The BTC rally has gained unprecedented momentum as institutional bitcoin inflows reach record levels, and the upcoming Bitcoin Conference 2025 in Las Vegas is serving as a major catalyst for cryptocurrency adoption. Market analysts are predicting that this BTC rally could drive bitcoin price prediction targets to $200,000 by year-end, and this is being supported by massive institutional bitcoin inflows.

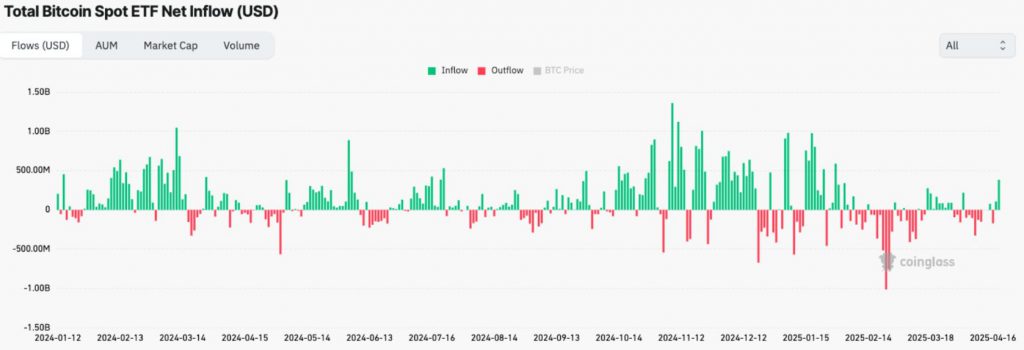

– Source: CoinGlass

Also Read: Why Robert Kiyosaki Wants You Buying Tiny Bitcoin (BTC) Satoshis?

How Institutional Bitcoin Inflows and Bitcoin Conference 2025 Shape Cryptocurrency and Price Predictions

The current BTC rally represents a fundamental shift in cryptocurrency markets, and it’s being driven by institutional bitcoin inflows that have exceeded $380 million in single-day records. The Bitcoin Conference 2025, which is scheduled for May 27-29 in Las Vegas, has also amplified market optimism around bitcoin price prediction models.

Fei Chen, Intellectia AI’s chief investment strategist, stated:

“While the forecast is optimistic, it’s also conditional. Any black swan — from a major regulatory clampdown to a geopolitical event — can disrupt trajectories.”

Record ETF Inflows Fuel BTC Rally

Institutional bitcoin inflows through Bitcoin ETFs have reached historic levels, and at the time of writing, the US’s 11 spot BTC funds collectively pulled more than $380 million in net inflows on April 21. This surge also coincided with Bitcoin breaking past $90,000, demonstrating how the BTC rally correlates directly with institutional demand and cryptocurrency adoption patterns.

Corporate treasuries now hold nearly $65 billion worth of BTC, and this is reinforcing the structural nature of current institutional bitcoin inflows. These holdings also represent a significant shift in how traditional finance views bitcoin price prediction models.

Also Read: Strategy’s Bitcoin Investment Could Push MSTR to $10 Trillion Valuation On 2.1 Billion Bitcoin Bet

Las Vegas Conference Amplifies BTC Rally

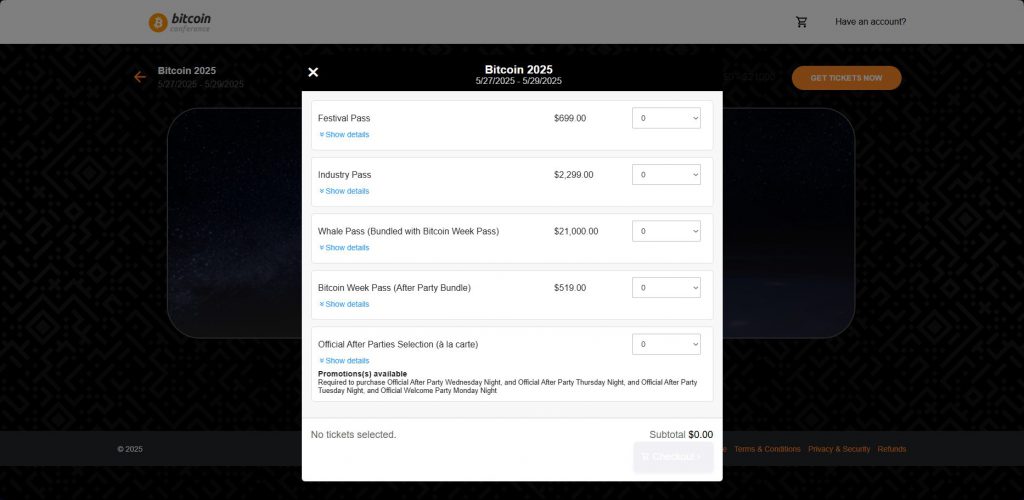

The Bitcoin Conference 2025 has played a key role in driving the recent BTC rally and over 30,000 people expected to attend makes it highly anticipated. Nevada Governor Joe Lombardo touts the state’s support for new developments in cryptocurrency.

Joe Lombardo, Governor of Nevada, stated:

“We’re excited to welcome The Bitcoin Conference to Nevada in 2025. The decision to move this historic event to Las Vegas not only highlights our state’s burgeoning position as a major financial and technological hub, but also our passion for welcoming innovators to our state.”

According to Bailey, BTC Inc CEO, Las Vegas is now playing a key role in the crypto boom and BTC rally.

David Bailey, CEO of BTC Inc, said:

“Las Vegas has experienced an incredible transformation over the last few years, establishing itself as a hub for entrepreneurship, technological innovation, and economic growth. Under the leadership of Mayor Goodman and Governor Lombardo, the city has also embraced the Bitcoin community with open arms.”

Those attending the conference are eager to see news relating to Bitcoin Layer 2 technology and institutional bitcoin dollars which may boost BTC appreciation as they address issues of bitcoin scalability and increase its use.

Also Read: Bitcoin Falls as President Trump Unveils New iPhone & EU Tariffs

The convergence of record institutional bitcoin inflows and the high-profile Bitcoin Conference 2025 positions the current BTC rally on solid foundations. With bitcoin price prediction targets reaching $200,000 and continued cryptocurrency adoption by major institutions, this rally appears fundamentally different from previous speculative cycles right now.

Also Read: Corporate Bitcoin Adoption: Treasury Strategies Driving Growth

FAQ:

Where will the Bitcoin Conference 2025 be held?

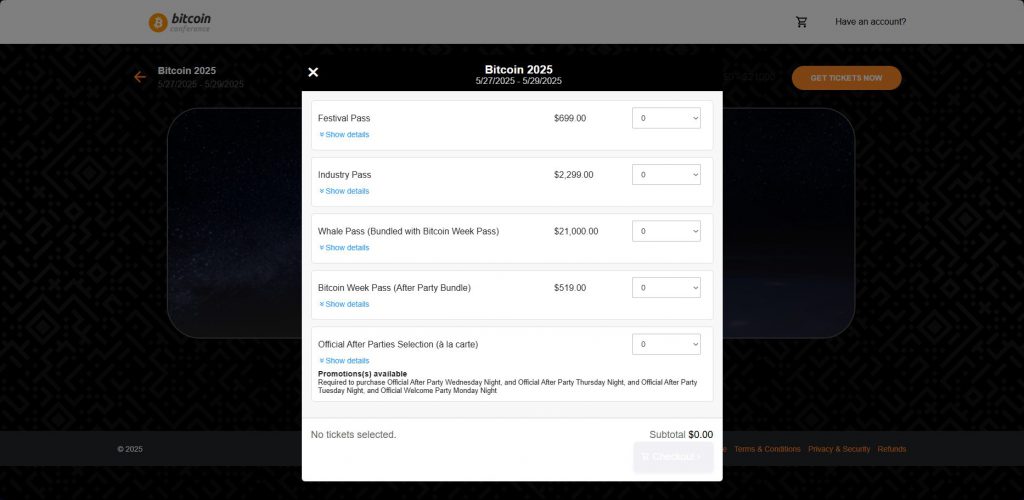

The Venetian Convention Center in Las Vegas, Nevada, will host the Bitcoin Conference 2025 from May 27-29, 2025. The event will draw over 30,000 attendees and serve as a major catalyst for the ongoing BTC rally, with tickets selling fast.

What will Bitcoin be worth in 2025?

Market analysts predict Bitcoin price prediction targets could reach $200,000 by the end of 2025, driven by record institutional bitcoin inflows and growing cryptocurrency adoption. Over $380 million in daily ETF inflows support the current BTC rally.

What will BTC peak at in 2025?

Analysts from Standard Chartered and Intellectia AI suggest the BTC rally could push Bitcoin past $200,000 in 2025, though this depends on continued institutional bitcoin inflows and favorable regulatory conditions supporting cryptocurrency adoption.