“Nothing stops this train,” Lyn Alden initially stated at Bitcoin 2025, walking the audience through a data-rich presentation that made one thing clear: the U.S. fiscal system is out of control—and Bitcoin is more necessary than ever.

Her first chart, sourced from the Federal Reserve’s FRED database, displayed a stark decoupling: the unemployment rate is down, yet the fiscal deficit has surged past 7% of GDP. “This started around 2017, went into overdrive during the pandemic, and hasn’t corrected,” Alden said. “That’s not normal. We’re in a new era.”

She didn’t mince words. “Nothing stops this train because there are no brakes attached to it anymore. The brakes are heavily impaired.

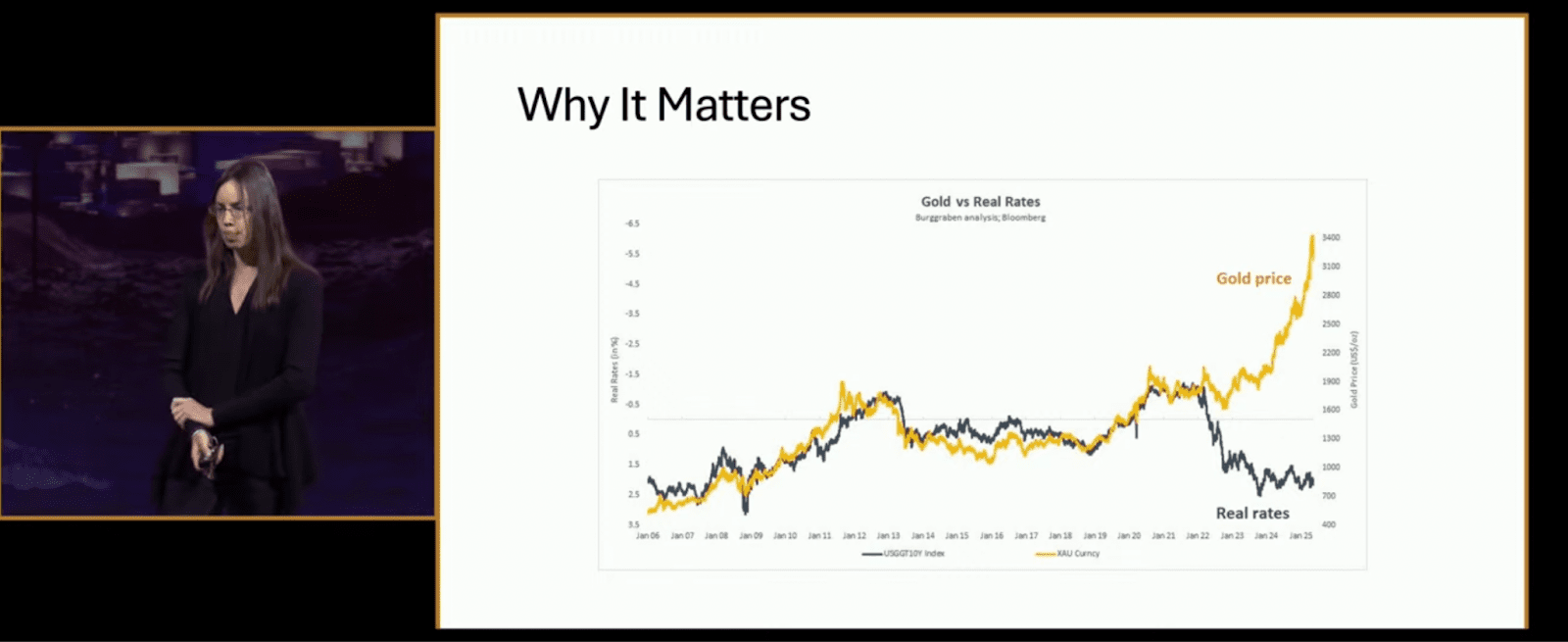

Why should Bitcoiners care? Because, as Alden explained, “it matters for asset prices—especially anything scarce.” She displayed a gold vs. real rates chart that showed gold soaring as real interest rates plunged. “Five years ago, most would have said Bitcoin couldn’t thrive in a high-rate environment. Yet here we are—Bitcoin over $100K, gold at new highs, and banks breaking under pressure.”

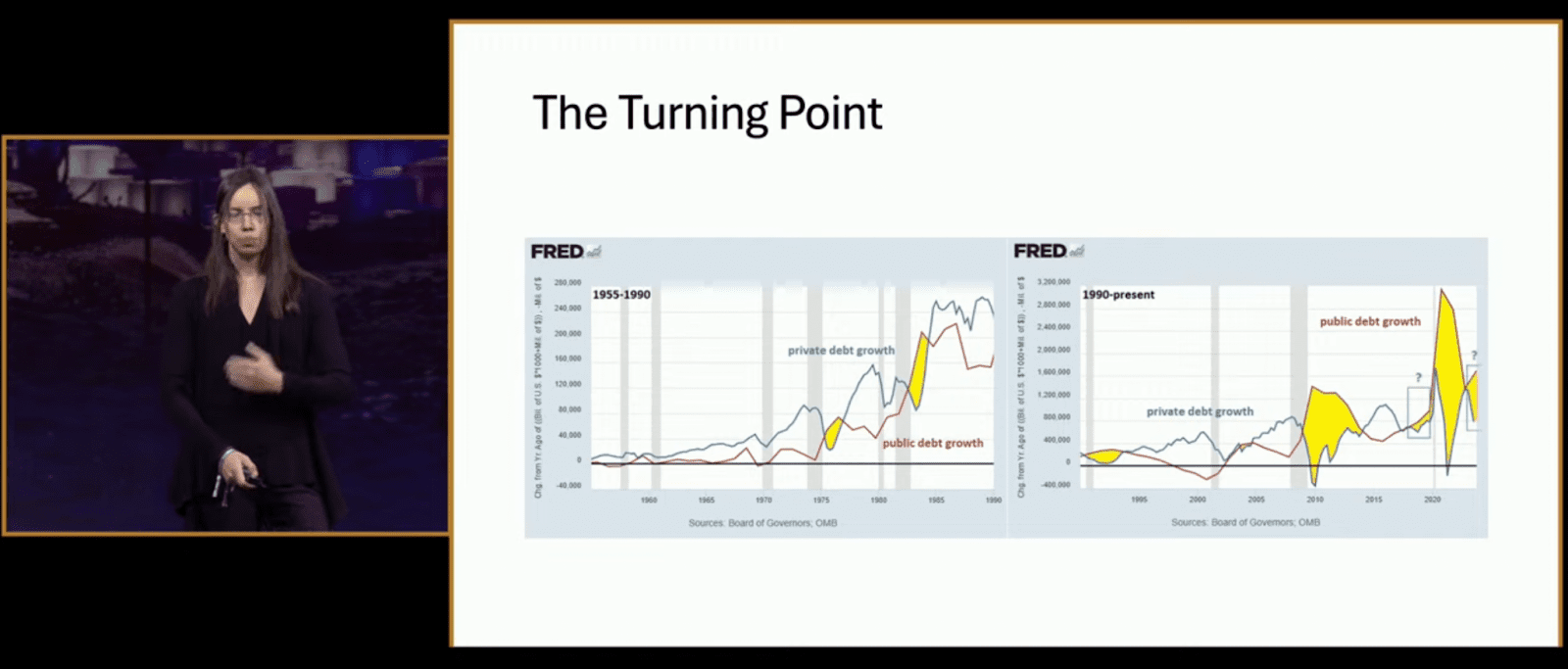

Next came what she called “The Turning Point”—a side-by-side showing how public debt growth overtook private sector debt post-2008, flipping a decades-long norm. “This is inflationary, persistent, and it means the Fed can’t slow things down anymore.”

Another chart revealed why rising interest rates are now accelerating the deficit. “They’ve lost their brakes. Raising rates just makes the federal interest bill explode faster than it slows bank lending.”

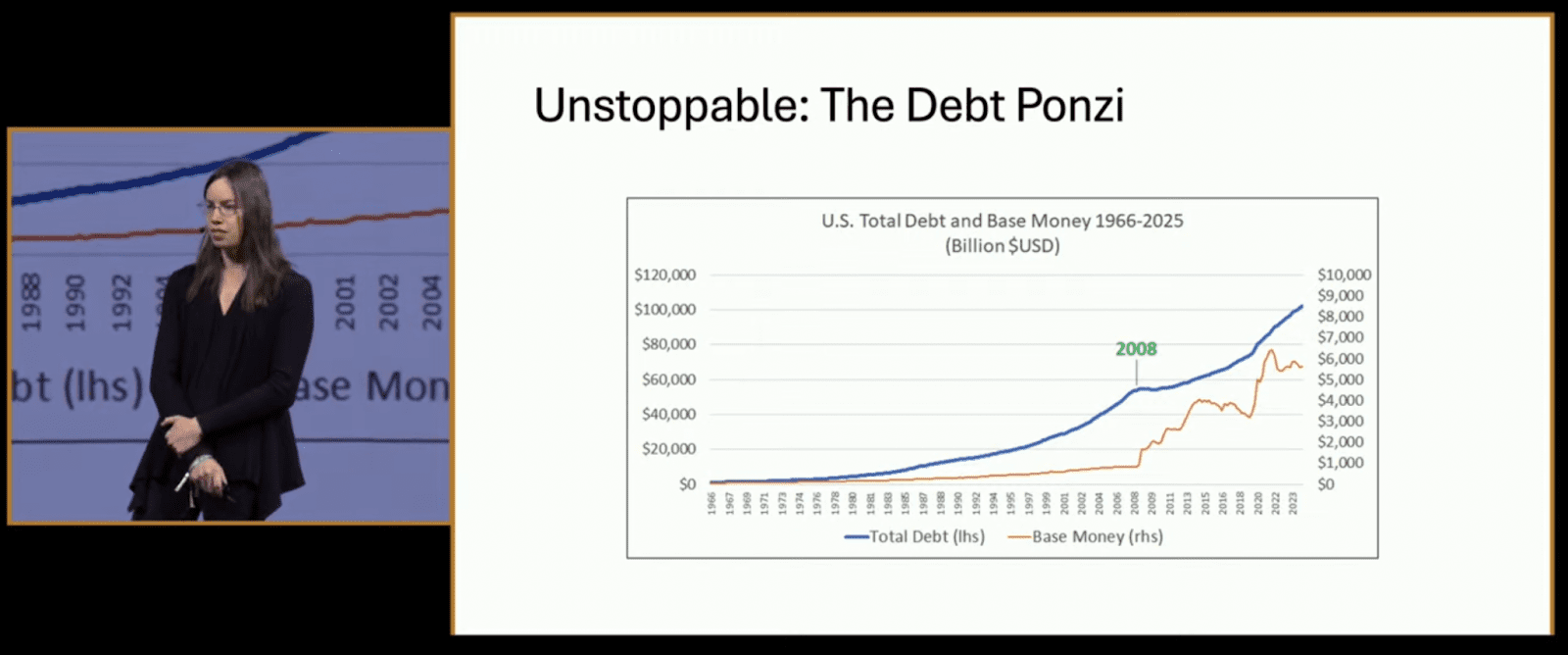

Alden called it a ponzi: “The system is built on constant growth. Like a shark, it dies if it stops swimming.”

Her slide showed a relentless rise in total debt versus base money—except for a jolt in 2008, and again after 2020. “This isn’t going backward. Ever.”

So why Bitcoin? “Because it’s the opposite. Scarce, decentralized, and mathematically capped,” Alden concluded. “There are two reasons nothing stops this train: math and human nature. Bitcoin is the mirror of this system—and the best protection from it.”

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below: