-

Ed Yardeni predicts the S&P 500 could reach 8,000 by 2030.

-

Yardeni’s prediction is based on a simple analysis of historical growth rates.

-

His bullish projection is supported by a “Roaring 2020s” scenario in which productivity grows.

There’s a simple reason one of the most bullish Wall Street strategists expects the stock market to continue rising in the years ahead: compound interest.

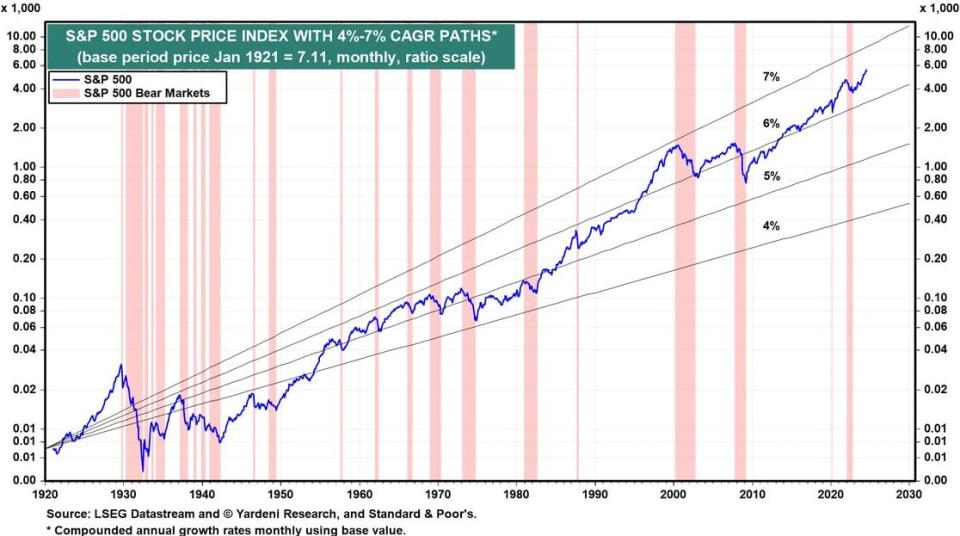

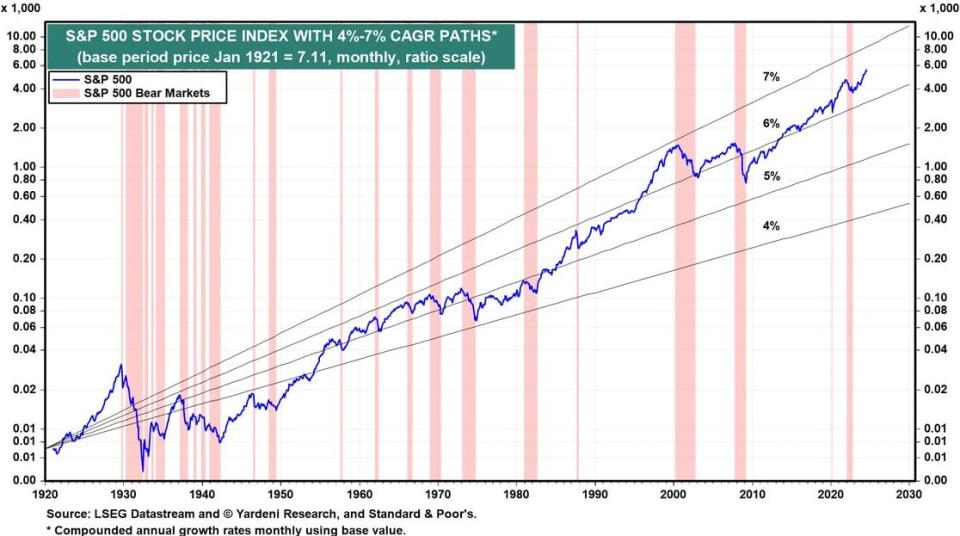

In a note on Thursday, Yardeni Research founder Ed Yardeni published a long-term chart of the S&P 500 that includes the potential future trajectory of the index based on compounded annual growth rates.

At a compounded annual growth rate of between 6% and 7%, the S&P 500 is on track to hit 8,000 by 2030, representing potential upside of about 40% from current levels.

Yardeni’s simple math-based projection isn’t outlandish when one considers that the long-term annualized growth rate of the S&P 500 is about 10% before inflation, and it’s been even higher at about 13% over the past decade.

Consistent earnings growth, favorable US demographics, and ongoing technological innovations have been driving the S&P 500 higher, and those factors should support a rising stock market in the years ahead.

“The S&P 500 stock price index is driven by its earnings per share (EPS), which has been growing mostly between 6% and 7% since the 1950s,” Yardeni said.

He added: “EPS could double to $400 by the end of the decade in our Roaring 2020s scenario,” Yardeni said.

Yardeni Research outlined its bullish “Roaring 2020s” scenario earlier this year. The forecast calls for increased productivity to fuel economic growth while inflation remains subdued.

If the S&P 500 does trade at the 8,000 level with EPS of $400, it would imply a price-to-earnings ratio of 20x, which is below current levels but slightly above the index’s long-term average.

Finally, interest rate cuts from the Federal Reserve should serve as another tailwind for stock prices in the years ahead, though Yardeni has cautioned that they could just add fuel to the fire, leading to a 1990’s style melt-up, which would be followed by a painful unwind.

“I raised the odds of an outright melt-up, like something we had in the 1990s,” Yardeni said last week. “I think that by cutting rates by 50 basis points and by indicating they want to do more, based on some of the recent comments, they risk overheating a warm economy. The economy’s doing quite well.”

Read the original article on Business Insider