- Sui’s TVL recently hit an all-time high.

- Its native token’s price also set a new price record recently.

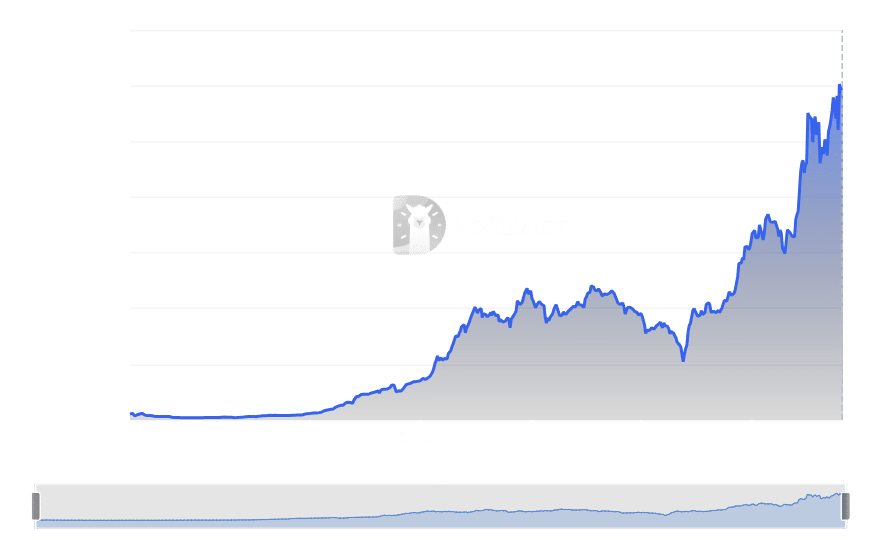

Sui Network’s [SUI] decentralized finance (DeFi) landscape recently achieved a significant milestone in its total value locked (TVL).

The surge in TVL highlighted the growing adoption and investment in SUI’s ecosystem, with Suilend and NAVI Lending emerging as key contributors.

Analyzing SUI’s lending platform dominance

AMBCrypto’s at the TVL chart underscored SUI’s exponential growth over the past year. It has consistently climbed from modest beginnings, reflecting heightened activity.

Analysis of the TVL, per DefiLlama’s chart, showed that the TVL was $1.79 billion at press time. Further analysis showed it hit its all-time high on the 12th of December, when it reached $1.8 billion.

This growth has been driven largely by lending platforms like Suilend and NAVI Lending, which have captured significant market share. These platforms account for 58% of the network’s total locked assets.

As of this writing, Suilend’s TVL was $552.5 million, while NAVI’s was $491.23 million.

Volume spike confirms activity

Analysis of the Sui volume showed a convergence in volume and TVL. As of this writing, the volume was about $168 million.

However, further analysis showed that the network saw its highest volume on the 12th of December, spiking to over $551 million. The spike coincided with the TVL hitting its ATH.

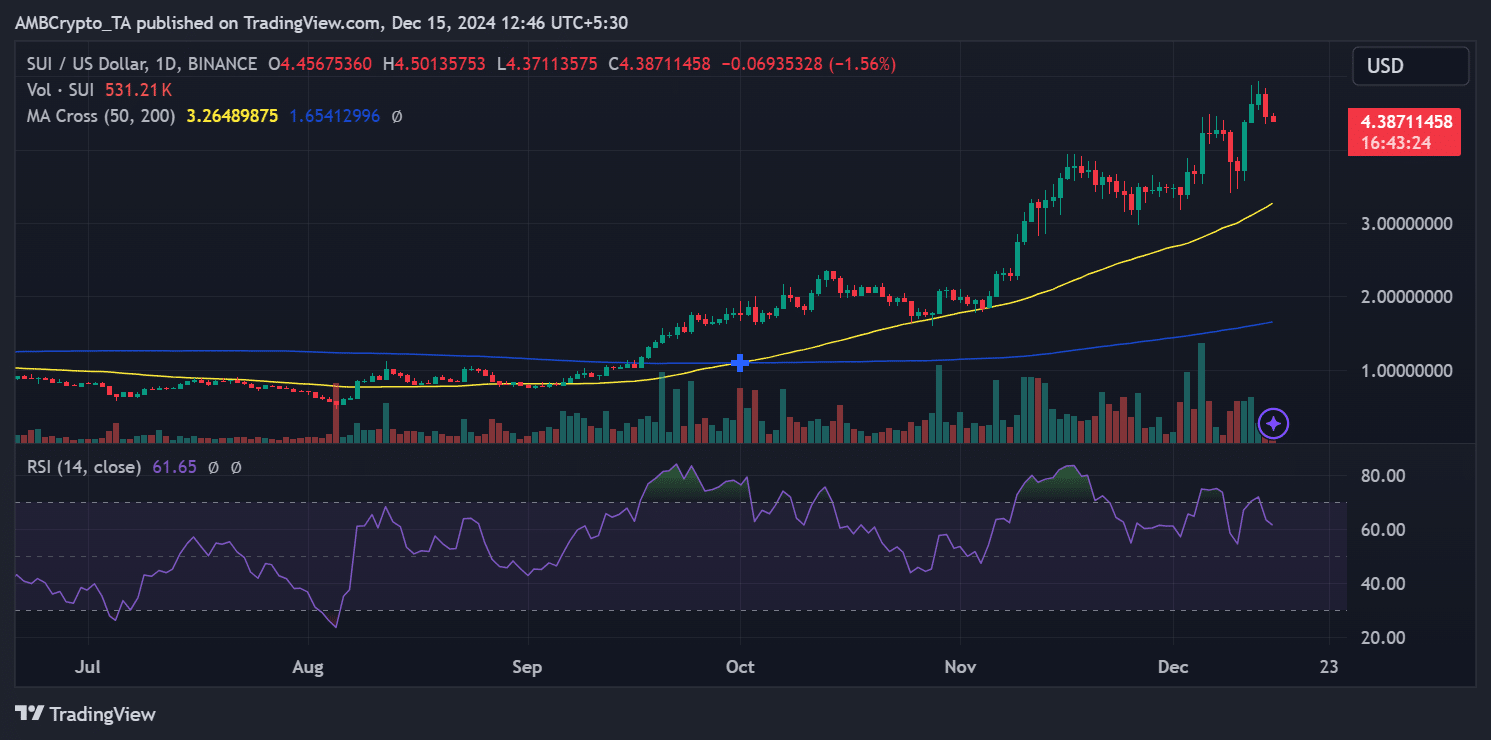

SUI’s bullish momentum faces consolidation

SUI’s price has mirrored its DeFi ecosystem’s growth, rallying significantly over the past months. Trading at $4.38 at press time, SUI remained above its key 50-day moving average, suggesting that bullish sentiment persisted.

The RSI at 61.65 indicated that the asset was approaching overbought territory, but still had room for further upside.

Volume analysis showed a steady increase in trading activity, supporting the upward price trend. However, the recent pullback from the $4.50 range signaled potential consolidation.

If SUI can hold above $4.20, it could set the stage for another rally, targeting $5 as the next psychological resistance.

Is your portfolio green? Check out the SUI Profit Calculator

Further analysis also showed that the price hit its ATH on the 13th of December, when it rose to $4.76. The ATH was a day after the network’s volume, and TVL crossed their milestones.

The $1.7 billion TVL milestone, driven by SuiLend and NAVI Lending, showcased the network’s potential. With the steady price and the rapidly evolving DeFi landscape, SUI appears well-positioned for further growth.