Following a long six-month corrective phase, Polkadot (DOT) is attracting interest once more; some analysts think the token might be about to undergo a major bullish reversal.

Among these, a market analyst referred to as “Worlds of Charts” notes that there has been an emerging pattern of a falling wedge at times interpreted as a sign of an imminent upward break.

Related Reading

Polkadot’s technical configuration has been consistently gathering steam. investors are attentively observing what might be a notable rise coming for the thriving altcoin.

$Dot#Dot Polkadot Is Exhibiting Signs Of Reversal After A Six-Month Corrective Phase. The Formation Of A Falling Wedge Pattern, Coupled With Pronounced Bullish Divergence On Key Indicators, Suggests A High Probability Of A Successful Breakout. Upon Confirmation, DOT May Target… pic.twitter.com/1JpVUM0oHJ

— World Of Charts (@WorldOfCharts1) September 25, 2024

As long as the bigger crypto market starts to revive, this prediction does not seem unreasonable because Polkadot is important for blockchain interoperability and has the potential to attract renewed investor attention.

Falling Wedge: Bullish Reversal Pattern

Among the most consistent technical indications for identifying reversals is the falling wedge formation. The token has been moving in two downward-sloping trends, therefore decreasing the price range.

The trajectory normally points to a declining bearish attitude; as the negative momentum fades, the likelihood of a breakout to the upside is more intense. For Polkadot, the trend has been developing over several months indicating that the token might be getting ready for a significant price ascent.

Added to this is the relative strength index, another familiar momentum indicator, that has recently made higher lows even as the price of DOT has trended lower.

Price and momentum divergence, which always indicates decreasing selling pressure, suggests bulls are about to reclaim control. The technical setup favors a rally despite expected volatility.

Price Growth Potential And Market Sentiment

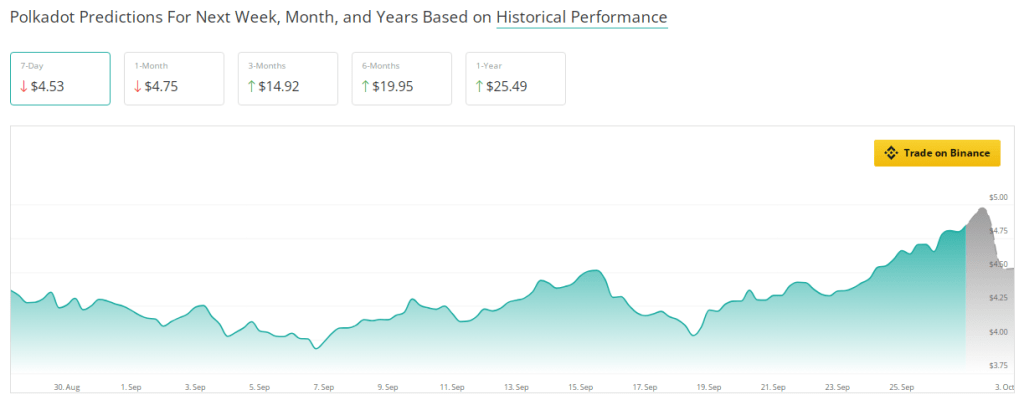

Given that the token has increased 13% over the past week and shows a remarkable 2.47% growth just in the last 24 hours, Polkadot’s present market mood is rather positive.

These increases show a growing demand for DOT even if more general market conditions are yet unknown. Currently trading at $4.92, the cryptocurrency has a market capitalization of $7.51 billion and a minor increase in trading volume.

The optimistic projection for the next years is even more motivating. Should DOT breach its wedge formation, experts think the price may move toward the $12 resistance level.

Reaching that would be a major turn from the current decline in the token and would create conditions for even further increases in the next months.

Polkadot: Long-Term Projections

Looking ahead, Polkadot’s development promise seems even more remarkable. In six months, CoinCheckup projects a 311% price growth; over the next year, it forecasts a more impressive 425% climb.

These figures fit Polkadot’s continuous network changes, including new alliances and its emphasis on increasing its cross-chain capacity.

Featured image from Polkadot, chart from TradingView