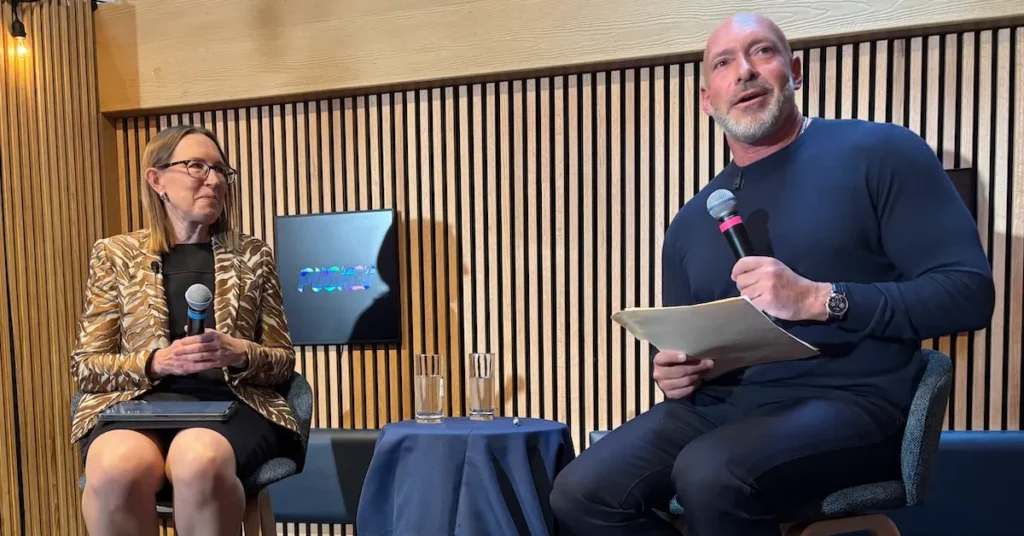

Yesterday, SEC Commissioner Hester Peirce sat down for a fireside chat with NYDIG founder Ross Stevens at New York City’s Bitcoin-themed bar PubKey.

The two traversed a number of topics during their discussion, including why it’s important that the world has a permissionless network and asset like Bitcoin as well as why transactional privacy should be a right for U.S. citizens.

Peirce didn’t mince words during the discussion, yet she also spoke with nuance and thoughtfulness as she responded to questions from not only Stevens but from members of the audience during a Q&A session, as well.

On Permissionlessness

Toward the onset of the talk, Peirce highlighted the fact that Bitcoin is a tool for freedom fighters as part of a broader theme of why it’s crucial that permissionless technology like Bitcoin exists.

She said that she often thinks about what it would have been like if someone like Harriet Tubman had had Bitcoin.

Stevens then posed a question about the risk of a situation in which a U.S. president issues an executive order that authorizes the government to confiscate U.S. citizens’ bitcoin, like the way Executive Order 6102 enabled the government to seize U.S. citizens’ gold in 1933.

Peirce admitted that “it’s still possible for an Executive Order like 6102 to happen in the U.S.,” and made the case that it’s up to us to remain vigilant so as not to permit something like this to happen again.

“To protect ourselves from something like Executive Order 6102, we must reaffirm the founding principles of America and hold the government accountable to those principles,” said the commissioner.

Stevens added that some of Bitcoin’s qualities, such as the ability to store one’s seed phrase in one’s mind, make it more resistant to seizure than gold and, therefore, a better freedom-preserving technology. (The topic of owning actual bitcoin, or holding one’s own bitcoin private keys, as a means of embracing the true nature of Bitcoin as a permissionless technology versus having bitcoin exposure via spot bitcoin ETFs or through custodians arose at many points in the discussion.)

Further along in the discussion, Peirce stressed the importance of the U.S. government continuing to view code as speech, a topic that Stevens brought up and has written extensively about.

“It’s important as regulators for us to treat code as speech,” began Peirce.

“Otherwise, developers would have to check their code with the government before publishing it,” she added, before also noting that developers having to do this could stifle and undermine their ability to publish open-source software.

On Privacy

Halfway through the talk, Stevens asked Peirce if Americans should be free to use crypto mixers.

Before directly commenting on the matter, Peirce spoke more broadly to the concept of financial privacy and that it seems to be of little concern to most U.S. citizens.

“It’s remarkable to me how little people care about financial privacy,” said Peirce. “It’s very personal how you spend your money — and we’ve ceded so much privacy.”

Regarding crypto mixers more specifically, Peirce stated that she believes Americans have a right to use such technology.

“There’s supposed to be a presumption of innocence in this country,” she said. “Technologies that allow you to do things on chain but also allow you to preserve privacy are really important.”

At the beginning of the Q&A portion of the event, Thomas Pacchia, the bar’s owner, highlighted the dangers of the Bank Secrecy Act (BSA) in that it mandates that users turn over significant amounts of personal data to financial institutions and asked what the odds were of one day seeing the act repealed.

Peirce agreed with Pacchia that there is great risk in financial institutions holding so much of their customers’ data but pointed out that the idea of repealing the BSA is a point of deep contention in Washington, D.C.

“Really bad things can happen if a centralized financial institution has a lot of information about you, but it’s such a third rail in D.C. to talk about the Bank Secrecy Act because of the fear that bad actors will rush in,” said Peirce.

Listening Intently

Peirce has stated a number of times, most recently at Bitcoin 2025, that she believes that the U.S. government works for the American people.

It’s clear that this isn’t just hot air or a talking point, as evidenced by how carefully she listens to the questions posed to her and how thoughtful her responses to said questions are.

For example, I asked Commissioner Peirce if there was any chance we might eventually see in-kind redemptions for the spot bitcoin ETFs for retail investors.

While she admitted that it’s “unlikely,” she offered me some space to make my case for why they’re important and concluded the exchange with me by stating that she’d “give it some more thought.”

She responded to Stevens and to each member of the audience who posed a question with the same type of care and consideration, which seemed to be appreciated as she broached topics as sensitive as having the legal right to hold one’s Bitcoin keys and to transact with bitcoin privately.

Peirce also seemed genuinely concerned about making sure that regulators don’t get in the way of Bitcoin and crypto fulfilling their promise as both freedom technology and an alternative to the traditional financial and monetary systems.

“I’m concerned that we’ll stunt growth if we do things the wrong way,” Peirce concluded, eliciting a warm round of applause from the Bitcoin enthusiasts in attendance.