We’re rolling into what is expected to be another wild tech earnings season, and you can bet AI is going to be front and center. And if there’s one company that everyone is watching, it’s Nvidia (NVDA).

Shares of the chip giant are up more than 16% in the last month, and the stock is currently on pace to unseat Apple as the largest publicly traded company by market capitalization.

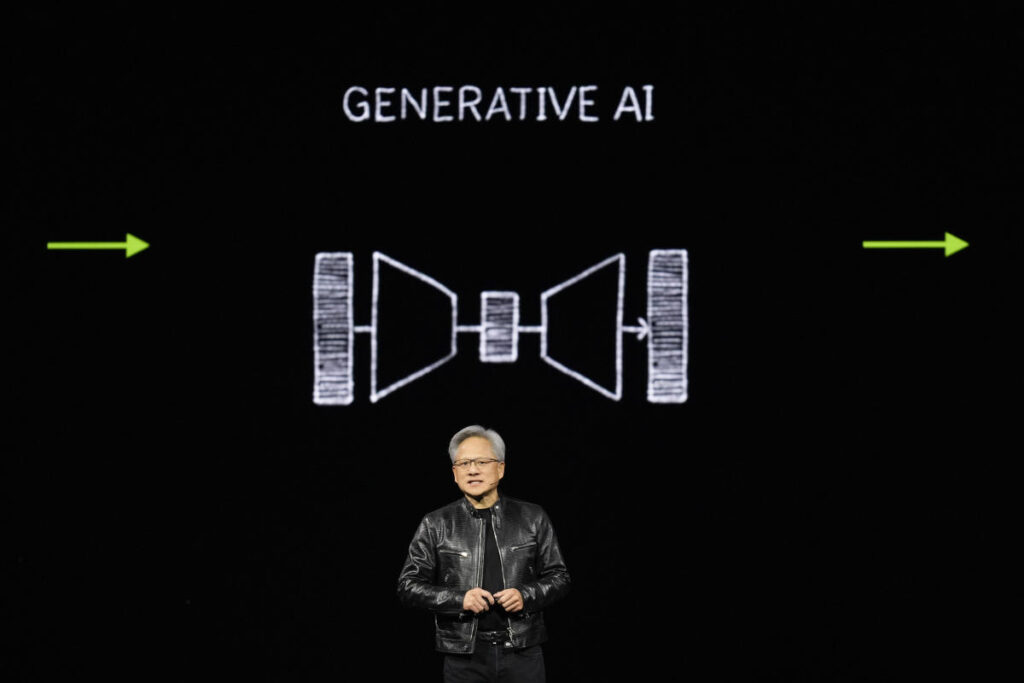

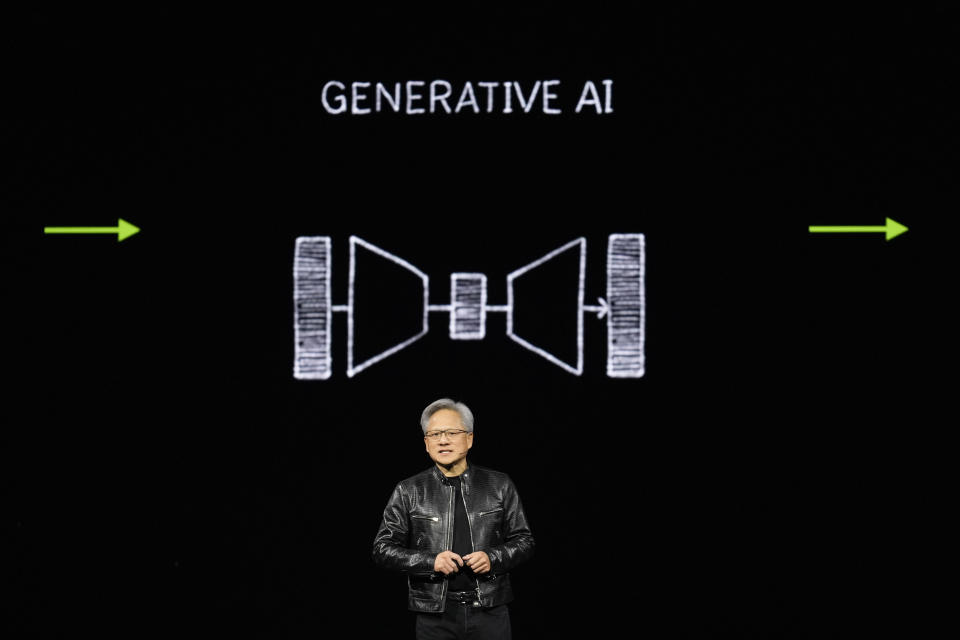

The jump comes after Nvidia CEO Jensen Huang said demand for the company’s upcoming Blackwell chip is “insane” during an interview with CNBC on Oct. 3. Since then, shares of Nvidia have climbed roughly 18%, topping out at $130. But reports that the Biden administration will establish a cap on the number of AI chips that can be shipped to certain countries put the rally on hold Tuesday before recovering some ground Wednesday.

Nvidia’s incredible stock performance and meteoric rise in data center sales over the last year have put the company in a difficult position for its upcoming earnings announcement, which it has yet to officially schedule.

In the company’s fiscal Q3 2024, overall revenue soared 206% to $18.1 billion, while data center revenue rose a whopping 279% to $14.5 billion. And while Nvidia isn’t staring down a decline in revenue, its growth will likely slow versus the same period last year, which could spook investors.

Don’t believe me? Just take a look at what happened after the company announced its Q2 earnings back in August. While the company beat on revenue and earnings per share, with data center revenue increasing 154% year over year to $26.3 billion, Nvidia shares still fell more than 6% immediately following the announcement. It took more than a month for the company’s stock price to recover.

The AI trade hasn’t raised all ships, either. Shares of Broadcom (AVGO) jumped 59% year to date, outpacing the broader S&P 500 (GSPC), which rose 21%. Qualcomm (QCOM) climbed 19% and AMD (AMD) added just 6% to its stock price. Intel (INTC), meanwhile, fell a stunning 55%.

Broadcom benefits from its involvement in AI infrastructure, connecting servers and the like, while Qualcomm is seen as a potential beneficiary of on-device AI growth via AI smartphones and AI PCs. AMD is facing off against Nvidia and serves as an alternative on both price and availability.

Then there’s Intel, which is struggling amid its enormous turnaround effort that includes building out its third-party chip fabrication capabilities as well as trying to catch Nvidia and AMD in the AI processor space.

But Nvidia is still the hands-down star of the show this earnings season. Investors will be looking for signs of continued AI spending from hyperscalers like Microsoft (MSFT), Google (GOOG, GOOGL), Meta (META), and Amazon (AMZN), which make up a huge portion of AI sales, to get a sense of how well Nvidia chips are selling.

They’ll also look at how other chip companies perform this quarter ahead of Nvidia’s announcement, which tends to be far later in the earnings cycle than its contemporaries.

Wall Street will similarly be on the lookout for information about Nvidia’s Blackwell rollout and whether the company is facing any supply constraints as it did with its Hopper chips. Either way, it’s going to be a wild few weeks. Buckle up.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance.