- Solana network activity maintains positive trajectory the bearish market conditions.

- Assessing the chances of SOL entering recovery mode after a bearish week.

The Solana [SOL] blockchain is still demonstrating signs of robust network activity despite the recent market cool down. The bears are responsible for subduing the market excitement previously observed in November and earlier this month.

It is business as usual for Solana as evident by its latest spike in activity. For context, the network’s TVL just hit a new 2024 high at 55.37 million SOL. The TVL performance is more accurate in terms of SOL rather than in dollar value because of SOL price fluctuations.

Positive TVL growth is often associated with long term optimism and healthy network activity. Solana on-chain volume remained high despite the recent bearish sentiments in the market. It averaged over $3 billion in daily volume in the last two days.

Solana transaction data also indicted growing network activity. Transactions have been on an uptrend for months and peaked at 67.77 million TXS in the last 24 hours. This was the highest recorded transaction count on the Solana network in the last 11 months.

Is SOL ready for a bullish comeback?

The recent surge in network activity could signal a surge in organic demand for the Solana native crypto. However, the overall market performance has been bearish especially this past week, and Solana’s native crypto was not spared.

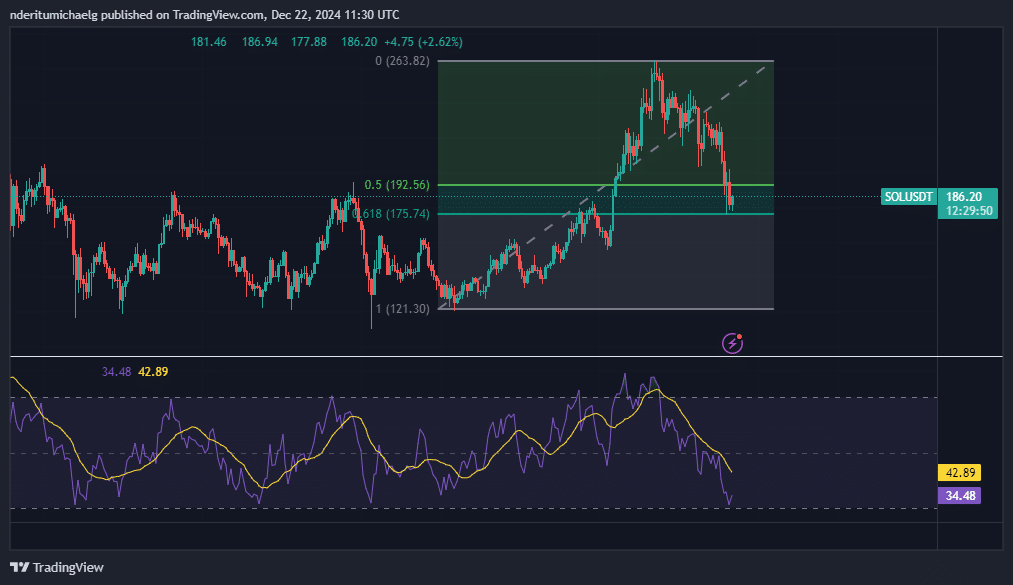

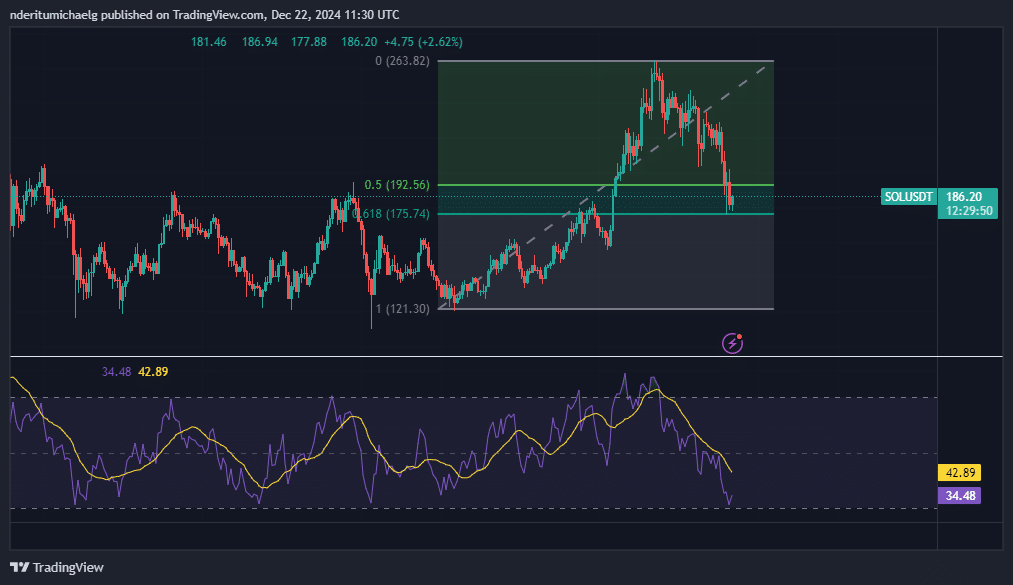

SOL dipped by 23% from its highest to lowest level last week. However, this also meant that it retested an important level. Price has been hovering within the 0.5 and 0.618 Fibonacci retracement level based on its September lows and its November peak.

Source: TradingView

The RSI almost dipped into oversold territory in the latest dip. This could indicate the possibility of more downside in the coming days. However, price was already showing signs of bearish exhaustion at the time of writing.

If a bullish recovery from the Fibonacci range is on the cards, then traders should expect signs. So far the bearish assault has cooled down. However, spot flows were still negative although it is worth noting that the intensity of outflows declined in the last 4 days.

The declining spot outflows may pave the way for some recovery. However, the derivatives market also revealed that SOL may not yet be ready for a strong comeback.

Is your portfolio green? Check out the SOL Profit Calculator

Open interest weighted funding rates were negative in the last 2 days. This was the first time that SOL funding rates were negative in the last 6 weeks.

source: Coinglass

Note however that Solana funding rates started to show signs of shifting back into the positive side in the last 24 hours.