-

The S&P 500 could lose a quarter of its value next year, according to Stifel.

-

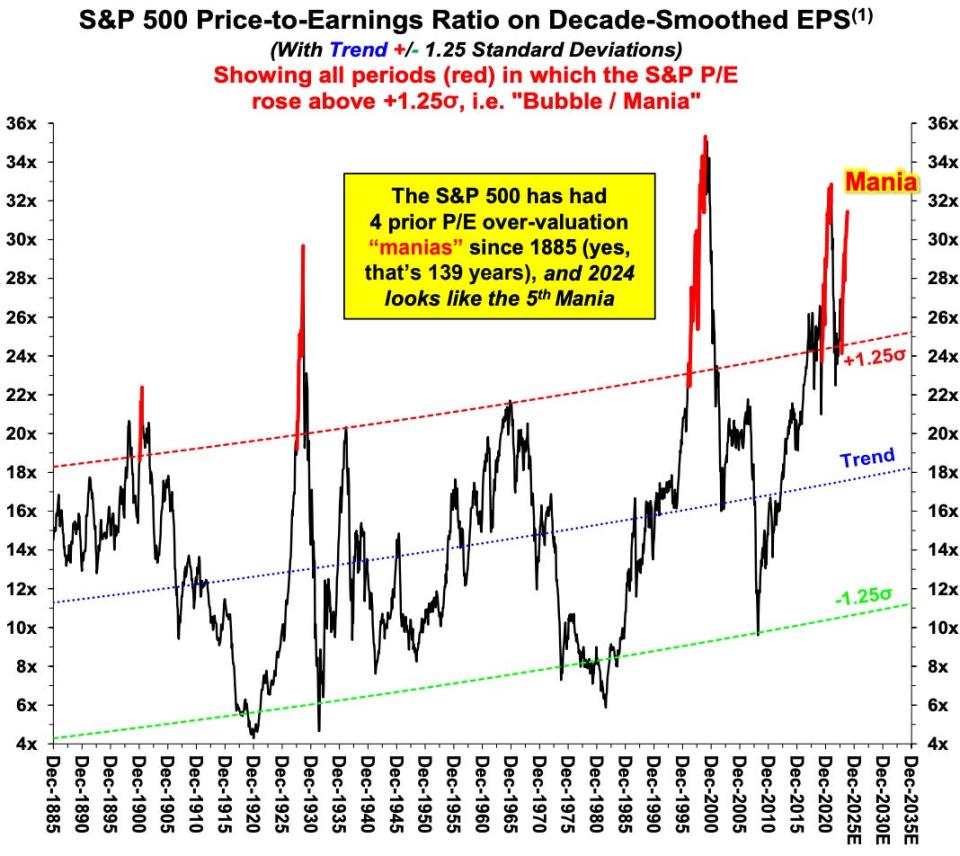

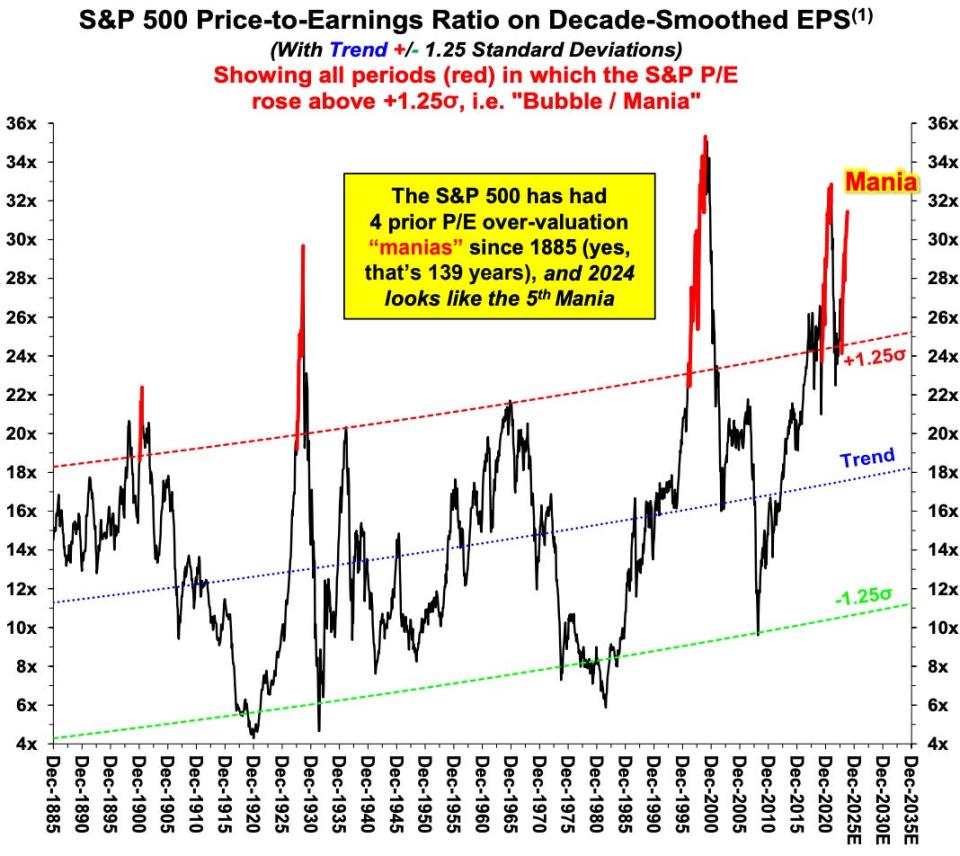

The benchmark index looks like it’s caught in a “mania,” the firm’s strategists said in a note.

-

Investors could be impacted long-term, as manias tend to lead to poor returns in the next decade.

The S&P 500 looks like it’s in the midst of another “mania,” and investors could see a steep drop in the benchmark index sometime next year, according to Stifel.

Strategists at the investment firm pointed to lofty valuations, with the S&P 500 breaking through a series of record highs this year on the back of an improving economic outlook, expectations for Fed rate cuts, and hype for artificial intelligence.

But the benchmark index now looks similar to the past four manias that have taken place, the firm said, comparing the current investing environment to the pandemic stock boom, the dot-com bubble, and stock run-ups in the 1920s and late 1800s.

Growth returns “excess of Value” in today’s market look “almost exactly the same” as they did leading up to the 1929 stock crash, the firm added.

“We took a clean sheet look at the equity market and came away with the same smh (shaking my head) emoji reaction. Despite all the soft-ladning and Fed rate cut optimism, the S&P 500 up almost 40% y/y has simply over-shot,” strategists said in a note on Tuesday.

If the S&P 500 follows the path of a “classic mania,” that implies the benchmark index will rally to around 6,400 before falling back to 4,750 next year, strategists said.

“Sure, we can cherry-pick with the best of them and apply the most over-valued cyclically adjusted valuation level of the past 35 years to show about 10% further upside, but that same analysis of a century of manias also returns the S&P 500 in 2025 to where 2024 began (down 26% from that prospective peak),” the note added.

Stocks could be challenged next year due to the uncertain outlook for Fed rate cuts, the strategists suggested. While the Fed has signaled more cuts are coming, central bankers also risk undermining their inflation goals if they cut rates too soon.

“The conclusion … is that if the Fed cuts rates in 2025 absent a recession (two 25’s as this year comes to a close do not count) then that would be a mistake, with investors paying the price in latter 2025 / 2026, based on historical precedent,” strategists wrote.

Investors could be impacted for the long-term, they added, pointing to previous manias, which historically led to weak stock returns over the following decade.

“Or at least that has been the case for the past three generations, making manias as disruptive for capital markets on the way down as they are euphoric on the way up,” they said.

A handful of other Wall Street forecasters have also said stocks look overvalued, but investors remain generally optimistic about the outlook for equities, particularly as they expect more rate cuts into 2025.

Read the original article on Business Insider