- Shiba Inu has a bullish structure on the daily timeframe.

- The order imbalance showed that a short-term price bounce was possible.

Shiba Inu [SHIB] bulls struggled to break past the resistance form earlier this year. However, there was increased activity on-chain. The Shibarium TVL reached a new all-time high and the Layer-2 solution recently set a transaction milestone.

Is SHIB set to consolidate?

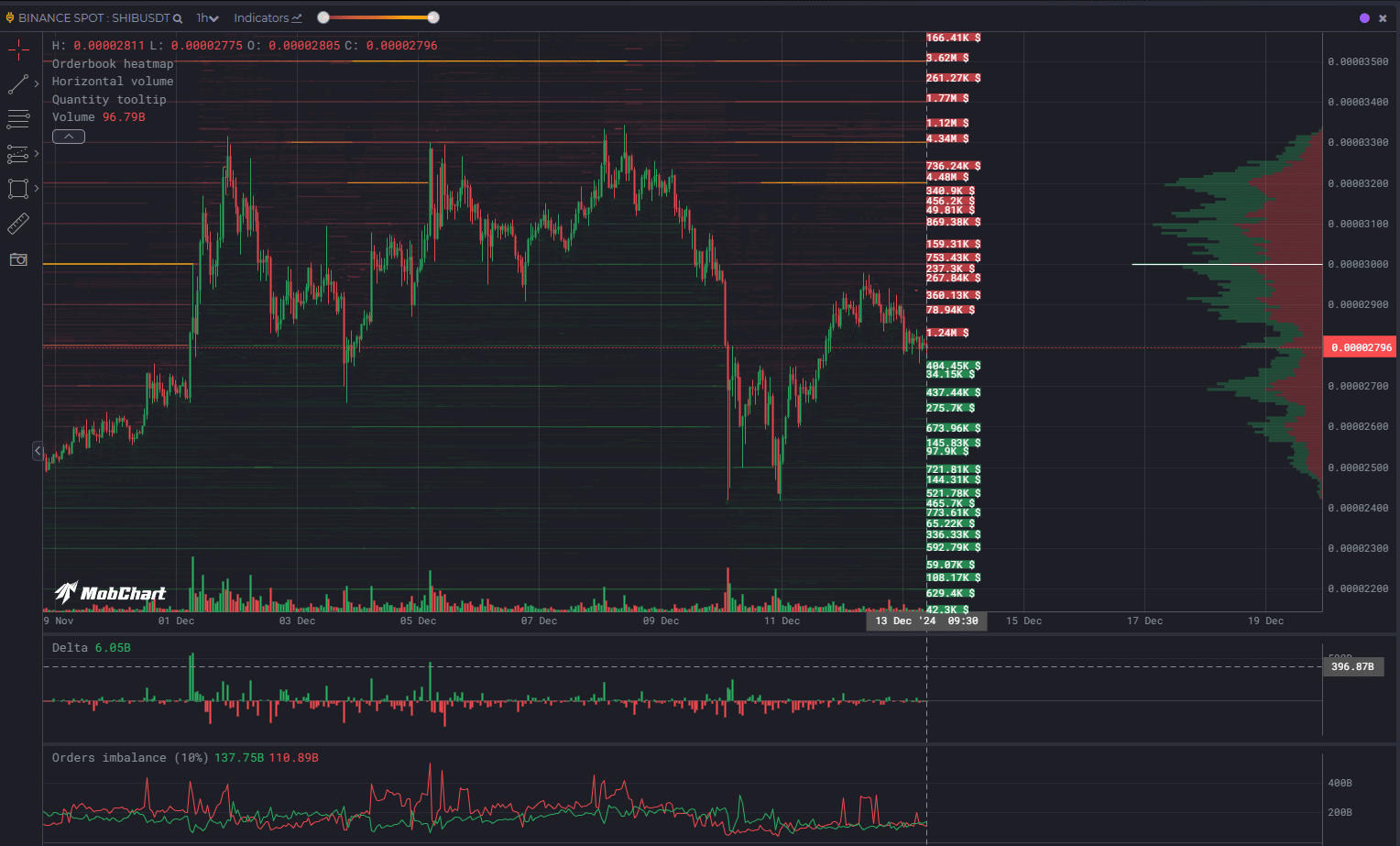

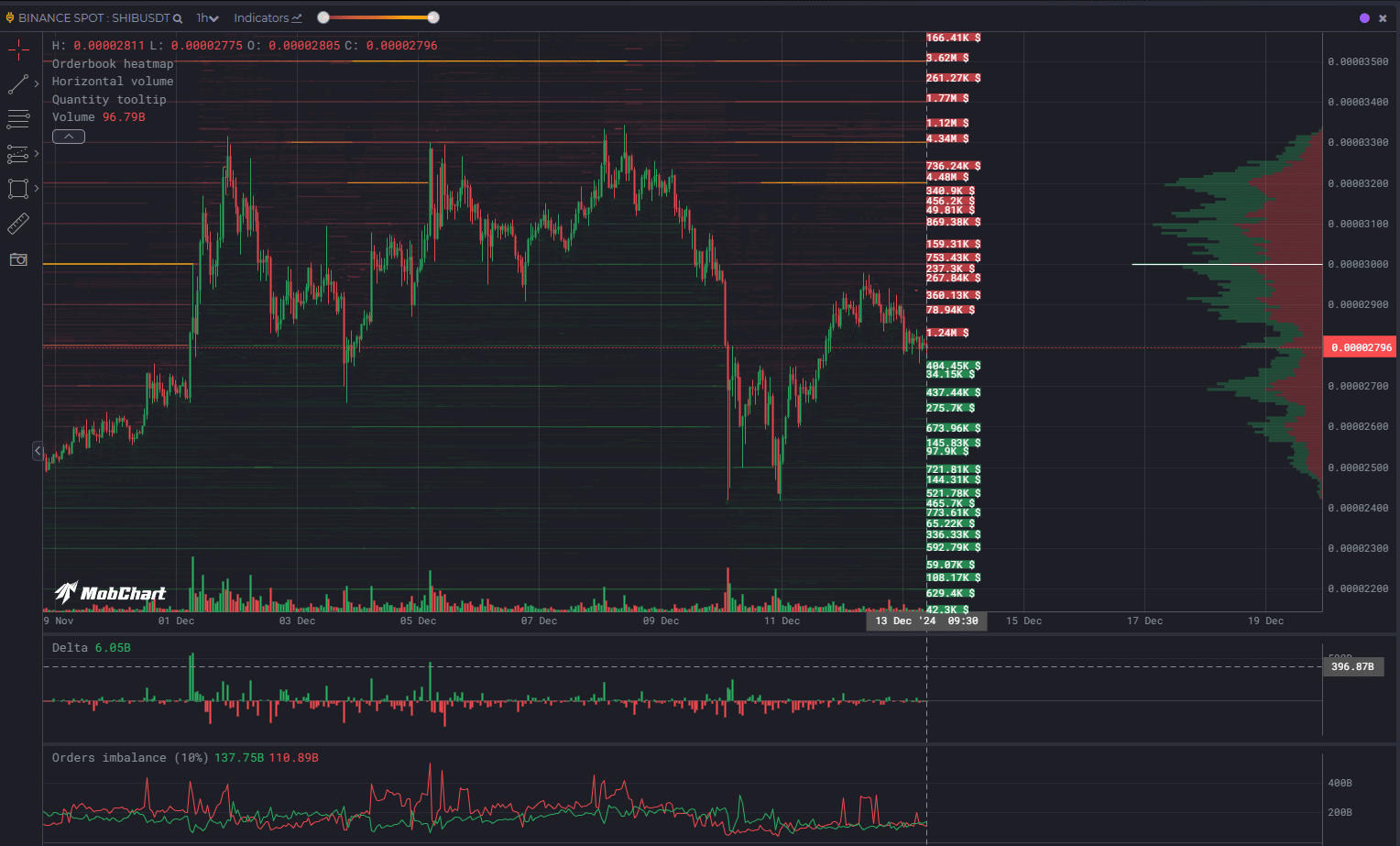

On the daily timeframe, SHIB has a bullish market structure. The higher low at $0.0000266 from the 3rd of December did not see a daily session close below it. However, the MFI has fallen from near 80 in early December to 61 at press time.

This showed that although momentum was bullish the capital inflow and buying pressure were losing strength. The fall below the $0.0000295 support level reinforced the bearish short-term bias.

This level has been a significant resistance since April and was beaten in the second half of November. The recent losses have forced Shiba Inu bulls beneath this level again.

From June to November, the $0.00002 resistance zone, highlighted by the red box, was also tested multiple times before a breakout. SHIB consolidated beneath this zone in October before rocketing higher.

This is a possibility that Shiba Inu traders and investors have to be prepared for in the coming weeks. The $0.00003-$0.000037 region is a firm resistance from March. It could take a while to exhaust the sellers in this area.

Orders imbalance suggests a potential price bounce

Source: MobChart

There were large limit sell orders set at $0.000032 and extending to $0.000035. This meant that the price could face difficulty climbing beyond this resistance zone, which also lined up well with the March price action.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

The orders imbalance showed that sell orders were fewer within 10% of the price. This can be perceived as a short-term SHIB buying opportunity and could see a bounce toward the $0.00003 resistance zone.

The delta showed that buy and sell pressure were finely balanced in recent hours.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion