MicroStrategy‘s Bitcoin purchase strategy has expanded with another significant acquisition. The company has bought 3,459 Bitcoin worth $285.8 million, bringing Michael Saylor’s total holdings to 531,644 BTC. This latest microstrategy bitcoin purchase reinforces their position as the largest corporate holder of the cryptocurrency.

JUST IN: Michael Saylor’s MicroStrategy buys another 3,459 Bitcoin worth $285.8 million.

— Watcher.Guru (@WatcherGuru) April 14, 2025

Also Read: No Insider Trading at the White House? Hassett Breaks Silence

Saylor’s Bold Bitcoin Strategy Fuels Institutional Crypto Buying

Michael Saylor Bitcoin investment approach continues to influence institutional bitcoin buying across the market. MicroStrategy completed the purchase between April 7–13, 2025, at an average price of $82,618 per Bitcoin. The company funded this Bitcoin purchase through its at-the-market offering program.

Purchase Details and Financing

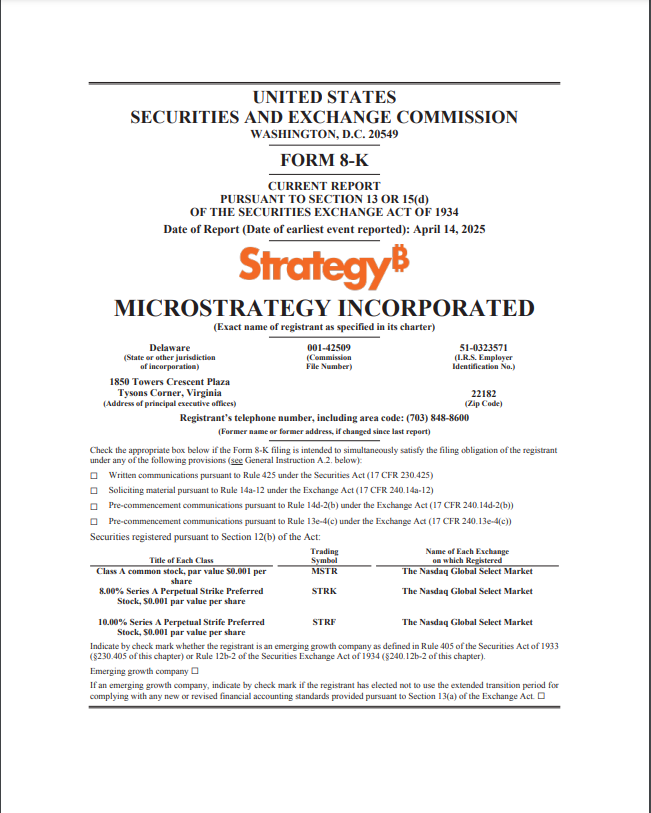

According to the SEC filing:

“The bitcoin purchases were made using proceeds from the Common ATM.”

MicroStrategy financed the corporate crypto investment by selling 959,712 MSTR shares, generating $285.7 million. The company has systematically implemented this bitcoin accumulation strategy through established financing channels and still has $2.08 billion available in its Common ATM program.

Also Read: Analyst Predicts SHIB to Surge 400%—Is This the Meme Coin’s Comeback?

Growing Bitcoin Treasury

With this Microstrategy Bitcoin purchase, the company’s holdings are now valued at approximately $35.92 billion at an average purchase price of $67,556 per Bitcoin. Their corporate crypto investment approach represents one of the most aggressive institutional positions on Bitcoin to date.

W. Ming Shao, Executive Vice President & General Counsel of MicroStrategy, stated:

“Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.”

Market Impact

This continued bitcoin accumulation strategy has been closely watched by market participants. Michael Saylor Bitcoin conviction remains unwavering despite market volatility, with the company dollar-cost averaging across different market conditions.

Also Read: UK Tests Offline CBDC Payments—What This Means for Bitcoin and Privacy Coins

The institutional bitcoin buying trend sparked by MicroStrategy continues to gain momentum as corporate crypto investment becomes more mainstream. This latest microstrategy bitcoin purchase demonstrates Saylor’s ongoing commitment to Bitcoin as a treasury reserve asset.