Peter Schiff’s Saylor warning has intensified as Bitcoin price dip concerns continue to mount among investors and analysts right now. The outspoken gold advocate has issued a rather stark caution regarding Michael Saylor’s Bitcoin strategy, and also highlighted some serious crypto market risks that could materialize should prices fall below the critical $70K threshold that many traders are watching closely.

Also Read: Musk’s D.O.G.E Disaster: How $1K in Dogecoin (DOGE) Got Rekt

Crypto Market Risks Rise As Bitcoin Faces Another Potential Crash

Increased volatility in the market has certainly amplified Peter Schiff’s Saylor warning conversations across various trading platforms and also social media channels in recent days.

Schiff’s Warning Details

Peter Schiff has specifically targeted Michael Saylor’s Bitcoin accumulation strategy in his latest critique of the digital asset. MicroStrategy’s rather extensive holdings have created significant exposure to any Bitcoin price dip, and this has prompted renewed crypto market risks discussions among financial experts.

This Peter Schiff Saylor warning emerged as Bitcoin showed some concerning signs of instability following its recent highs, with several technical indicators suggesting potential further downside in the near future.

MicroStrategy’s Vulnerability

Under Saylor’s direction, MicroStrategy has actually become one of the largest corporate Bitcoin holders, which makes it especially vulnerable to any sudden Bitcoin price dip. The company’s aggressive strategy seems to lack adequate risk management protocols according to several critics and analysts.

Should prices drop below $70K again in the coming weeks, the unrealized losses could significantly impact shareholder value, which further reinforces Peter Schiff’s warning concerns that many investors are now considering.

Also Read: WonderFi To Be Acquired for $250M as Robinhood Eyes Global Crypto Domination

Market Indicators

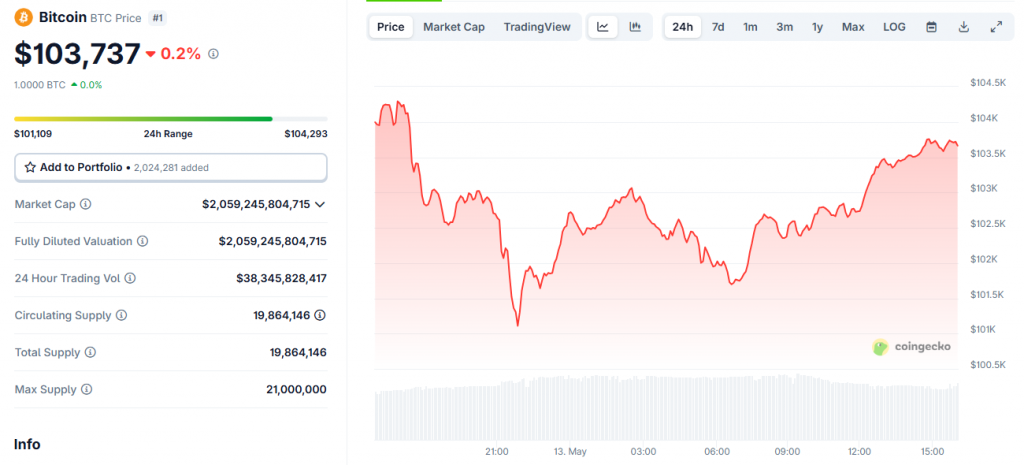

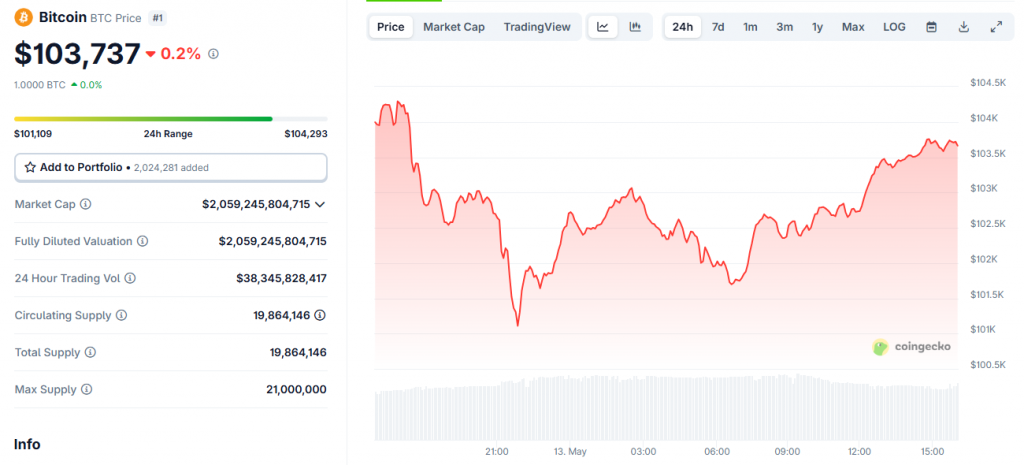

Recent market data shows Bitcoin’s price action becoming increasingly volatile and unpredictable. Traders have repeatedly tested several key resistance levels in recent sessions, while momentum struggles above certain important thresholds add additional weight to experts’ crypto market risks assessments.

Michael Saylor’s Bitcoin acquisition approach has continued despite these warning signs, with MicroStrategy apparently adding to its holdings even as prices have fluctuated considerably.

Broader Market Implications

The ongoing tension between Schiff and Saylor essentially represents the wider debate about cryptocurrency’s uncertain future. The specific focus on the $70,000 price point also highlights both technical and psychological importance in potential Bitcoin price dip scenarios that might unfold.

Investor Reactions

Market response to the Peter Schiff Saylor warning has been quite mixed at this point. Some passionate Bitcoin supporters have simply dismissed the comments as another attempt to discredit cryptocurrency, while others acknowledge the inherent crypto market risks in such an aggressive acquisition strategy as Saylor’s.

Expert Perspectives

The reaction of the market to Peter Schiff Saylor’s warning has been rather mixed so far. Some of the ardent Bitcoin advocates have just brushed aside the comments as another ploy to bring down cryptocurrency whereas others concede the underlying crypto market dangers in such a fiery buy venture as to happen to Saylor.

Also Read: Bitcoin: Who Is Dumping and Who Is Buying BTC?

Financial analysts who don’t align directly with either figure point out that while headwinds definitely challenge Michael Saylor’s Bitcoin strategy, many other factors beyond just the $70,000 mark will ultimately determine Bitcoin’s medium-term performance.