Broadcom shares moved higher in early Monday trading, putting the stock on pace for a December gain of around 40%, following another price target boost for the AI chipmaker from a top Wall Street analyst.

Broadcom (AVGO) shares topped the $1 trillion mark this month, in terms of market value, as the group continues to benefit from its market leadership in custom AI chips as well as its role as a potential partner for hyperscalers seeking to design their own processors in order to wean their reliance from Nvidia (NVDA) .

Amazon (AMZN) , Google parent Alphabet (GOOGL) and Microsoft (MSFT) have all partnered with Broadcom to develop custom AI infrastructure, while reports have suggested that Apple (AAPL) is looking to develop its Baltra AI server chip with the Palo Alto, California-based group.

Broadcom also makes specialized networking gear which determines the speed at which information collected in one network is passed along to the next.

Collectively, the group sees the serviceable size of those markets rising to between $60 billion and $90 billon over the next three years.

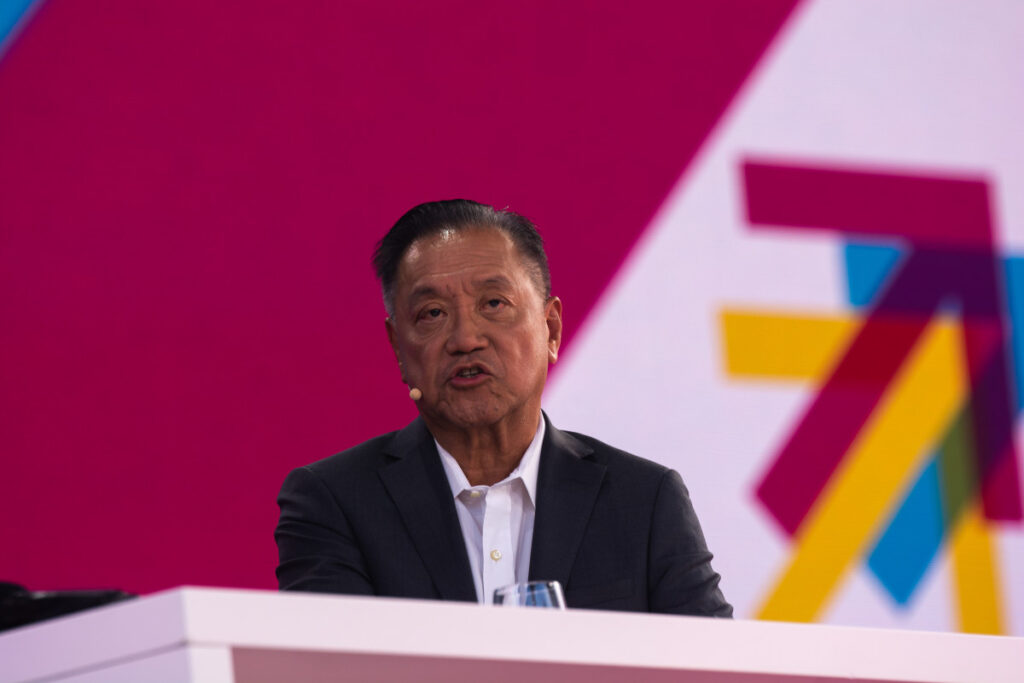

“We are very well positioned to achieve a leading market share in this opportunity and expect this will drive a strong ramp from our 2024 AI revenue base of $12.2 billion,” CEO Hock Tan told investors on a conference call earlier this month.

Bullish AI market outlook

That outlook has triggered a host of upgrades on Broadcom stock from Wall Street analysts, including Timothy Arcuri of UBS, who lifted his price target by $50, to $270 per share, in a note published Monday.

“After reviewing Broadcom’s serviceable addressable market (SAM) disclosures and reassessing likely outcomes for its custom compute and AI networking businesses, we are raising our AI revenue estimates for FY26/FY27 by approximately 20% and 40%, respectively,” Accuri and his team wrote.

Broadcom told investors on Dec. 12 that it sees AI revenues for its fiscal first quarter, which ends in December, rising 65% from last year to $3.8 billion. That compares with a 10% growth rate for its overall chip sales, which translates into a top line of $14.6 billion.

Related: Analysts overhaul Broadcom stock price targets after Q4 earnings

“Even with these higher estimates, we still see room for upside given our middle-of-the-road market share assumptions and the strong likelihood of significant SAM expansion if/when Broadcom adds two additional hyperscalers to its AI customer base,” Accuri said.

Bloomberg reported earlier this week that Apple was close to making an in-house chip for its Bluetooth and WiFi connections under a project named Proxima.

More AI Stocks:

- Top analyst revisits Micron stock price target ahead of Q1 earnings

- Analysts revamp Ciena stock price target after AI outlook

- Cathie Wood buys $30 million of under-the-radar AI stock

The tech-focused website the Information, meanwhile, reported that Broadcom was working with the iPhone maker to develop an AI-processing chip using Taiwan Semiconductor’s N3P processing platform.

Broadcom shares were marked 2% higher in premarket trading to indicate an opening bell price of $225.12 each.

Related: Veteran fund manager delivers alarming S&P 500 forecast