(Bloomberg) — Humana Inc. investors haven’t struggled through anything this bad since the global financial crisis 15 years ago.

Most Read from Bloomberg

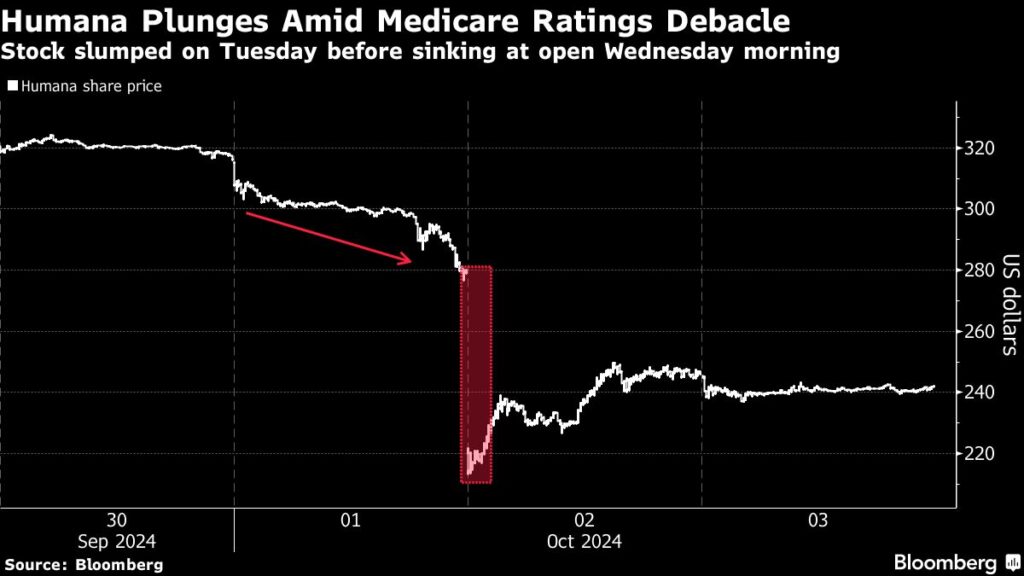

The health insurer’s stock price plunged 22% on Tuesday and Wednesday alone, something it last did in February 2009. And they kept falling, with shares suffering their worst week since 2020 and putting them at a level last seen in March of that year.

It all started on Tuesday, when speculation rippled through the stock market that Humana was going to lose high quality ratings on some of the major plans it manages for the US Medicare program. By early Wednesday morning, a week before the government is due to release its official Medicare ratings, the company confirmed the rumors were true. As a result, only about a quarter of its members will be in highly rated plans that generate extra revenue, down from 94% previously, Humana said.

The news sent its shares into a tailspin, falling as much as 24% within the first five minutes of Wednesday’s trading, its biggest intraday decline since Feb. 23, 2009. At the peak of the selloff on Wednesday morning, Humana had lost a third of its market value in just two sessions. It regained some of that decline by the end of the day.

All in all, it was a “worst case scenario” come to fruition, according to UBS analyst AJ Rice.

Quality ratings, also referred to as “star ratings,” range from one to five and help to drive billions of dollars in revenue for Medicare Advantage insurers. More stars allow plans to receive lucrative government bonus payments, while fewer stars can make it harder to attract new customers.

For Humana, a reduced rating would be catastrophic since its business is primarily focused on Medicare. The future hit to profits could reach as much as $23 per share in 2026, “which would almost eliminate 2026 earnings,” according to Bank of America analysts led by Joanna Gajuk. It also could push the firm’s margin recovery further out, according to Gajuk, who has a sell-equivalent rating on the stock.

Wall Street responded to Humana’s confirmation of Medicare’s decision by slashing price targets on the stock, and at least four analysts downgraded their ratings on the shares. Still, the Street consensus is for them to hit $342 in the next 12 months, a 42% jump from current levels. And of the 27 analysts covering Humana, 10 have buy ratings, 15 have holds and only two have sells.

The insurer has already seen surprise jumps in medical costs and tighter reimbursements from the government this year. Perhaps not surprisingly, investors are fleeing the troubled insurer, leading to a loss of nearly half of its market value, which has tumbled from around $56 billion at the start of 2024 to roughly $29 billion now.

Rippling Fear

Fears about falling star ratings, which are crucial for Medicare Advantage plans, are rippling across the health insurance industry. While the government hasn’t released its official star ratings, some are visible on Medicare’s plan finder tool that helps consumers shop for coverage.

That led to a jump in Clover Health Investments Corp. on Wednesday, as some of the health insurer’s Medicare Advantage plans for 2025 appear to have received higher quality ratings. And two large plans from CVS Health Corp. appeared to retain four-star ratings on the website, Evercore ISI analyst Elizabeth Anderson wrote in a note on Wednesday. Shares of the pharmacy chain gained afterward.

On the flip side, UnitedHealth Group Inc. sued the US government this week, claiming that its quality rating was unreasonably downgraded after one customer service phone call.

Regulators are expected to announce official results on or about Oct. 10.

Meanwhile, the cloud over Humana is spreading to other related companies. Shares of agilon health inc., which runs a platform for primary-care physicians treating Medicare patients, lost 20% on Tuesday, Wednesday and Thursday, its worst three-day streak in six months. The firm counts Humana among its key payer partners.

“We were surprised by the sharp decline in stars ratings,” BTIG analyst David Larsen, who holds a neutral rating on agilon, wrote in a research note Thursday. “We worry that if Humana saw such a large decline in ratings, and bonus payments, other payers may face even more pressure.”

–With assistance from John Tozzi and Brandon Harden.

(Updates details on stock and analyst data, and chart.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.