(Bloomberg) — Nvidia Corp., the chipmaker at the heart of the artificial intelligence boom, is joining the oldest of Wall Street’s three main equity benchmarks.

Most Read from Bloomberg

The company will replace rival Intel Corp. in the 128-year-old Dow Jones Industrial Average prior to the start of trading on Nov. 8, S&P Dow Jones Indices said in a statement late Friday. Sherwin-Williams Co. is also joining, replacing Dow Inc.

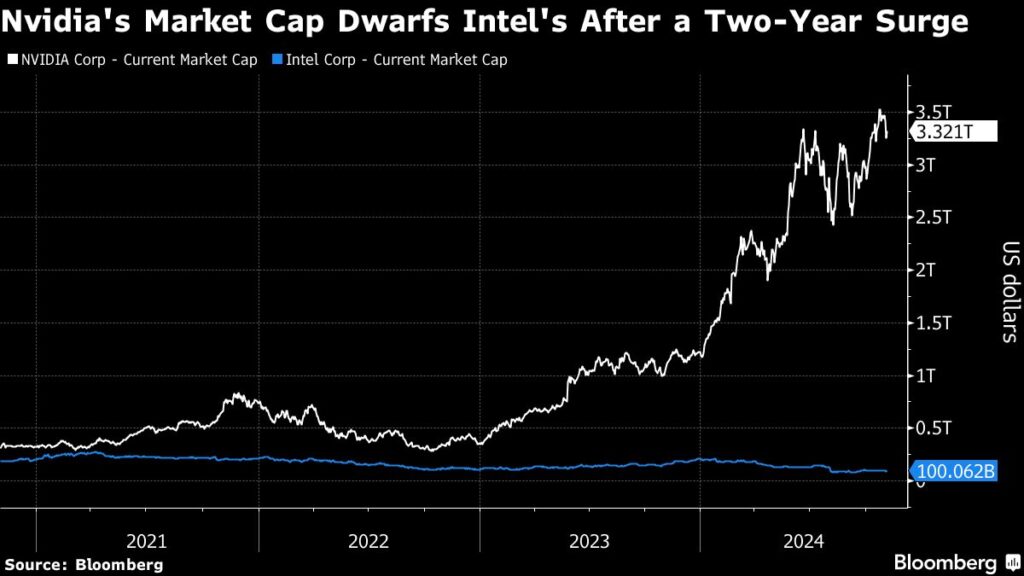

The addition of Nvidia to the blue-chip index is a testament to the power of the AI-driven rally that’s pushed the chipmaker up 900% in the past 24 months. The Dow Jones Industrial Average was the only major US equity benchmark that didn’t hold Nvidia — until now.

“Nvidia is a well-run company and joining the Dow demonstrates just how powerful its rally has been in recent years after it was at the right place at the right time when no one else was,” said Scott Colyer, chief executive at Advisors Asset Management.

The Santa Clara, California-based company has been the poster child of the euphoria surrounding AI and the biggest driver of stock market gains. The chipmaker ended the week with a market value of $3.32 trillion, about $50 billion shy of Apple Inc. Shares were up 3.2% in post-market trading, putting Nvidia in a position to dethrone Apple as the world’s most valuable company as soon as Monday if the gains hold.

Intel joined the gauge in November 1999 when it was added along with Microsoft Corp., SBC Communications and Home Depot Inc. Once the industry leader in computer processors, Intel has been recently struggling under a turnaround plan. The company has slashed spending in 2024, cut jobs and suspended investor payouts. Shares have lost 54% this year, and sank another 2% after the bell.

“Intel has lagged in a huge way,” said Adam Sarhan, founder of 50 Park Investments. “Now, the Dow is evolving. You don’t want to see stocks that were there 30 years ago. You want to see what’s the strongest that survive today.”

Midland, Michigan-based Dow Inc. has been in the blue-chip index since 2019, when it was spun off by former parent DowDuPont.

The Dow Jones Industrial Average, which first started as an index of 12 industrial stocks that included General Electric Co., has faced criticism for being a much narrower equities gauge than the S&P 500 Index or the Nasdaq 100 and lacking technology stocks that have dominated markets in recent years.