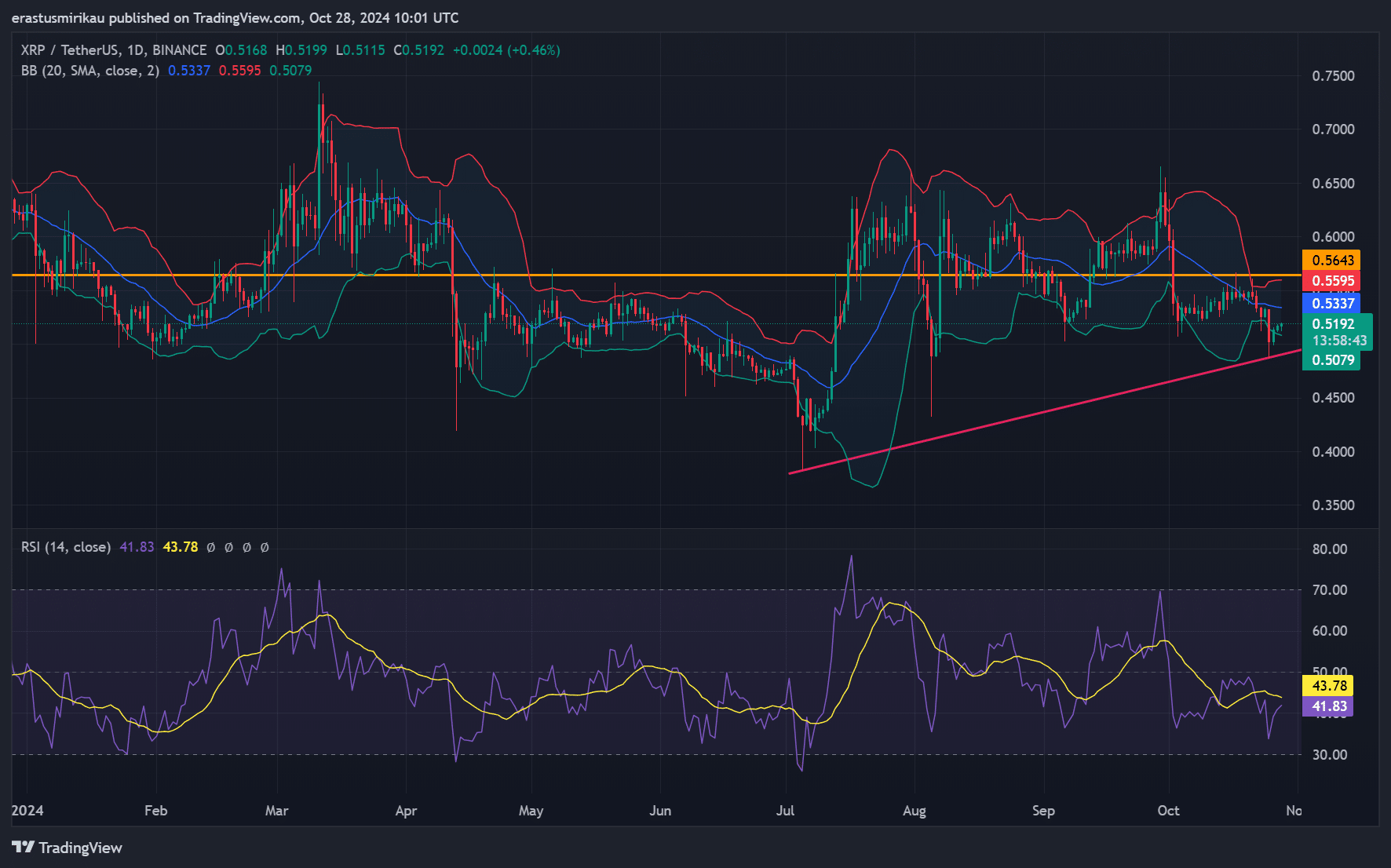

At press time, XRP was trading at $0.5192, up by 0.46% in 24 hours. Over the past months, XRP’s price action has hovered in a broad consolidation zone, but recent trends hint at a potential breakout.

Observing the Bollinger Bands, XRP is trading close to the middle band, indicating that volatility remains low, though a bullish move may be building.

The Relative Strength Index (RSI) sits at 41.83, approaching oversold territory. Therefore, any sustained increase in the RSI could drive positive momentum if XRP continues to hold above its ascending trendline.

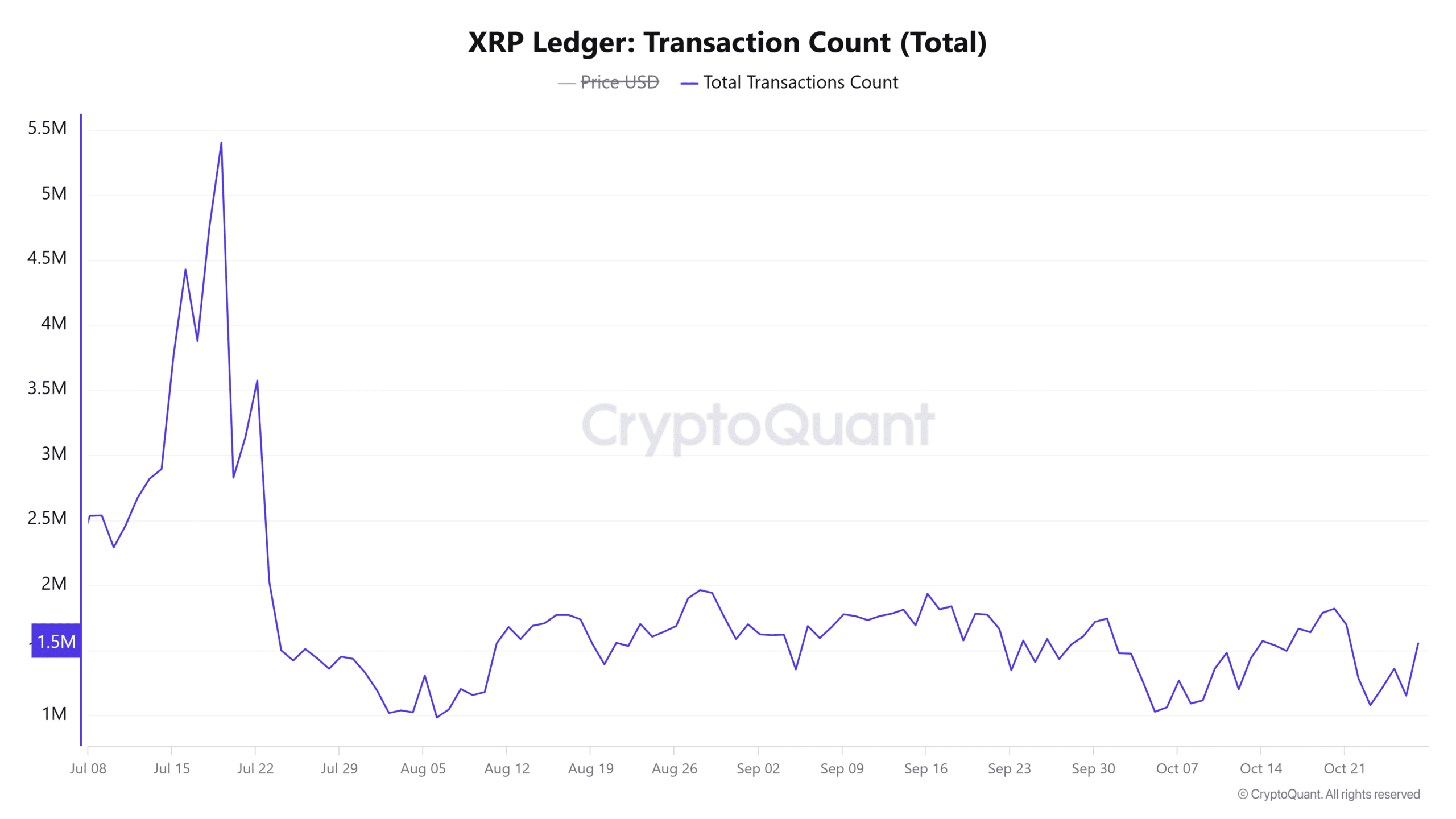

Transaction count highlights increased network engagement

XRP’s transaction count has climbed to 1.5655 million, showing a 1.24% rise over the past 24 hours. This consistent transaction growth reveals heightened network engagement, which often correlates with increasing price momentum.

Consequently, this upward trend in transactions may signal an underlying demand for XRP. If the transaction count continues to rise, it could support further price gains, reflecting a broader interest in XRP’s utility and potential price appreciation.

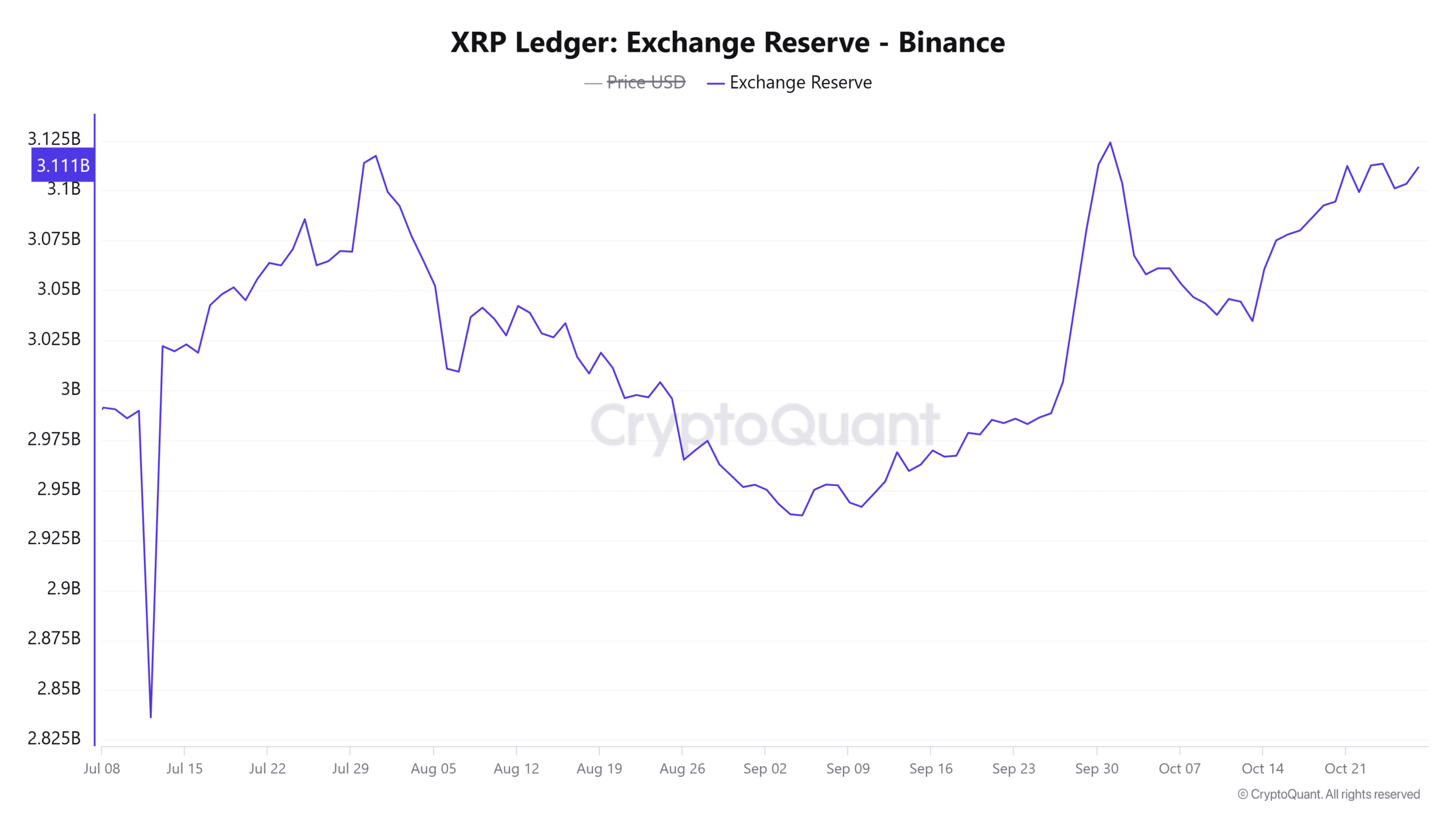

XRP exchange reserves indicate caution in buying pressure

Currently, the exchange reserves stand at 3.11 billion, marking a slight 0.36% increase in the last day. An increase in exchange reserves often signals that more coins are held on exchanges, suggesting potential selling pressure.

This uptick could pose a challenge to XRP’s upward momentum.

However, if exchange reserves start to decline, it would indicate less selling pressure, possibly paving the way for a more substantial rally. Therefore, a close watch on reserves is essential to gauge short-term sentiment accurately.

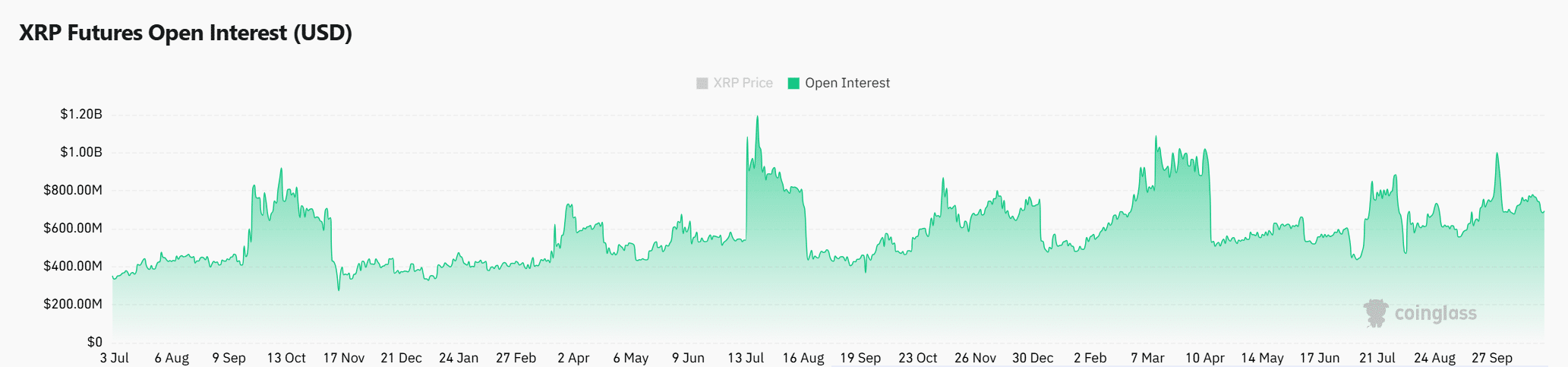

Rising open interest signals growing speculation

Open interest in futures has increased by 1.61%, reaching $701.52 million, reflecting higher levels of market participation. This rise in open interest suggests that traders are betting on significant price action, with interest building in altcoin’s future performance.

Should this trend persist, it could bolster a bullish scenario, especially if it aligns with declining exchange reserves and a strengthening RSI.

Realistic or not, here’s XRP’s market cap in BTC’s terms

Is XRP primed for an uptrend?

The increased transaction count and open interest underscore growing optimism and strong market engagement. However, elevated exchange reserves indicate a potential selling pressure that could slow a rally.

For XRP to capitalize on this momentum and confirm a bullish trend, a decline in exchange reserves is crucial, alongside sustained buying support. With these factors aligning, XRP could indeed be set for a breakout.